A new paper by Harvard University’s Joint Center for Housing Studies examines 11 state and local programs created to address the housing needs of middle-income renters.

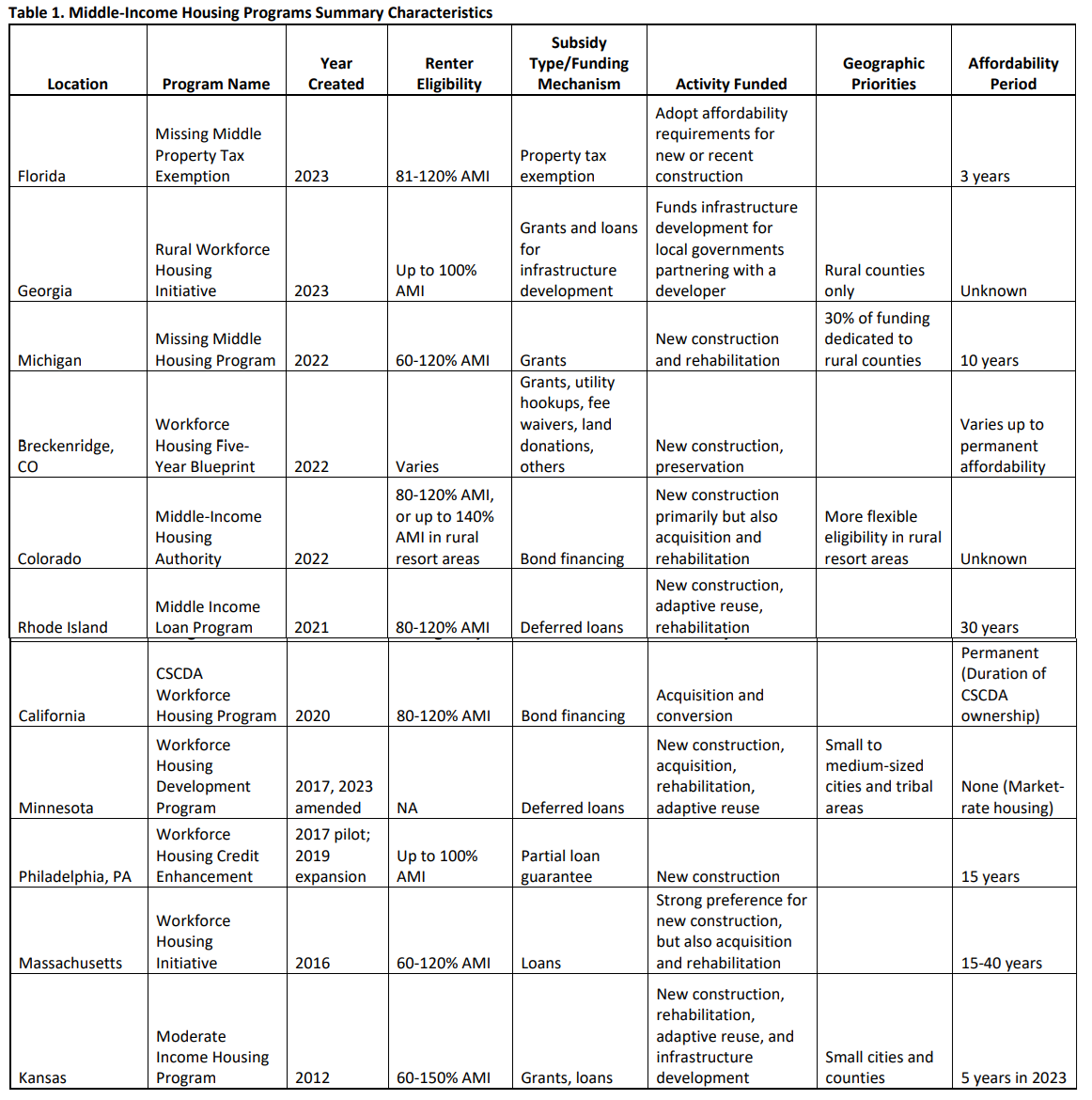

The programs studied in “Subsidizing the Middle: Policies, Tradeoffs, and Costs of Addressing Middle-Income Affordability Challenges” provide direct and indirect public subsidy, everything from grants and loans to property tax exemption and government guarantee of construction loans (see table below).

Most of the programs were created after 2019. While they have similar audiences, intentions, and benefits, and are present across a wide range of market conditions, housing costs, and political environments, they are quite diverse in nature.

Eligibility is usually determined by a percentage of area median income (AMI) threshold, unlike other programs that use employment status, occupation, and the like, and tend to emphasize new construction over rehabilitation or related aspects (adaptive reuse, acquisition and conversion).

The Colorado Middle-Income Housing Authority, for instance, subsidizes creation of 3,500 units for middle-income renter households, including at least 2,800 new builds.

For property owners, the affordability period is generally modest. Places like Rhode Island are on the high end, requiring qualifying housing to be kept affordable for at least 30 years, whereas the affordability period in Michigan is only 10 years. California does things a little differently, creating longer-term, if not permanent, affordability by buying rental housing which it then income- and rent-restricts.

The per-unit funding for state and local governments is generally low. Some states, like Massachusetts and Michigan, provide loans per affordable unit, sometimes up to $100,000 per home. Others, like Georgia and Kansas, provide infrastructure grants for local governments to enable the construction of new units.

Most of these programs are relatively new, within the last five years, so more research needs to be done. State and local governments need to balance the needs of lowest-income renters with middle-income renters. But the fact that so many programs have been created in such a short period of time speaks to the unaffordability boom spreading across geographic and socioeconomic lines.

Click here to read more on the Harvard University’s Joint Center for Housing Studies latest report.