The latest Loan Monitoring Survey from the Mortgage Bankers Association (MBA) reveals that the total number of loans in forbearance increased from 0.21% in May 2024 to 0.23% as of June 30, 2024. MBA estimates that 115,000 homeowners are currently in forbearance plans, as the nation’s mortgage servicers have provided forbearance to approximately 8.2 million borrowers since March 2020.

“The number of loans in forbearance increased in June for the first time since October of 2022,” said Marina Walsh, CMB, MBA’s VP of Industry Analysis. “Furthermore, the performance of both loan workouts and overall servicing portfolios weakened, particularly for government loans.”

The share of Fannie Mae and Freddie Mac (GSE) loans in forbearance increased one basis point from 0.10% to 0.11% in June 2024. Ginnie Mae loans in forbearance increased by five basis points from 0.39% to 0.44%, and the forbearance share for portfolio loans and private-label securities (PLS) remained flat at 0.31%.

Forces factoring into the shift

“There were several factors that caused the forbearance rate to rise in June, including the uptick of severe weather events that hit multiple regions of the country, as well as early signs of consumer distress that could potentially impact borrowers’ ability to pay their mortgages,” said Walsh. “Additionally, June’s month-end fell on a Sunday, and the weekend timing typically leads to higher mortgage defaults in any given month.”

In June, the U.S. Department of Housing & Urban Development (HUD) announced the implementation of federal disaster assistance for the state of New Mexico, and ordered federal assistance to State, tribal and local recovery efforts in areas impacted by the South Fork Fire and the Salt Fire beginning on June 17, 2024, and continuing. President Biden issued a major disaster declaration in Lincoln County and the Mescalero Apache Tribe. HUD provided a 90-day moratorium on foreclosures of mortgages insured by the Federal Housing Administration (FHA), as well as foreclosures of mortgages to Native American borrowers guaranteed under the Section 184 Indian Home Loan Guarantee program, among other loss mitigation actions taken.

In another weather-related event, HUD offered federal disaster assistance for the state of Hawaii and ordered federal assistance to State and local recovery efforts in the areas affected by severe storms, flooding and landslides from April 11 to April 14, 2024. HUD also provided a 90-day moratorium on foreclosures of mortgages insured by the FHA, as well as foreclosures of mortgages to Native American borrowers guaranteed under the Section 184 Indian Home Loan Guarantee program.

HUD also granted a 90-day moratorium on foreclosures of mortgages insured by the FHA for victims in the state of Iowa, ordering federal assistance for state, tribal, and local recovery efforts in areas hit by severe storms, flooding, straight-line winds, and tornadoes beginning on June 16, 2024.

Additional June survey findings

- By reason, 75.9% of borrowers are in forbearance for reasons such as a temporary hardship caused by job loss, death, divorce, or disability. Another 16.2% are in forbearance because of a natural disaster. Only 7.9% of borrowers are still in forbearance because of COVID-19.

- By stage, 59.4% of total loans in forbearance are in the initial forbearance plan stage, while 21.4% are in a forbearance extension. The remaining 19.2% are forbearance re-entries, including re-entries with extensions.

- Total loans serviced that were current (not delinquent or in foreclosure) as a percent of servicing portfolio volume (#) decreased to 95.65% (on a non-seasonally adjusted basis) in June 2024, down 49 basis points from 96.14% in May 2024.

- The five states with the highest share of loans that were current as a percent of servicing portfolio: Washington, Idaho, Oregon, Colorado, and California.

- The five states with the lowest share of loans that were current as a percent of servicing portfolio: Louisiana, Mississippi, Indiana, Alabama, and West Virginia.

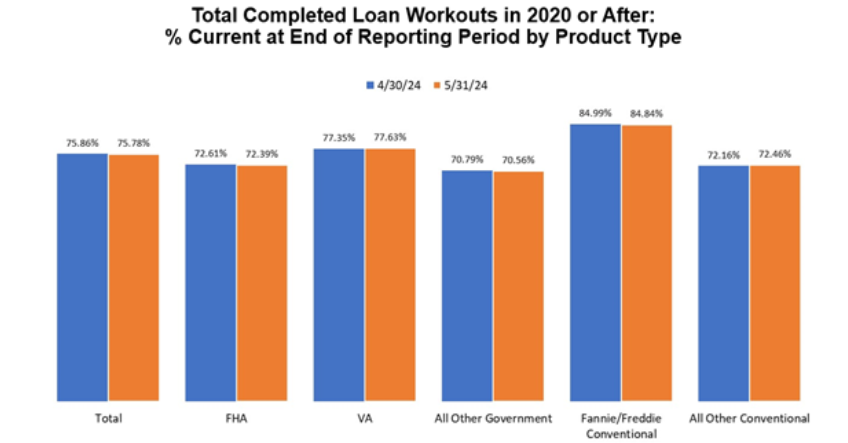

- Total completed loan workouts from 2020 and onward (repayment plans, loan deferrals/partial claims, loan modifications) that were current as a percent of total completed workouts decreased to 27% in June 2024, down 251 basis points from 75.78% the prior month. The performance of loan workouts across all product types worsened in June 2024.