Auction.com’s latest Seller Insights report reveals that leaders in the default servicing sector are anticipating a controlled economic descent, with gradual increases in foreclosure rates despite sustained high interest rates. The findings, compiled from a survey conducted during the Auction.com Disposition Summit, highlight industry expectations for the remainder of 2024.

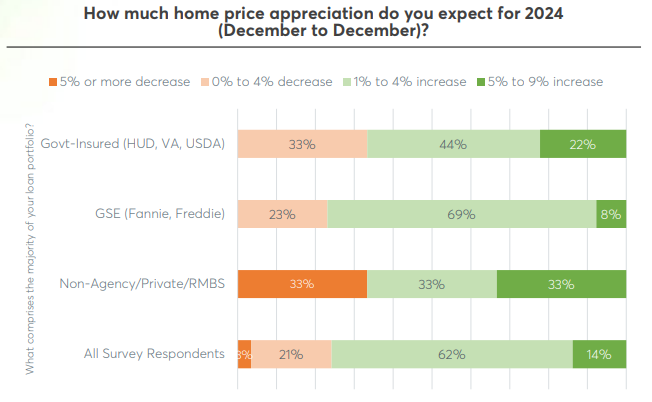

Surveying a diverse group including banks, nonbanks, and government entities, the report indicates a prevailing sentiment among 76% of respondents who foresee continued growth in home prices throughout the year. This optimism comes in spite of the challenges posed by interest rates, which are expected to linger at an average of 6.3% through the year’s end.

“Our partners in the default servicing industry are on the frontlines of any emerging risk in the mortgage market, and we communicate regularly with them to identify those risks and build solutions of value,” said Jason Allnutt, CEO at Auction.com. “Nearly halfway through the year, leaders in this industry are telling us that the risk of rapidly rising delinquencies and foreclosures this year remains low and that they expect a soft landing in the housing market and broader economy despite an expectation that mortgage rates will remain relatively high throughout the remainder of the year.”

Regarding foreclosure volumes, 57% of those surveyed anticipate a gradual rise of between 1% and 4% by the year’s conclusion. This expectation contrasts with the significant declines observed since 2019, attributed largely to enhanced loss mitigation strategies post-pandemic.

Joe Cutrona, Chief Business Officer at Auction.com, noted the sustained efficacy of these strategies: “We’ve maintained foreclosure volumes at roughly half of their peak levels in 2019, owing to robust post-pandemic mitigation measures.”

Survey respondents also expressed confidence in the performance of loans undergoing loss mitigation, with 51% expected to achieve permanent performance status. This success is bolstered by a substantial home equity cushion, with an average combined loan-to-value ratio of 65% for seriously delinquent loans in their portfolios.

Elan Chambers, SVP at Auction.com, underscored the strategic use of home equity: “This cushion has been pivotal in steering distressed homeowners away from foreclosure, a testament to effective industry and policy collaboration.”

Emerging Risks

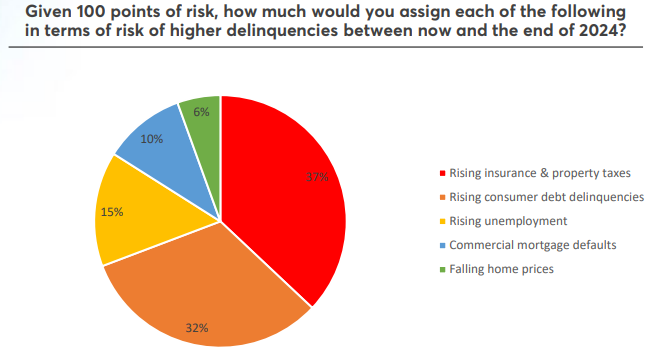

Survey respondents identified the rising “hidden” homeownership costs of homeowners insurance and property taxes as the biggest potential risk for triggering higher delinquency rates in 2024.

Respondents assigned 37% of a theoretical 100 points of risk to those hidden homeownership costs, followed by rising consumer debt delinquencies with 32% of risk and rising unemployment with 15% of risk. Commercial mortgage defaults received 10% of risk while falling home prices received only 6% of risk.

“Although the risk of rapidly rising delinquencies in the near term remains low, there are some signs of consumer and homeowner stress emerging,” said Daren Blomquist, VP of Market Economics at Auction.com.

Identifying emerging risks, survey participants flagged rising costs associated with homeownership—specifically insurance and property taxes—as the foremost potential threat to loan performance in 2024. This concern overshadowed other risks such as consumer debt delinquencies and fluctuations in unemployment rates.

The insights gleaned from Auction.com’s report reflect a measured outlook within the default servicing sector, characterized by proactive measures to mitigate risks and sustain market stability amidst persistent economic challenges.

Click here for the report in its entirety.