According to a new CoreLogic study, a decrease in affordability has resulted from the simultaneous rise in mortgage rates and housing prices in the U.S.

Some purchasers are looking into buydown points and adjustable-rate mortgages (ARMs) as alternatives to fixed-rate mortgages (FRMs) in order to lower their monthly payments, especially during the first term of the loan. A percentage point increase in the mortgage rate results in increased monthly payments and extra expenses for homebuyers.

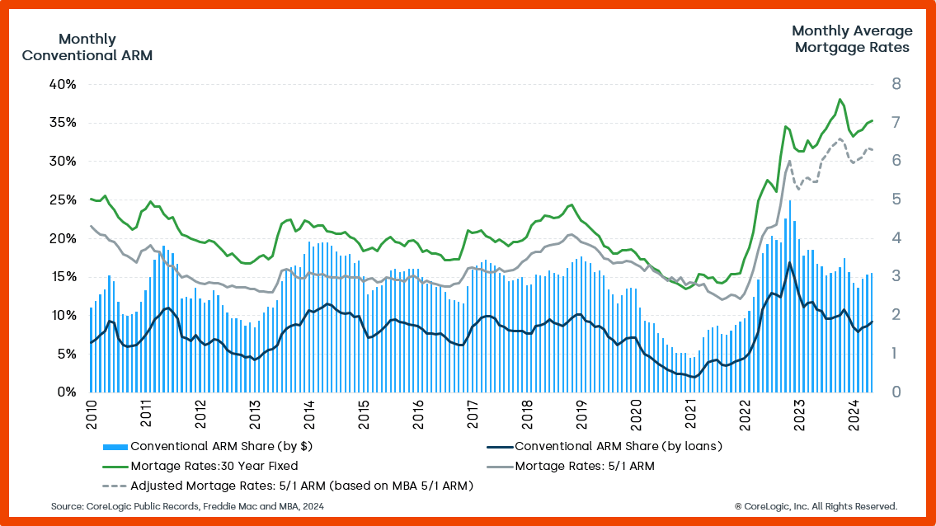

Compared to ARMs, FRMs are now more common after the 2007 housing market crashed. Between mid-2005 and mid-2009, the percentage of ARM dollar volume in mortgage originations decreased from approximately 45% to 2%.

Since then, depending on the current FRM rate, the ARM portion of monthly mortgage originations has varied between about 4% and 25%.

ARM Shares Shrunk During the Pandemic Era

During the pandemic, the ARM share decreased, and in January 2021 it reached a 10-year low of 4% of mortgage originations. But during the past two years, FRM interest rates have risen from below 3% to record highs, which has given ARMs new life.

As interest rates increased, the share of ARMs in the dollar volume of conventional single-family mortgage originations increased to 15.5% in May 2024, the highest amount so far this year. In May, the average 30-year fixed-rate mortgage (FRM) rate rose from 6.99% in April to 7.06%. The 5/1 rate did not change during that time. Nonetheless, throughout the pandemic, the difference in interest rates between the FRM and the ARM shrank and is currently back to its pre-pandemic level.

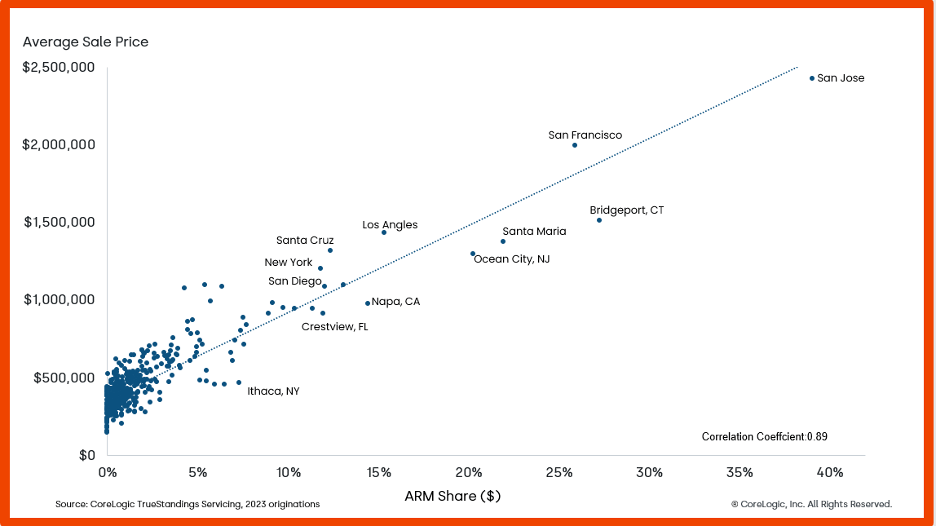

The location and loan amount have a considerable impact on the ARM share. ARMs are more prevalent among homebuyers with larger loans and in affluent areas than among those with smaller loans. Buyers who choose ARMs over FRMs typically save more money each month on the initial payment, particularly on larger loans because ARMs have lower initial interest rates.

Examining ARMS Across U.S. Housing Markets

The average retail price and the ARM share are positively correlated. Metros with higher average sales prices have larger ARM shares. For instance, among all conventional mortgage originations in 2023, the San Jose, CA, metro region had the highest average sale price as well as the greatest percentage of ARMs.

ARMs accounted for 40% of the dollar volume of mortgage originations over $1 million in May 2024, a percentage that remained constant from May 2023. The percentage of ARMs in mortgages between $400,001 and $1 million was almost 13%, which represents a 2 percentage point decrease from May 2023. In May 2023, the percentage of ARMs for mortgages in the $200,001–$400,000 range was under 7%, a decrease of 4 percentage points from the prior year. In spite of these decreases from year-over-year, the ARM share rose in comparison to the previous month.

The share of ARMs is rising in tandem with rising mortgage rates, but it is still lower than and distinct from levels observed prior to the Great Recession. The 5/1 and 7/1 types of ARMs are currently the most widely used, which reduces danger. Furthermore, the proportion of outstanding ARMs and their quantity are still quite low, even with the present increase in originations. By dollar amount and count, ARMs made up about 5% and 3%, respectively, of conventional originations as of April 2024.

To read the full report, including more data, charts, and methodology, click here.