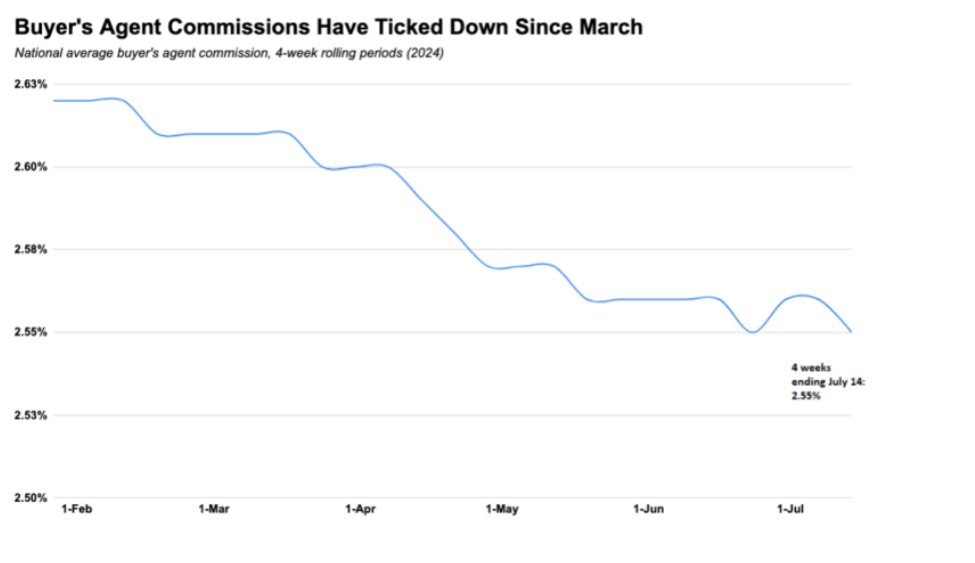

The typical U.S. home seller pays a 2.55% commission to the real estate agent hired by their home’s buyer, according to a new analysis of MLS data by Redfin—down from an average of 2.62% reported in January.

Commissions have been gradually declining over the past decade, from an average of 2.89% in 2013 to 2.66% in 2023. It’s possible that news of a legal settlement by the National Association of Realtors (NAR) in March has contributed to the recent decline by making consumers more aware they can offer any commission to a buyer’s agent or none at all.

History of a Settlement

In mid-March, NAR announced an agreement to resolve litigation over broker commission claims asserted on behalf of home sellers. The agreement would settle claims against NAR, over one million NAR members, all state/territorial and municipal Realtor associations, all association-owned MLSs, and all brokerages having a NAR member as principal in 2022 with a residential transaction volume of $2 billion or less. The settlement was the culmination of a series of lawsuits against NAR.

The NAR settlement accomplished two essential goals: it released most NAR members and many industry stakeholders from liability in these instances, and it ensured that cooperative compensation remains an option for customers when purchasing or selling a house. NAR also obtained in the deal a mechanism enabling practically all brokerage organizations with a residential transaction volume of more than $2 billion in 2022, as well as MLSs that are not completely controlled by Realtor’s associations, to acquire releases efficiently if they so desire.

Gauging the Ripple Effect

“Redfin agents are reporting that commissions have been top of mind for clients since the NAR settlement was announced, and some sellers are asking about what it would mean to offer no commission or a relatively low one,” said Redfin Chief Economist Daryl Fairweather. “Still, even before the blitz of publicity around the class-action lawsuits and NAR settlement, commissions were coming down. That’s partly because of the competitive housing market before and during the pandemic—which motivated some sellers to offer a low commission because they knew they could still attract buyers—and greater fee transparency.”

In dollar terms, the average commission paid to a buyer’s agent in the U.S. is $15,377, up slightly from $15,124 in January. The dollar amount has increased marginally even though the percentage has declined because of the rise in home prices. The national average commission is calculated as an average of actual buyers’ agent commissions in the multiple listing services (MLSs) that are currently reporting on this data. This analysis looked at rolling four-week periods through July 14, 2024, finding the following:

- Commission percentages have declined in all but three of the most populous U.S. metros since the NAR settlement–but the decreases are small.

- Broken down by metro area, commission percentages paid to buyer’s agents have declined in all but three of the most populous metro areas since the NAR settlement was announced. They increased incrementally in one, and stayed flat in two. Most of the declines are small, less than one-tenth of a percent. Redfin analyzed the 50 most populous U.S. metros and included in this analysis the 49 with sufficient data.

- Commission percentages have declined most in Detroit, with the average commission paid to a buyer’s agent in the Motor City at 2.87% during the four weeks ending July 14, down from 3.18% in January. Next lowest was Cleveland (2.39%, down from 2.62%), and Miami (2.63%, down from 2.84%).

- Commission percentages increased incrementally in Cincinnati, where the average was 2.95%, up from 2.93% in January.

- Commission percentages were reported the highest in Austin, Texas (2.99%); Cincinnati, Ohio (2.95%); and San Antonio, Texas (2.91%).

- Commission percentages were reported the lowest in Nassau County, New York (1.95%); Providence, Rhode Island (2.05%); and Anaheim, California (2.11%).

- In dollars, the average amount of money buyer’s agents earn in commission is highest in metros where homes are expensive. In San Francisco, the average commission was $50,734 during the four weeks ending July 14. Next came San Jose, California ($43,159) and Anaheim, California ($39,877).

- Buyer’s agents earned the least amount of money per deal in places where homes are relatively inexpensive, all in the Rust Belt: Cleveland, Ohio (average of $5,280 per deal); Detroit, Michigan ($7,054); and Pittsburgh, Pennsylvania ($7,918).

Click here to read more about Redfin’s analysis of agent commissions.