Recent data from First American (First Am) Data & Analytics’ Real House Price Index (RHPI) reveals a significant shift in the housing market, with increased housing supply leading to improved affordability in some areas. First Am’s Chief Economist Mark Fleming emphasizes that as housing supply grows, affordability tends to improve, diminishing the dominance of a seller’s market.

National trends: a mixed bag

Nationally, housing affordability saw a modest improvement in June, driven by slightly lower mortgage rates and positive income growth. However, the overall picture remains less favorable compared to a year ago, with affordability down approximately 4%. This decline is attributed to a 5.6% rise in nominal house prices and a 0.2% point increase in the 30-year fixed mortgage rate.

Household income has risen by 3.8% since June 2023, bolstering consumer house-buying power. Yet, this increase was insufficient to counterbalance the affordability loss from higher mortgage rates and rising house prices.

Regional disparities: supply boosts affordability

The national housing market has been grappling with undersupply for over a decade. Limited supply coupled with rising demand has historically driven prices up and reduced affordability. However, recent data shows a 21% increase in housing supply nationally, with 48 of the top 50 markets experiencing year-over-year growth in inventory.

The distribution of this inventory growth is uneven. Southern and Western markets have seen particularly strong increases, while the Northeast and Midwest have experienced more modest gains.

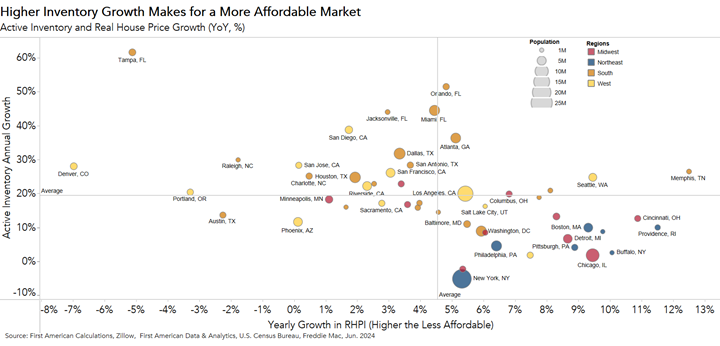

The scatterplot below of the top 50 markets is divided into four quadrants, with the y-axis representing annual for-sale inventory growth and the x-axis representing affordability growth as measured by the RHPI[1]. The analysis indicates a statistically significant and negative relationship between housing supply and improving affordability – the faster the inventory growth, the more affordable the market becomes.

Affordability improved year-over-year in only five of the top 50 markets. Notably, in Tampa, Florida, active inventory surged by nearly 62 percent, resulting in a 5 percent improvement in affordability. These markets also recorded below-average nominal house price growth, indicating that increased supply is balancing the market.

Shifting market dynamics: the waning seller’s market

Despite the overall increase in housing supply, some markets continue to experience strong demand that outpaces supply growth, leading to robust price appreciation and declining affordability. Cities like Memphis and Seattle fall into this category, with above-average inventory growth but significant declines in affordability.

While inventory levels are higher than last year, they remain historically low. National housing supply is still nearly 34 percent lower compared to June 2019, before the pandemic began. Nonetheless, the trend of increasing supply signals a potential shift towards more balanced market condition

June 2024 Real House Price Index Highlights

The First American Data & Analytics’ RHPI showed that in June 2024:

- Real house prices decreased 1.3% between May 2024 and June 2024.

- Real house prices increased 3.9% between June 2023 and June 2024.

- Consumer house-buying power, how much one can buy based on changes in income and mortgage rates, increased 1.7% between May 2024 and June 2024, and increased 1.7% year over year.

- Median household income has increased 3.8% since June 2024 and 91.8% since January 2000.

- Unadjusted house prices are now 61.4% above the housing boom peak in 2006, while real, house-buying power-adjusted house prices are 1.8% above their 2006 housing boom peak.

- Real house prices are 45.3 % more expensive than in January 2000.

June 2024 Real House Price State Highlights

- The five states with the greatest year-over-year increase in the RHPI are: Rhode Island (+11.9%), Illinois (+10.4%), Delaware (+9.5%), New Jersey (+9.4%), and West Virginia (+8.8%).

- The five states with the greatest year-over-year decrease in the RHPI are: Colorado (-6.1%), Oregon (-1.9%), Louisiana (-1.6%), Vermont (-0.9%), and Texas (-0.7%).

June 2024 Real House Price Local Market Highlights

- Among the U.S. Census Bureau’s Core Based Statistical Areas (CBSAs) tracked by First American Data & Analytics, the five markets with the greatest year-over-year increase in the RHPI are: Memphis, Tenn. (+12.5%), Providence, R.I. (+11.5%), Cincinnati (+10.9 %), Buffalo, N.Y. (+10.1%), and Hartford, Conn. (+9.8%).

- Among the CBSAs tracked by First American Data & Analytics, the five markets with the greatest year-over-year decrease in the RHPI are: Denver (-7.0%), Tampa, Fla. (-5.1%), Portland, Ore. (-3.3%), Austin, Texas (-2.3%), and Raleigh, N.C. (-1.8%).