While the housing market is showing signs of becoming (somewhat) friendlier toward prospective buyers, home prices and mortgage rates remain high. Although 21% of Americans still plan to buy a home this summer, over half of all Americans believe that the housing market is “prohibitively expensive.” This is according to new LendingTree data.

The housing market is showing signs of becoming (somewhat) more accommodating to prospective buyers, although both property prices and mortgage rates are still high. As a result, mortgage demand is currently at its lowest point in more than 20 years, underscoring how intimidating the current market seems to most Americans.

Because most Americans don’t plan to buy a home this summer, according to the most recent LendingTree study, demand probably won’t increase anytime soon.

Key Findings:

- Buying a home isn’t in the forecast for most Americans this summer. While 77% of Americans believe the housing market is prohibitively expensive in their area, 21% are still considering buying a home this summer. Gen Zers are most likely to be on the hunt for a new home this summer, with 37% considering buying.

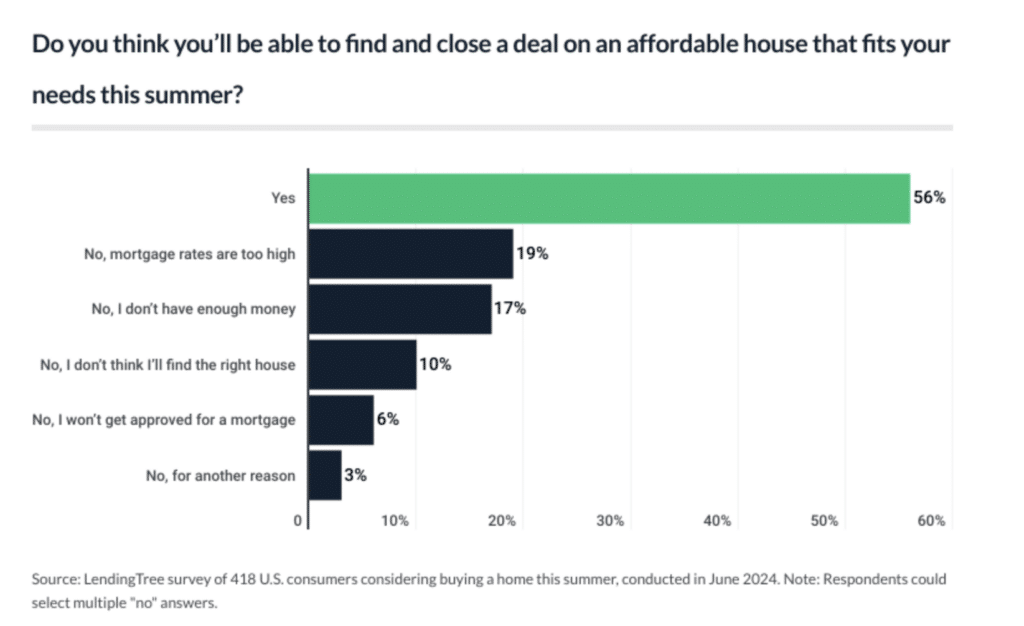

- Some potential buyers are optimistic. Among those considering buying this summer, 56% are confident they’ll be able to find and close on an affordable house that fits their needs, and 44% are buying because they believe they’ll get a good deal. However, 19% don’t think a deal is possible because mortgage rates are too high.

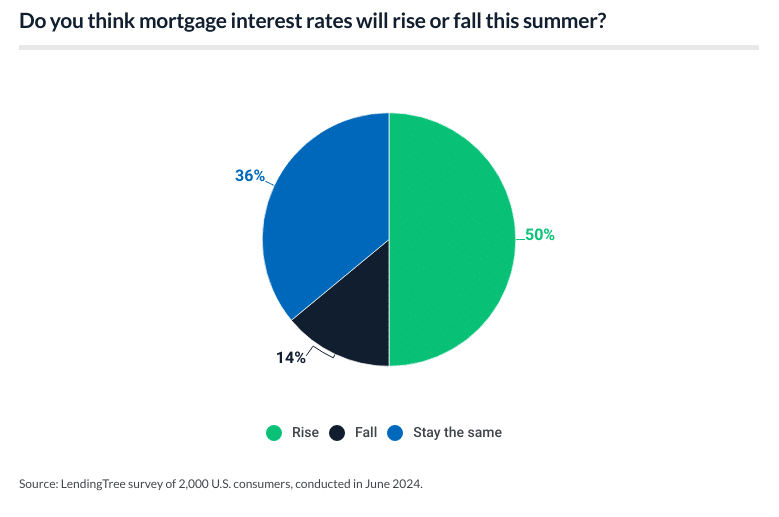

- Few think rates or home prices will improve anytime soon. 86% of respondents think mortgage interest rates will rise or stay the same this summer; among them, 23% worry rates will never fall. Additionally, 87% believe home prices in their area will rise or stay the same this summer; among them, 36% think high home prices are here to stay.

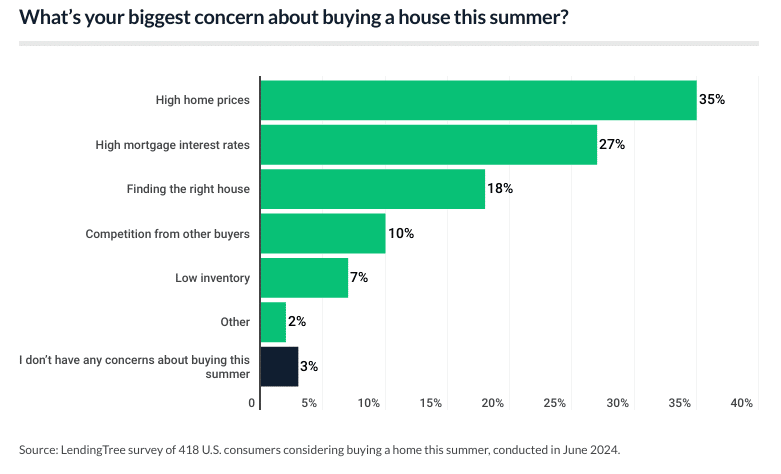

- Economic concerns weigh on potential homebuyers this summer. Among summertime home shoppers, their top concerns about buying now are high home prices (35%), high mortgage interest rates (27%) and finding the right house (18%). Interest rates are top of mind for current mortgage holders, as 29% feel trapped in their homes due to their current rates.

Homebuying Isn’t in the Cards for Most Americans This Summer

Although the housing market usually heats up as the weather gets warmer, this summer’s market isn’t expected to be especially heated. 77% of Americans, headed by 81% of Gen Xers aged 44 to 59, women, and parents of small children, feel that the homes in their neighborhood are too expensive. As a result, most prospective buyers will probably wait to buy until the market becomes more affordable.

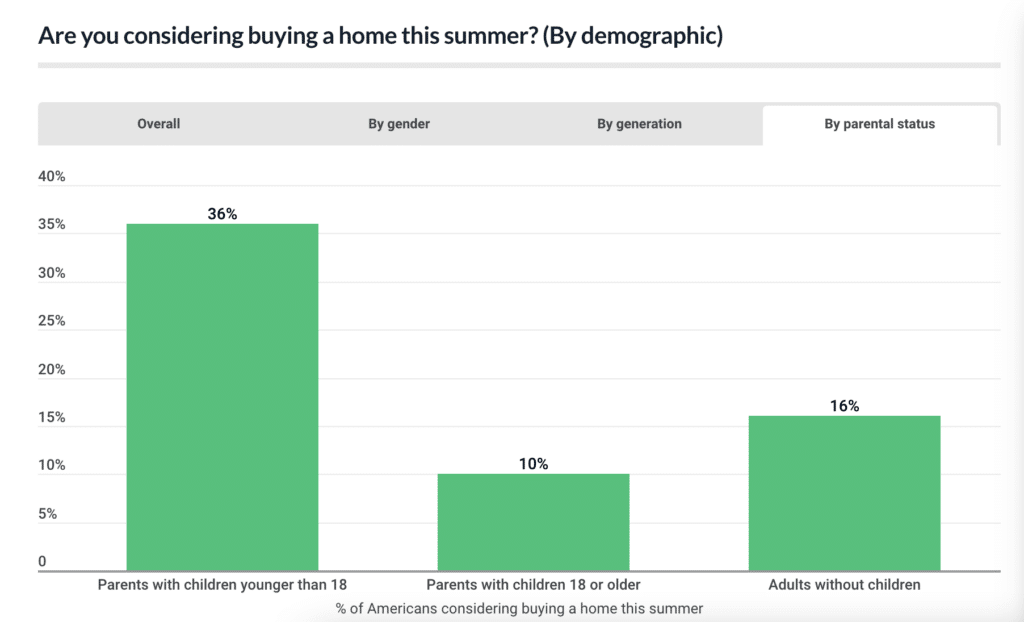

Nevertheless, some people are still thinking about purchasing in the upcoming months, with some groups being more enthusiastic than others. This summer, 37% of Gen Zers between the ages of 18 and 27 are more inclined than 36% of parents of children under the age of 18 to explore purchasing a property. In total, 21% of Americans are still considering it.

The factors behind this vary greatly. Compared to members of previous generations, Gen Zers, for instance, are less likely to be current homeowners. As a result, if they can move out of another living arrangement like renting or rooming in with their parents, some might feel more motivated to negotiate today’s pricey market.

Moving before summer ends and school starts may seem more necessary to families with little children than to those who won’t have to worry about relocating them during the school year.

Would-Be Summer Buyers Generally Confident They’ll Find a Home

Some 56% of people who are thinking about purchasing a home this summer believe they will be able to locate and close on a property that meets their wants and is within their price range. In terms of generation, 59% of millennials between the ages of 28 and 43 are the highest.) Concerns about approval or excessive mortgage rates are among the reasons given by individuals who decline.

Of the prospective buyers surveyed, 44% stated they were considering moving because they thought they would be able to find a good deal on a house. A further 37% of respondents claim to have outgrown their present home, and 10% plan to move to a new town, city, state, or region.

Potential summertime sellers have worries, just like buyers do. Receiving a reasonable offer is the main concern for four out of ten (40%) sellers this summer. A further 26% fear they might not be able to find another house, and 23% are concerned there won’t be enough demand from buyers.

All of these concerns are valid, in actuality. In the current market, there are many obstacles for both buyers and sellers, and it’s frequently easier said than done.

That being said, not all anxieties are insurmountable because of valid issues. All around the nation, people are still purchasing and selling homes. Both buyers and sellers can improve their chances of obtaining what they want in today’s market by being patient and willing to make concessions.

It’s easy to point the finger at high home prices for the current state of the housing market’s lack of buyer appeal, but mortgage rates also have a significant impact. For present homeowners, this may be particularly true (67% having an APR of less than 5.00%). In contrast, at the time this study was conducted, the average rate on a 30-year fixed-rate mortgage was 6.95%.

Considering that their rates may be far lower than those of new loans, it makes sense that 29% of mortgage-holders feel “trapped” in their property by their existing mortgage rate. This is highest among men (33%), millennials (34%) and parents of small children (38%).

Rates Are High, But Will They Go Even Higher?

Of all Americans, half (50%) think that over the rest of this summer, mortgage rates will increase. A further 36% are slightly more upbeat, believing they’ll remain the same, and 14% are confident they’ll decline. By June of next year, respondents predict that mortgage rates will average 9.53% on average.

Freddie Mac reports that the average interest rate on a 30-year fixed-rate mortgage was 6.95% when LendingTree’s poll was conducted in June. Respondents believed that the average rate was exactly 7% at the median level. However, respondents believed that the average rate was 9.87%, almost three percentage points higher on average.

Even while a three percentage point discrepancy might not seem like much, the disparity is nothing to laugh at. For example, a $350,000 30-year fixed mortgage with a 6.95% interest rate has a monthly payment of roughly $2,317 (not including other expenses like insurance and taxes).

In the end, it’s hard to predict where mortgage rates will end up in the upcoming weeks and months. However, some bright spots are starting to show. For example, mortgage rates might conclude the year closer to 6.00% than 7.00% if inflation keeps down and the Federal Reserve starts reducing its benchmark rate in September.

To read the full report, including more data, charts, and methodology click here.