Homebuyers who are purchasing for the first time and have low to moderate incomes are disproportionately affected by elevated mortgage rates and home prices, according to a new CoreLogic study.

Rising property values, cripplingly high interest rates, and two years of rising inflation are pushing more and more homebuyers to take out expensive second mortgages. This is particularly true for people who are the least able to finance a home. However, “piggyback loans” are offering aspiring buyers another option to become homeowners.

Buyers Explore Piggyback Loans Amid Affordability Constraints

What is a piggyback loan? In addition to the primary mortgage on the home, a piggyback loan is a supplementary loan taken out by buyers. These tiny home equity loans, also known as home equity lines of credit (HELOCs), are a popular choice for cash-strapped buyers who need assistance with closing expenses or obtaining financing for a down payment. Conventional loans that are piggybacked are frequently referred to as “80-10-10” loans, in which the borrower combines a 10% piggyback loan with a 10% cash down payment.

Despite its advantages, secondary loans of this kind do not come without its fair share of problems. Compared to a primary mortgage, these loans are typically more expensive and have higher interest rates. Borrowers on these loans will also probably have to pay additional origination or closing costs.

Homebuyers Fuel Growing Popularity of Piggyback Financing

Following a sharp increase in mortgage rates in the middle of 2022, an increasing number of FHA-dependent homebuyers have turned to additional piggyback lending for support. Low-to-moderate income families and first-time homebuyers, who frequently cannot meet traditional down payment criteria or have insufficient credit history to qualify for conventional loans, are drawn to FHA loans.

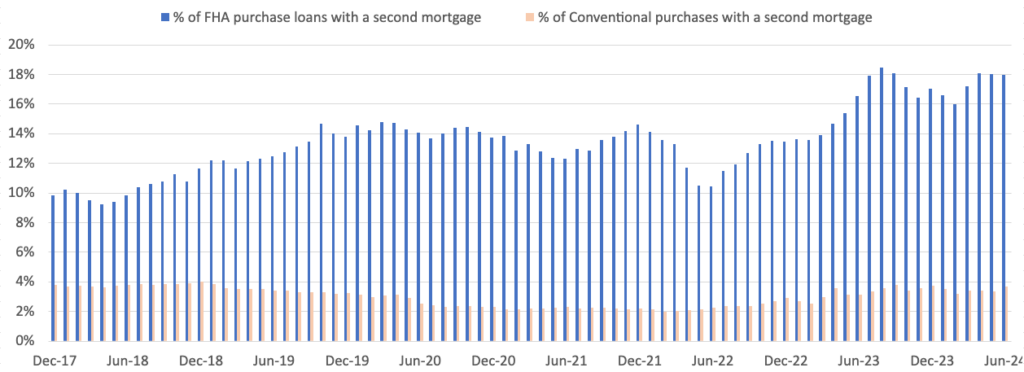

For FHA borrowers, the percentage of piggybacked house purchases has historically been greater. 9.8% of all FHA purchase-loan volume was made up of piggybacked transactions as of 2017. A second loan that was backed by someone else was present in 3.8% of traditional purchase loans. on the end of 2019, the percentage of conventional purchases piggybacked on FHA purchases was 3.2%, compared to 13.8% for FHA purchases.

The percentage of piggybacked FHA purchase loans increased from 10.8% to 18% between June 2022 and June 2024, a rise of more than 7 percentage points. More conventional borrowers are turning to piggyback loans as a result of the skyrocketing cost of homeownership; as a result, the percentage of piggybacked loans in this group increased from 2.2% in June 2022 to 3.6% in June 2024.

“Piggybacked Purchases” Increasingly Seen for Lower-Value Homes

The fact that low-to-moderate income homebuyers, who have been financially pressured by rising inflation and the high cost of living, have been disproportionately affected by housing affordability difficulties is further supported by property prices for homes acquired with piggybacked loans.

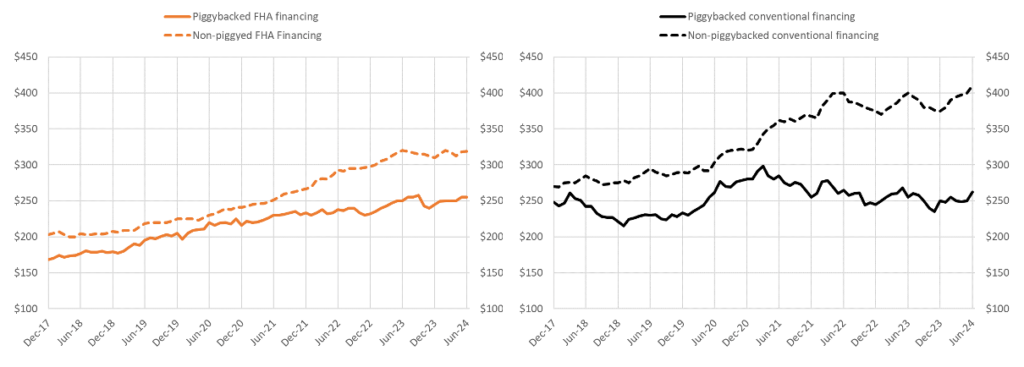

Further, the value of homes acquired through secondary piggyback loans is usually substantially lower. In addition, over the past two years, there has been a noticeable increase in the price disparity between the properties of those who applied for a second mortgage and those who did not.

The study also showed that first-time homebuyers (FTHBs) and those with the lowest ability to afford a home have been disproportionately affected by the housing affordability crisis. This was determined by piggybacking home transactions between FHA loans and conventional financing.

By the end of 2017, the median property value of homes purchased using FHA loans backed by the government was $34,600, or 17% less than that of homes purchased without such loans ($168,600 against $203,200). They were $19% less expensive in June 2022 ($237,800 compared $292,800), saving $55,000; two years later, in June 2024, the difference increased to $64,000 ($255,000 versus $319,000).

When comparing houses purchased with traditional financing, there is a comparable link. The typical purchase price of piggybacked properties was $265,000 in June 2022, which was $135,000 or 33% less than the median price of non-piggybacked acquisitions. By June 2024, the difference had grown to 36%, with the median price of piggybacked homes being $262,000, while the median price of a non-piggybacked purchase was $410,000.

Piggybacked Home Purchases are Over-Leveraged

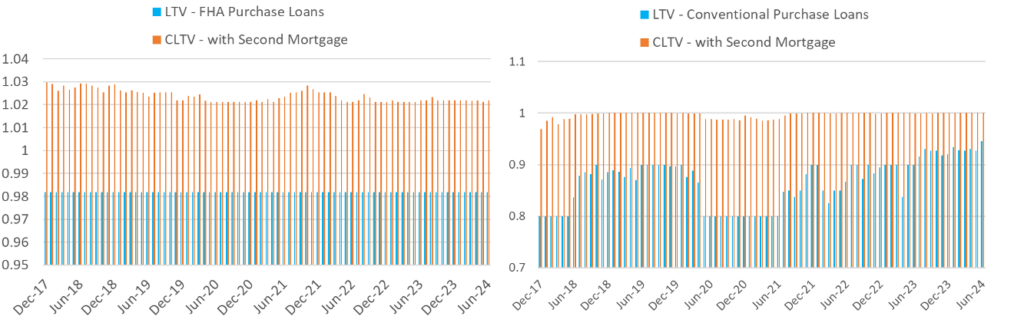

A closer examination of the loan-to-value (LTV) ratios for homes purchased using piggybacks revealed that the buyers of these homes are overly burdened.

Before accounting for the total amount borrowed with a piggyback loan, the median origination loan-to-value ratio for piggybacked FHA loans is 98.19. The typical origination loan-to-value (LTV) range for conventional loans has been 80–90. The LTV on conventional loans has continuously been more than 90 throughout the past 12 months, with a peak ratio of 94.5 in June 2024.

Homeowners frequently have zero or even negative equity after deducting the amount borrowed through piggyback loans. For borrowers with FHA loans, the combined LTV, or CLTV, was 1.022; for borrowers with conventional loans, it was 1.0. Many borrowers are more vulnerable to nonpayment and default in the event of an unforeseen, unfavorable impact on job or family finances if they have little or no equity in their homes.

The resilience of the job market and the stability of the US economy will be key factors in determining how well these over-leveraged loans perform overall. But even with widespread predictions that house prices will rise further, the U.S. economy will continue to grow while inflation declines, and there will likely be a much-awaited September Federal Reserve policy rate cut, it is still important to closely monitor how these highly leveraged loans perform in the months ahead.

To read the full report, including more data, charts, and methodology, click here.