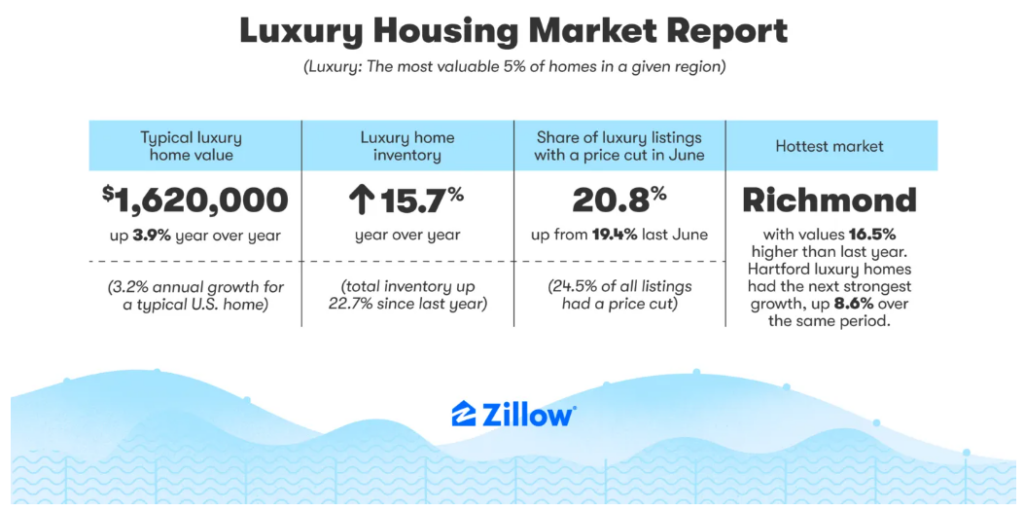

A new analysis from Zillow has found that luxury home value growth has now outpaced appreciation on typical homes for five consecutive months. The typical luxury home—defined by Zillow as the most valuable 5% of homes in a given region—is worth about $1,620,000. Among the 50 largest U.S. metro areas, the typical luxury home ranges from a low of just under $750,000 in Buffalo to more than $5.3 million in San Jose.

Luxury home values across the U.S. are 3.9% higher than a year ago. That’s faster appreciation than the 3.2% annual growth for the typical U.S. home. For every month from January 2019—the earliest year-over-year change in Zillow’s records—through January 2024, typical home values were outpacing luxury homes on an annual basis. For every month since, luxury home values have been growing faster.

A “Different” Type of Buyer

“Luxury homes can be challenging to sell because the pool of buyers is so much smaller. That’s one reason prices for them usually grow more slowly,” said Anushna Prakash, Economic Research Scientist at Zillow. “We’re seeing a different trend play out this year. Luxury home buyers are likely less affected by higher mortgage rates than a typical buyer, especially repeat buyers who saw their home equity soar over recent years. Many will be able to pay with cash, and skip a mortgage payment altogether.”

Luxury home inventory has been slower to recover than inventory overall, helping to keep prices climbing. Inventory in the luxury segment is up 15.7% year-over-year, and is 46.9% below pre-pandemic norms. By comparison, total inventory is 22.7% higher than last year, and about 32.6% below pre-pandemic averages.

Examining Market Trends

The share of luxury listings with a price cut is climbing, but is tracking below the market as a whole. In June, 20.8% of luxury listings experienced a price cut, up from 19.4% the previous June. Among all homes, 24.5% of listings had a price cut.

The luxury home market in Richmond, Virginia is red hot, with values 16.5% higher than last year, far surpassing the growth seen in any other major market. Luxury homes in Hartford, Connecticut had the next strongest growth, up 8.6% over the same period. Ranking third, luxury homes in Charlotte, North Carolina averaged $1,607,506, up 7.9 % year-over-year.

Luxury home inventory in Richmond was down 13.2% year-over-year, making it one of only six major markets with fewer luxury homes for sale than last year. Luxury homes in Richmond that sold in June did so after just six days on the market, the fastest rate in the country. Luxury home inventory was also down year-over-year in the following markets:

- Milwaukee, Wisconsin (down 19.5% year-over-year)

- Buffalo, New York (down 5.4% year-over-year)

- Cleveland, Ohio (down 4.5% year-over-year)

- New York, New York (down 4.4% year-over-year)

- San Francisco, California (down 4.0% year-over-year)

And in the Lone Star State, Austin, Texas was the only major market where luxury home values declined over the past year, dropping 1.5% year-over-year. Home values in Austin overall saw a meteoric rise during the pandemic, and a building boom in response to that demand has helped lessen competition for each home and bring price growth under control. Other markets seeing little rise in value in their luxury markets include:

- New Orleans, Louisiana (where the average luxury home price remained unchanged at $1,033,156 year-over-year)

- Portland, Oregon (where the average luxury home price was $1,506,635, up just 0.4% year-over-year)

- Minneapolis (where the average luxury home price was $1,188,521, up just 0.9 % year-over-year)

- San Antonio, Texas (where the average luxury home price of $1,158,841 was up just 1.0% year-over-year)

- Denver, Colorado (where the average luxury home price was $1,991,133, up just 1.1% year-over-year)

Click here for more information on Zillow’s study on the luxury home market.