Though home prices have plateaued in many areas, they remain near record highs across the United States. According to the opinions of LendingTree staff writer Jacob Channel, with steep housing costs, some Americans may recall the dramatic price surges of the early to mid-2000s, which preceded the Great Recession of 2007-2009. This historical comparison might incite panic, as the Great Recession led to significant home value declines and numerous foreclosures.

However, today’s housing market, while expensive, appears to be in far better shape than it was before the Great Recession. Nationwide, home prices have largely avoided major drops, and most homeowners have maintained their mortgage payments, thereby avoiding foreclosure.

According to a LendingTree analysis of the latest U.S. Census Bureau American Community Survey data, a relatively small number of homeowners have lost their homes to foreclosure.

Key findings

- Across the U.S., only 46,237 homes are vacant due to foreclosure. For comparison, there are 143.4 million housing units in the 50 states (excluding the District of Columbia).

- Homes nationwide are unlikely to be empty due to foreclosure—even if vacant. Across the U.S., 13,868,075 housing units are vacant. Of that amount, only 0.33% are empty because of foreclosure. Most others are only temporarily empty, typically because they’re used for vacations or on the market to be bought or rented.

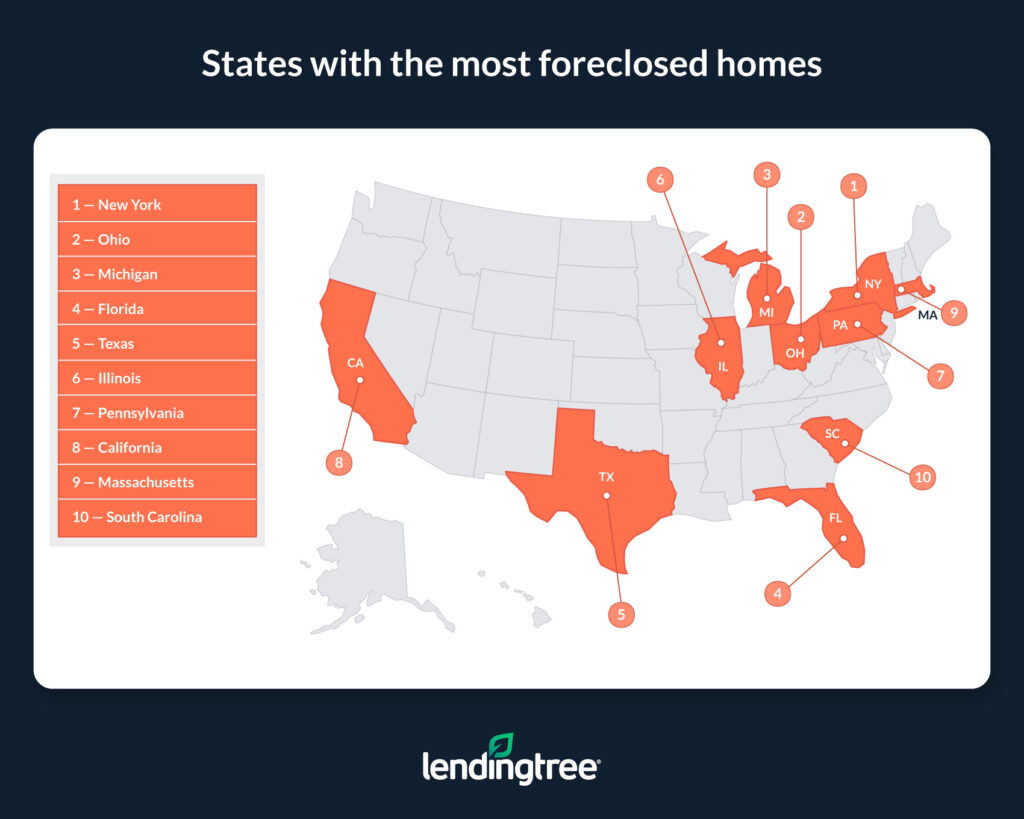

- New York, Ohio and Michigan have the most foreclosed homes. In these states, 4,342, 3,489 and 3,454, respectively, are vacant due to foreclosure. On average, 0.06% of homes in these states are empty because they’ve been foreclosed on. Among only vacant homes in these states, an average of 0.68% are unoccupied due to foreclosure.

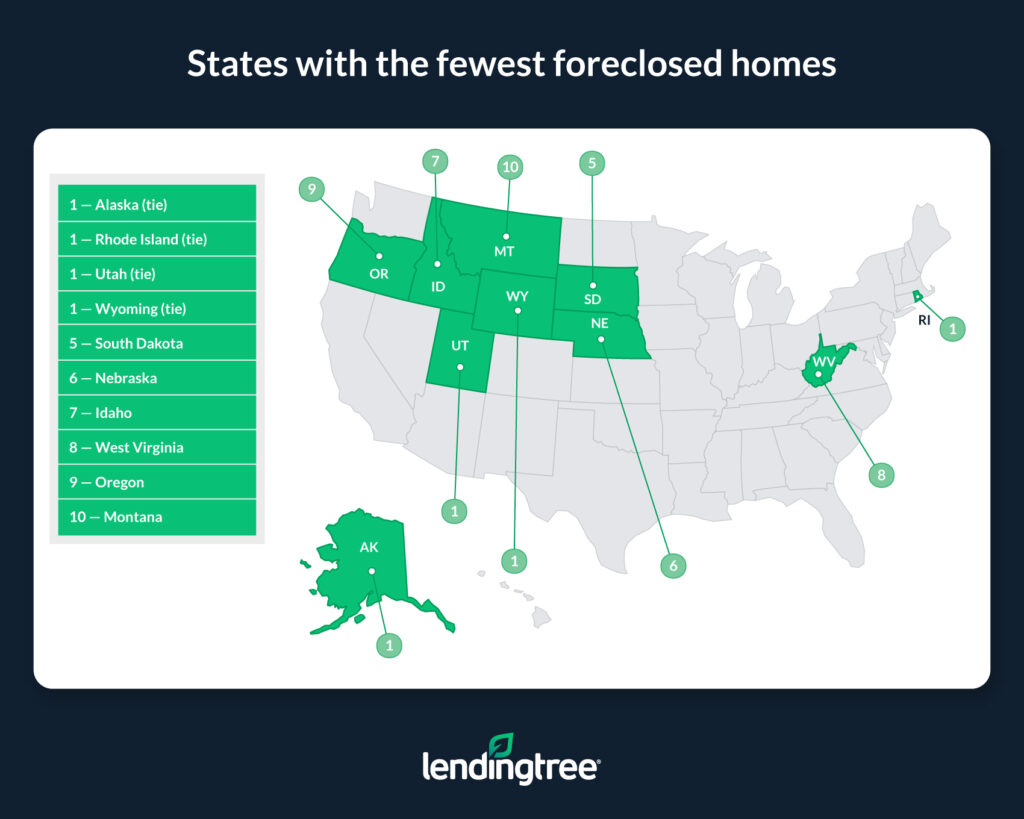

- Alaska, Rhode Island, Utah and Wyoming have no reported foreclosed homes. While the American Community Survey estimates there are zero foreclosed homes across these states, margins of error (see the methodology for more info) could impact that, albeit not by much.

States with the Most Foreclosed Homes

1. New York

Total housing units: 8,585,784

Vacant housing units: 811,476

Housing units vacant due to foreclosure: 4,342 (±1,062)

Share of housing units vacant due to foreclosure: 0.05%

Share of vacant housing units unoccupied due to foreclosure: 0.54%

2. Ohio

Total housing units: 5,293,227

Vacant housing units: 415,021

Housing units vacant due to foreclosure: 3,489 (±1,094)

Share of housing units vacant due to foreclosure: 0.07%

Share of vacant housing units unoccupied due to foreclosure: 0.84%

3. Michigan

Total housing units: 4,605,363

Vacant housing units: 515,569

Housing units vacant due to foreclosure: 3,454 (±1,288)

Share of housing units vacant due to foreclosure: 0.07%

Share of vacant housing units unoccupied due to foreclosure: 0.67%

States with the Fewest Foreclosed Homes

1. (tie) Alaska

Total housing units: 329,160

Vacant housing units: 54,586

Housing units vacant due to foreclosure: 0 (±170)

Share of housing units vacant due to foreclosure: 0.00%

Share of vacant housing units unoccupied due to foreclosure: 0.00%

1. (tie) Rhode Island

Total housing units: 486,017

Vacant housing units: 39,329

Housing units vacant due to foreclosure: 0 (±242)

Share of housing units vacant due to foreclosure: 0.00%

Share of vacant housing units unoccupied due to foreclosure: 0.00%

1. (tie) Utah

Total housing units: 1,228,707

Vacant housing units: 99,047

Housing units vacant due to foreclosure: 0 (±204)

Share of housing units vacant due to foreclosure: 0.00%

Share of vacant housing units unoccupied due to foreclosure: 0.00%

1. (tie) Wyoming

Total housing units: 277,106

Vacant housing units: 33,785

Housing units vacant due to foreclosure: 0 (±207)

Share of housing units vacant due to foreclosure: 0.00%

Share of vacant housing units unoccupied due to foreclosure: 0.00%

Why Aren’t Foreclosures More Common?

Foreclosures are uncommon across all states, which may seem surprising given the high costs associated with homeownership. Several factors contribute to this trend.

Despite elevated home prices and mortgage rates, most homeowners are managing to keep up with their payments. Mortgage delinquency rates remain lower than they were before the pandemic, largely because many current homeowners purchased or refinanced their homes when mortgage rates were below 5%.

Additionally, lenders typically avoid pursuing foreclosures until they have exhausted other options. Even if a homeowner falls behind on payments, lenders generally attempt to work with them to become current before moving to foreclose. The foreclosure process is both time-consuming and costly, making it a less desirable option for lenders unless the borrower is seriously delinquent.

Ultimately, the data indicates that most homeowners are not at significant risk of losing their homes to foreclosure. While owning a home remains challenging—and those facing foreclosure are certainly encountering serious difficulties—the majority of homeowners are maintaining a relatively healthy financial status.