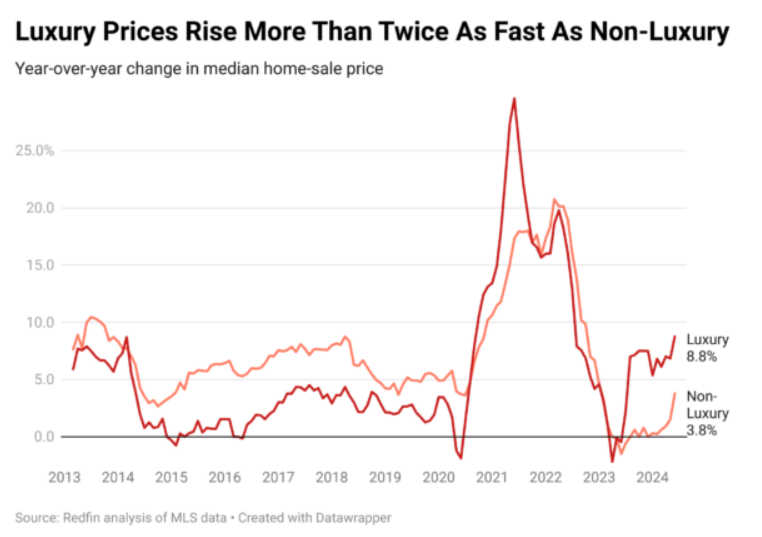

Redfin reports that the typical U.S. luxury home sold for a record $1,180,000 in Q2 2024, up 8.8% from a year earlier—the biggest increase in nearly two years. Non-luxury home prices grew at less than half that pace, rising 3.8% to a record high median of $342,500. Redfin defines “luxury homes” as those estimated to be in the top 5% of their respective metro area based on market value, and non-luxury homes as those estimated to be in the 35th-65th percentile based on market value.

“The luxury market has withstood the havoc wreaked by high mortgage rates this year, thanks to an abundance of all-cash buyers,” said Redfin Senior Economist Sheharyar Bokhari. “Now that sales are stabilizing and more homes are being listed for sale, it’s unlikely that luxury prices will continue to grow at quite as high a rate.”

High-end buyers were less likely to be impacted by the rate lock-in effect and uncertainty around the direction of mortgage rates, which sat above 7% for much of the quarter. They were also more likely to have benefited from a strong stock market and high levels of home equity. This spring, 43.7% of luxury homes sold were purchased with all cash, up from 43.2% a year earlier.

Monitoring luxury sale trends

The number of luxury homes sold in Q2 was virtually unchanged from a year earlier, ticking up by 0.2%, marking the third consecutive quarter of sales growth. Non-luxury home sales fell 3.4% to the lowest second-quarter number in a decade.

“There is still strong demand for well-priced, high-end properties, especially those which are presented beautifully and move-in ready,” said Crystal Zschirnt, a Redfin Premier Agent in Fort Worth, Texas, where luxury home sales were up 9.7% year on year and typically sold four days faster than non-luxury homes. “We had a client recently list a property for $2.4 million that we ended up selling for $2.6 million. We are still seeing multiple offers in situations where a property is priced accurately, visually appealing and doesn’t need any work.”

Compared to Q2 of 2019, luxury sales were down 12.8%, while non-luxury sales were down 20.1%.

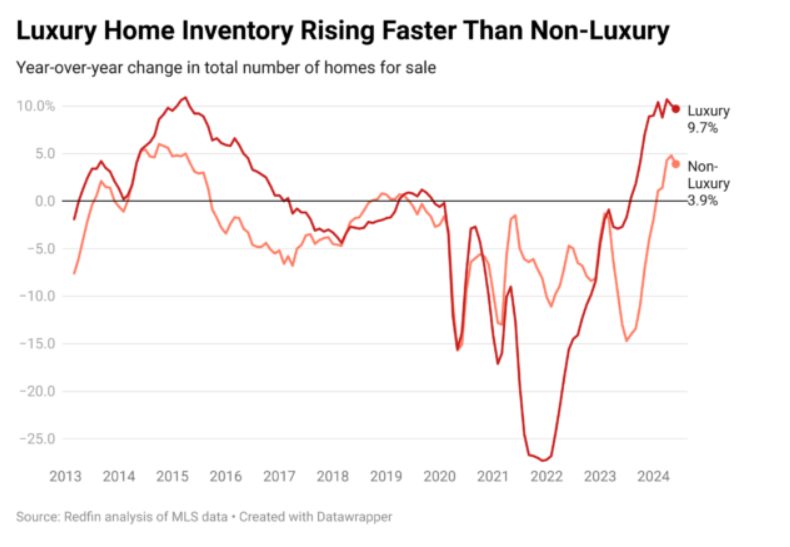

Luxury home inventory grows

Inventory in the luxury home space rose 9.7% year-over-year, marking the fourth consecutive quarter of growth following a major drop off during and after the pandemic. Non-luxury inventory rose 3.9%.

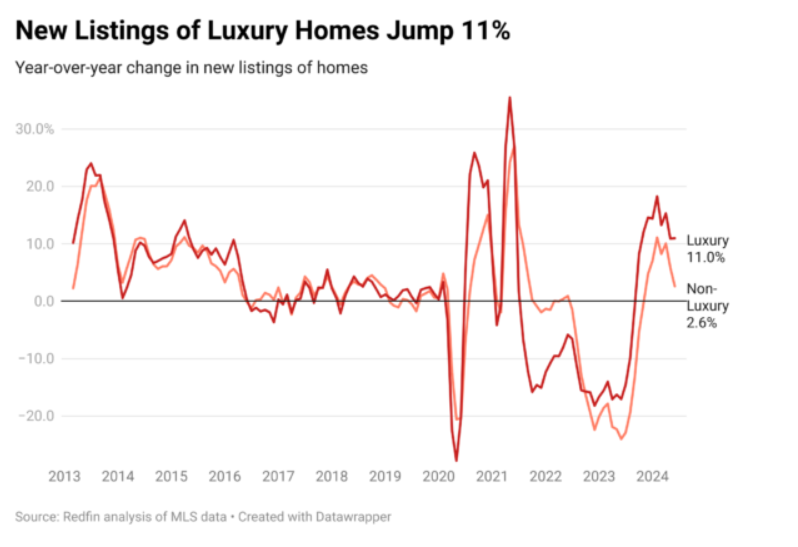

The number of new listings of luxury homes increased 11%, far outpacing the 2.6% increase in new listings of non-luxury homes And as the inventory of luxury homes rises, they remained on the market for a median of 40 days—two days longer than a year earlier. Non-luxury homes also took longer to sell, at a median of 31 days—up from 28 days last year.

“We are seeing luxury homes selling within 30-45 days, but that’s a lot longer than in 2022 when they were flying off the shelf,” said Juan Castro, a Redfin Premier Agent from Orlando, Florida, where inventory spiked 22.7% in Q2, year-over-year. “International cash buyers are still driving activity, but we have seen a slowdown in local buyers, as it’s really hard to upsize to a luxury home with a 7% mortgage rate.”

Luxury breakdowns by region

The median sale price of luxury homes rose most in the following metros tracked by Redfin:

- Providence, Rhode Island (16.5% increase to $1,395,000);

- San Jose, California (16.4% increase to $4,830,000); and

- Nassau County, New York (14.3% increase to $2,572,500).

The median sale price of luxury homes fell in just two metros:

- New York (-3.2% to $3,200,000); and

- Austin, Texas (-1.5% to $1,650,000).

Luxury home sales increased the most in Q2 in:

- Nashville, Tennessee (20.4%)’;

- Tampa, Florida (14.3%); and

- Seattle (13.9%).

While on the other end of the spectrum, luxury home sales decreased the most in:

- Newark, New Jersey (-20.1%);

- Baltimore, Maryland (-15.5%); and

- Indianapolis, Indiana (-12.4%).

In terms of active listings, the total number of luxury homes for sale increased the most in:

- Tampa, Florida (29.6%);

- Jacksonville, Florida (28.9%); and

- San Antonio, Texas (26.6%).

Whereas total inventory/active listings fell the most in:

- Newark, New Jersey (-16%);

- Chicago, Illinois (-9.8%); and

- Atlanta, Georgia (-6.2%).

New listings of luxury homes increased the most in:

- Providence, Rhode Island (31.5%);

- Miami, Florida (28.1%); and

- Tampa, Florida (27.6%).

New listings of luxury home sales fell in in 11 metros, with the biggest declines reported in:

- Newark, New Jersey (-18.3%);

- San Francisco, California (-15.4%); and

- Chicago, Illinois (-8.9%).

Luxury homes sold the fastest in Seattle with a median of six days, while Detroit; San Jose, California; and Indianapolis, Indiana all recorded a median of 10 days. Luxury home sales sold the slowest in Miami, Florida (114 days); West Palm Beach, Florida (108); and Nassau County, New York (81).

The10 most expensive U.S. home sales reported in Q2 2024 were found primarily in Colorado and Florida, specifically in:

- Glenwood Springs, Colorado (Aspen): $77 million

- Glenwood Springs, Colorado (Aspen): $66.5 million

- Los Angeles, California: $62.8 million

- Miami, Florida (Miami Beach): $62.5 million

- Glenwood Springs, Colorado (Aspen): $59 million

- West Palm Beach, Florida (Palm Beach): $51.3 million

- West Palm Beach, Florida (Highland Beach) $50 million

- West Palm Beach, Florida (Palm Beach): $49.6 million

- Glenwood Springs, Colorado (Aspen): $48.8 million

- Glenwood Springs, Colorado (Woody Creek): $46 million

Click here to view Redfin’s full Q2 report on luxury home sales.