According to ATTOM’s second-quarter 2024 U.S. Home Sales Report, typical single-family home and condo sales in the U.S. during Q2 yielded a profit margin of 55.8% for home sellers. This number remained essentially unchanged from Q1 of 2024, increasing by roughly one percentage point, but declining by one point from the second quarter of the previous year.

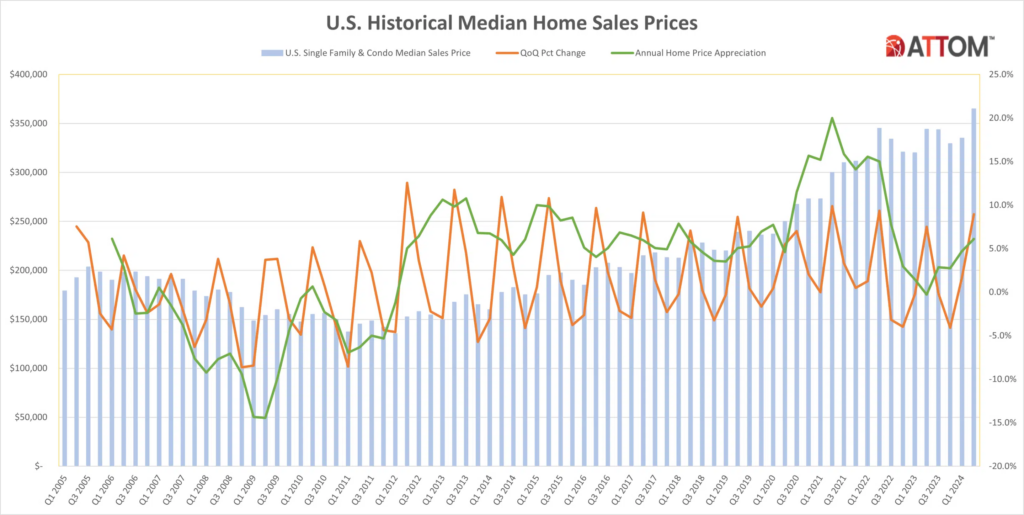

Despite the fact that the median price of a home in the United States surged to a new record of $360,000 during the 2024 spring home-buying season, the countrywide investment return barely moved and remained well behind a highwater mark reached in 2022.

The increase in price did contribute to sellers’ average raw earnings of more than $130,000. That almost set a new record for high points. However, because recent sellers were not able to beat the price surges they had been absorbing when they originally acquired their homes, the renewed price boom did not sufficiently increase profit margins, or the % return on investment, across the nation.

“The second-quarter profit report offers a mixed bag of plusses and minuses that added up to an overall picture of not much change for sellers,” said Rob Barber, CEO of ATTOM. “Prices jumped back upward, which was great news for owners. So did raw profits. Profit margins also remained historically elevated. But the bottom-line profit-margin trend didn’t move much at all because soaring prices are far from a new thing. Even greater price improvements will be needed to kick margins up over the rest of the year.”

The most recent price and profit figures are based on a time when the national median home value increased by 6% annually and 9% quarterly. These improvements coincided with the customary springtime surge in demand from homebuyers, as well as historically low supply of available properties that made deals hard to come by and generally stable 30-year fixed loan mortgage rates.

Nevertheless, because median values had been rising by roughly 8% on a quarterly basis and 7% on an annual basis when homeowners were purchasing the houses they later sold in the second quarter of this year, the price rises had little effect on investment returns. These comparable pricing trends mostly neutralized one another.

Profit Margins Tick Upward Quarterly While Still Down Annually in Majority of Nation

The percentage difference between the median purchase and resale prices, or typical profit margins, rose in 94 (58.8%) of the 160 metropolitan statistical areas in the United States that had enough data to be analyzed between the first and second quarters of 2024. However, in 100 of those metros, or 62.5%, they continued to decline annually.

When the national return on median-priced house sales peaked at 64.3% in Q2 of 2022, they were also lower in around three quarters of those localities.

The metro areas with property values typically exceeding $350,000, which comprise the upper echelons of the housing market, bore the majority of the year-over-year decline in profit margins. Typical margins declined in nearly three quarters of those markets, compared to around half of lower-priced markets. Metro regions were considered eligible if, in the second quarter of 2024, they had at least 1,000 sales of single-family homes and condominiums and a sizable population.

The biggest year-over-year decreases in typical profit margins came in the metro areas of Hilo, HI (margin down from 80.5% in Q2 of 2023 to 45.3% in Q2 of 2024); Port St. Luce, FL (down from 95% to 73.9%); Daphne-Fairhope, FL (down from 49.8% to 34%); Crestview-Fort Walton Beach, FL (down from 60.7% to 45.1%) and Naples, FL (down from 84.9% to 69.2%).

In metro areas with a population of at least one million, Honolulu, Hawaii (returning from 51.8% to 38.5%); Austin, Texas (down from 50.3% to 40.3%); Nashville, Tennessee (down from 72.9% to 63.3%); Seattle, Washington (down from 94.4% to 85%); and San Antonio, Texas (down from 34.9% to 27%) saw the largest annual profit-margin decreases in Q2 of 2024.

The areas with the largest annual increases in returns on investment were:

- Rockford, IL (up from 54.8% to 74.5%)

- Scranton, PA (up from 79.9% to 97.7%)

- Lansing, MI (up from 50.1% to 62.7%)

- Roanoke, VA (up from 45.1% to 56.1%)

Syracuse, NY had the largest annual improvements in returns on investment.

The largest annual increases in profit margins among metro areas with a population of at least 1 million came in Rochester, NY (up from 66.2% to 76%); Cleveland (up from 53.5% to 61%); Hartford, CT (up from 65.8% to 73.3%); Chicago (up from 39.5% to 46.1%) and Providence, RI (up from 73.3% to 78.8%).

Investment Returns Still Exceed 50% in Two-Thirds of U.S.

In 106 of the metro areas examined (66.3%), returns on investment for median-priced house sales in the second quarter of 2024 exceeded 50%, notwithstanding the most recent trends. While it was still significantly higher than the level of roughly 10% five years ago, it was down from over three quarters of those locations in the second quarter of last year.

The investment return leaders among areas with a population of at least 1 million in Q2 of this year were:

- San Jose, CA (typical return of 109.6%)

- Seattle (85%)

- San Francisco (83.6%)

- Boston (81.3%)

- Miami (80.3%)

Among areas with a population of at least 1 million, those with the lowest typical returns were in New Orleans (24.4%); San Antonio (27%); Houston (34.8%); Virginia Beach, VA (37.3%) and Dallas (37.9%).

Raw Profits Return to Near-Record Levels

In the months of April through June of 2024, the raw profit on median-priced home sales nationally increased by 10.1% on a quarterly basis and by 5.2% on an annual basis. The most recent raw profit of $130,712 represented the highest since the spring of 2022, when it was $135,000.

Of the markets examined, 134 saw an increase in typical raw earnings on a quarterly basis (83.8%), and 86 saw an increase on an annual basis (53.8%).

The biggest year-over-year increases in raw profits on typical sales among metro areas with a population of at least 1 million were in Chicago (up 21.6%); Hartford, CT (up 18.4%); Rochester, NY (up 18%); Cleveland (up 17%) and New York (up 15%).

Raw profits on median-priced sales exceeded $100,000 during Q2 in 62.5% of the metro areas analyzed, with 18 of the top 20 along the east or west coasts. They were led by San Jose, CA (raw profit of $836,500); San Francisco ($547,000); San Diego ($400,000); Los Angeles ($375,500) and Barnstable, MA ($365,000).

The 30 lowest raw profits were all in the Midwest or South. The smallest were in Shreveport, LA ($8,063); Beaumont, TX ($27,266); Columbus, GA ($37,703); Lubbock, TX ($38,083) and Peoria, IL ($38,700).

Spring Buying Season Spurs Quarterly, Annual Price Surges

In Q2 of this year, the median price of single-family homes and condos nationwide increased from $335,000 to $365,000. Also, it increased from $344,000 in the second quarter of the previous year.

In roughly 95.7% of the metro regions across the nation with sufficient data for analysis, the typical value climbed quarterly, and in 89.6%, it increased annually. In over 75% of those markets, it reached all-time highs. With hikes of at least 5% annually in nearly three-quarters of the metro areas in the Midwest and Northeast, those regions benefited most from the most recent price spike.

Metro areas with the biggest year-over-year increases in median home prices were Des Moines, IA (up 16.8%); Trenton, NJ (up 16.2%); Fort Wayne, IN (up 15.2%); Scranton, PA (up 14.3%) and Albany, NY (up 14.1%). The largest annual median-price increases in metro areas with a population of at least 1 million were in San Jose, CA (up 11.5%); Detroit (up 11.3%); Hartford, CT (up 11.1%); New York (up 9.9%) and Miami (up 9.7%).

Metro areas with a population of at least 1 million where the median home price went down most from the second quarter of last year to the same period this year were Austin, TX (down 3.1%); Memphis, TN (down 3%); Honolulu (down 2.5%); Birmingham, AL (down 2.2%) and San Antonio (down 1.4%).

Homeownership Tenure Sees Slight Uptick

The average tenure of homeowners who sold in the second quarter of 2024 was 7.88 years. This was an increase from 7.7 years in 2024’s first quarter and 7.59 years in 2023’s second quarter.

In eighty percent of the metro regions with enough data, the average tenure increased between the second quarter of 2023 and the same period this year. Lake Havasu City, AZ had the biggest annual gains in tenure (18%), followed by Vallejo, CA (12%), Salinas, CA (15%), Manchester, NH (13%) and Redding, CA (16%).

The longest 35 average tenures for owners who sold in the second quarter were again in the Northeast or West regions of the U.S. They were led by Barnstable, MA (13.46 years); Bridgeport, CT (12.58 years); Hartford, CT (12.4 years); Santa Rosa, CA (12.29 years) and Boston (12.25 years). The smallest average tenures among second-quarter sellers were in Crestview-Fort Walton Beach, FL (6.55 years); Panama City, FL (6.59 years); Ocala, FL (6.61 years); Oklahoma City (6.67 years) and Austin, TX (6.71 years).

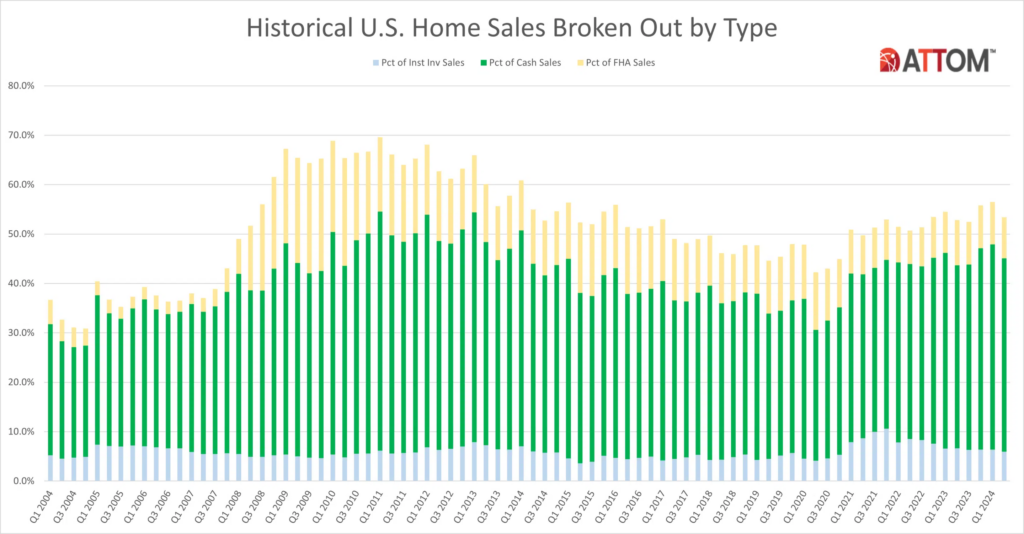

Cash Sales Decline as Portion of All Transactions

In Q2 of 2024, 39.1% of single-family home and condo sales nationwide were made up of all-cash transactions. While it was higher than 37.1% in Q2 of the previous year, it was down significantly from 41.6% in Q1 of 2024.

“Cash-sale levels dropped a bit in the second quarter, but remained above average as mortgage rates hovered back and forth around 7% for 30-year fixed loan,” Barber said. “With no sign that rates are headed down significantly, which would lower borrowing costs, we are likely to continue seeing higher portions of cash deals.”

Among metropolitan areas with sufficient data, those where all-cash sales represented the largest share of all transactions in Q2 of 2024 included Myrtle Beach, SC (68.7% of all sales); Claremont-Lebanon, NH (63.6%); Naples, FL (61.5%); Utica, NY (61.2%) and Columbus, GA (60.8%).

To read the full report, including more data, charts, and methodology, click here.