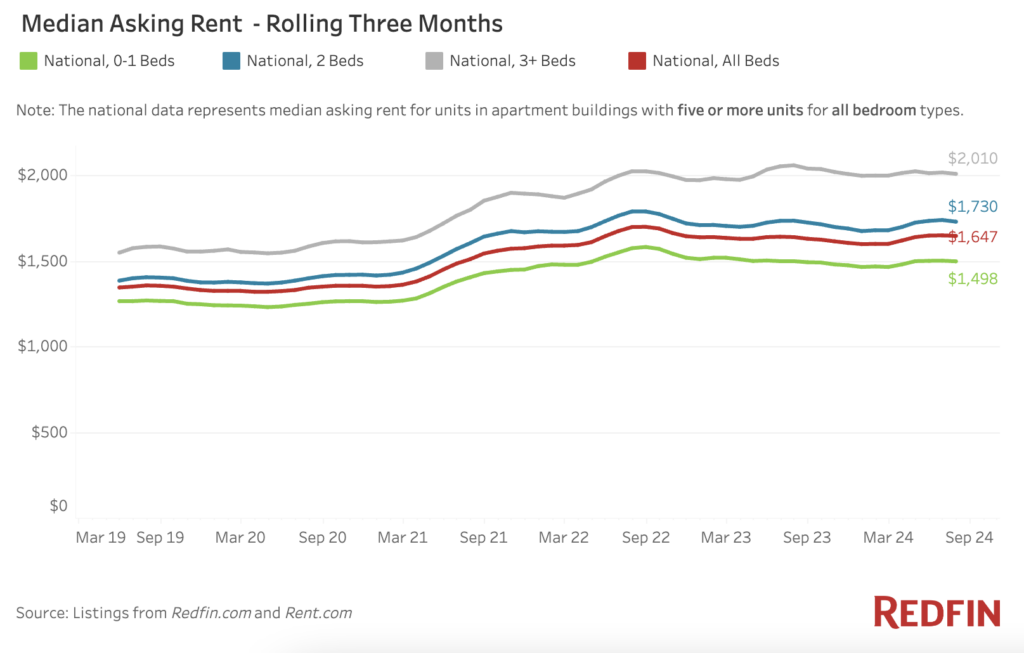

For the first time since June 2020, the median asking rent decreased in July compared to the same month last year across all bedroom counts, according to a new report from Redfin.

The average monthly rent for apartments with one to one and two bedrooms dropped by 0.1% to $1,498; for apartments with three or more bedrooms, the median rent decreased by 2.4% to $2,010. From their all-time highs reported in the previous two years, all three categories have decreased by at least $50.

Due to rising demand in the 0–1 and 2 bedroom apartment categories, prices stayed unchanged despite an increase in supply entering the market. However, because there was less demand for larger, more costly apartments that also compete with single-family home rentals, the supply of apartments with three or more bedrooms grew, which caused prices to drop more rapidly in July.

While the vacancy rate for buildings with five or more apartments—the focus of Redfin’s report—was 7.8% in Q2, up from 7.4% a year earlier, the total rental vacancy rate has been at 6.6% for four straight quarters, the highest level since 2021.

“Rents have recently steadied—or even dropped slightly—because of the sheer number of apartments built over the past two years,” said Redfin Senior Economist Sheharyar Bokhari. “Construction is slowing down and prices will eventually start rising again, but now is still a good time for renters to find a deal, especially families looking for an apartment with at least three bedrooms.”

U.S. Median Asking Rent Rises, But Hovers Just Below All-Time High

In July, the median asking rent increased by 0.4% year-over-year to $1,647 for all combined bedroom counts. The national median asking rent decreased by 0.2% from June to July and by $53 from the record high of $1,700 set in August 2022. Renter households still face significant affordability challenges despite the minor decline, as they make approximately $11,000 less than what is required to afford a typical apartment.

Rent prices have continued to drop significantly in metro regions in Texas and Florida, two states where a lot of new apartments have been constructed since the outbreak.

Austin, Texas’s median asking rent fell 16.9% year-over-year in July, the most of any metro area we examined. Not far behind was Jacksonville, FL, where the median asking rent dropped by 14.3%.

The remaining five metro areas with the largest declines in asking rents were San Diego (down 12.7%), San Francisco, CA (down 7.6%), and Tampa, FL (down 5.9%).

Among the metro areas Redfin examined, Virginia Beach, VA, saw the largest increase in median asking rent, rising 13.7% year over year in July. Chicago (up 10.3%), Cincinnati (up 9.9%), Baltimore (up 12.5%), and Washington, D.C. (up 11.6%) posted the next highest gains.

To read the full report, including more data, charts, and methodology, click here.