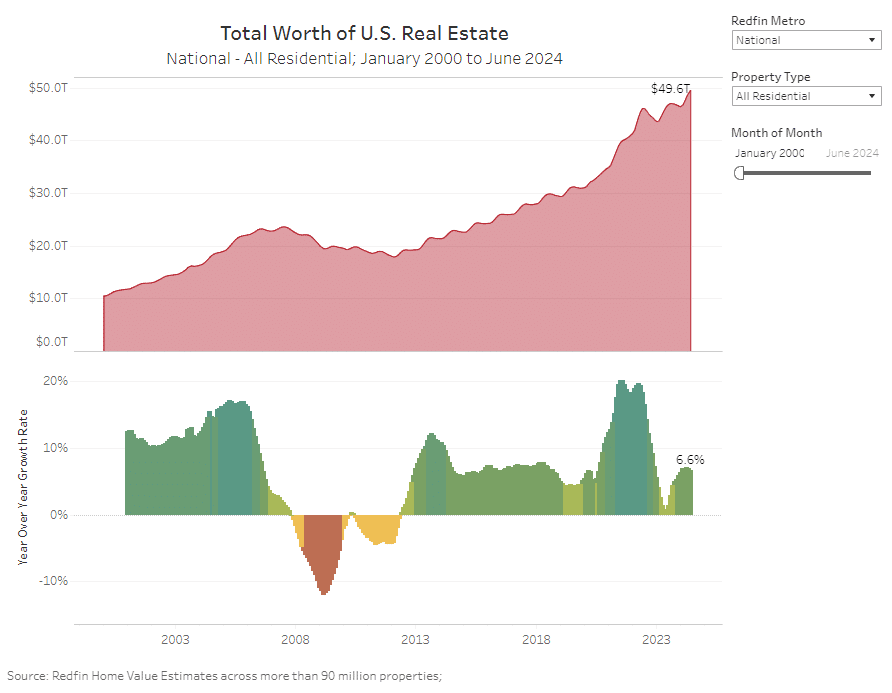

The U.S. housing market is rapidly approaching the $50 trillion mark, with the total value of homes across the country hitting a record $49.6 trillion, according to a new report by Redfin. This represents a $3.1 trillion increase over the past year, marking a 6.6% year-over-year growth.

In a decade, the value of U.S. homes has more than doubled, rising nearly 120% from $22.7 trillion in June 2014. Chen Zhao, Redfin’s Economics Research Lead, predicts that the market will likely surpass $50 trillion within the next 12 months due to a lack of new listings keeping prices elevated.

“Mortgage rates have started falling, but many potential sellers and buyers are waiting to make a move, meaning we are likely to continue seeing a pattern where prices slowly tick up,” said Zhao. “That’s great news for the millions of American homeowners who see their equity rising, but first-time buyers are going to keep finding it tough to find an affordable home.”

Trillion-dollar metros double

The number of metropolitan areas where the total value of homes exceeded $1 trillion has doubled over the past year, growing from four to eight. Anaheim, Chicago, Phoenix, and Washington, D.C., have joined New York City, Los Angeles, Atlanta, and Boston in the trillion-dollar club. San Diego and Seattle are expected to join them soon if current trends continue.

While San Francisco’s aggregate home value is approximately $700 billion, when combined with neighboring Oakland and San Jose, the Bay Area’s total market value nears $2.5 trillion. Similarly, the combined Dallas-Fort Worth area surpasses the $1 trillion threshold.

New Jersey leads in value gains

New Jersey metros close to New York City saw the largest jumps in property value over the last year. New Brunswick’s total home value surged 13.3% to $582.6 billion, while Newark’s value increased 13.2% to $406.2 billion. Other cities with significant gains include Anaheim, CA (12.1% to $1.1 trillion), Charleston, SC (11.8% to $188.9 billion), and New Haven, CT (11.8% to $91 billion).

Cape Coral, FL, was the only metro to experience a decline, with a 1.6% drop in total home value to $204.2 billion. Sun Belt metros, particularly in Texas, showed slower growth compared to other regions, with New Orleans, Austin, North Port, FL, and Fort Worth, TX, rounding out the bottom five in terms of market value gains.

Suburban and rural areas see growth

Suburban homes now account for over $30 trillion in market value, while rural areas are experiencing the fastest growth. Rural home values rose 7% year over year to $7.8 trillion, outpacing urban areas, where values increased by 6% to $10.3 trillion. The number of homes in suburban areas (57 million) significantly outnumbers those in urban (22 million) and rural (21 million) regions.

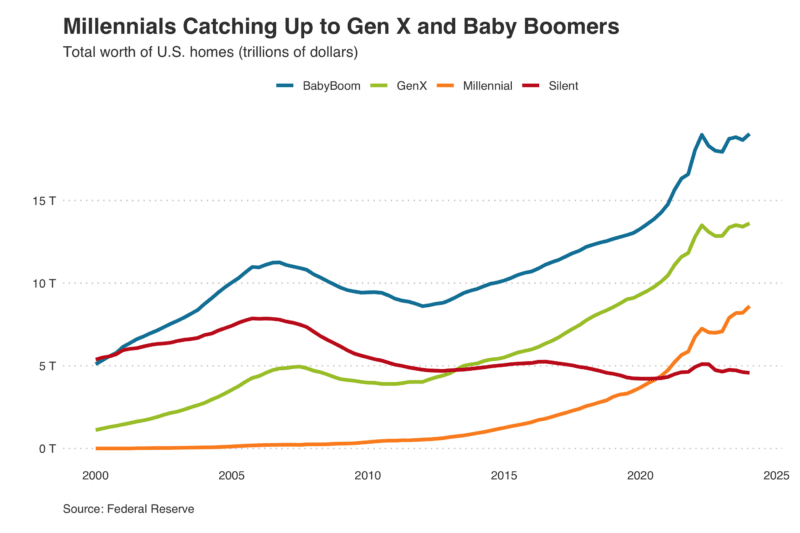

Millennials driving market expansion

Millennials are emerging as key players in the housing market, with the total value of homes owned by this generation rising 21.5% year over year to $8.6 trillion in the first quarter of 2024. This growth is nearly four times faster than that of any other generation. Millennials now represent a larger share of the homebuying market, with around two-thirds of mortgages in 2023 issued to buyers under the age of 45.

In contrast, the total value of homes owned by the Silent Generation declined for the fifth consecutive quarter, falling 1.6% to $4.6 trillion. Baby boomers and Gen X saw increases of 6.1% and 5.9%, respectively.

Asian neighborhoods lead in value increases

Neighborhoods with a majority Asian population saw the largest increase in home values, rebounding from previous declines to rise 9% over the past year to $1.4 trillion. This growth is largely driven by price increases in West Coast cities.

In comparison, majority-white neighborhoods saw a 6.6% increase in value to $39.4 trillion. Homes in majority-Black neighborhoods rose 5.4% to $1.4 trillion, while those in majority-Hispanic areas increased 6.4% to $2 trillion.

As the U.S. housing market continues to grow, the impact on various demographics and regions remains a critical area of focus for analysts and policymakers alike.

Click here to view the report in its entirety.