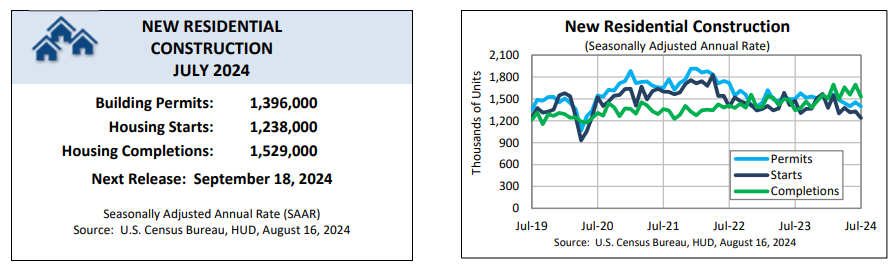

According to the latest U.S. Census Bureau and the U.S. Department of Housing & Urban Development (HUD)’s new residential construction report, privately-owned housing starts in July 2024 were at a seasonally adjusted annual rate of 1,238,000, 6.8% below the revised June 2024 estimate of 1,329,000, and 16% year-over-year below the July 2023 rate of 1,473,000. Single-family housing starts in July were reported at a rate of 851,000—14.1% below the revised June 2024 figure of 991,000. The July rate for units in buildings with five units or more was 363,000.

“Housing starts came in below expectations, dropping to the lowest level since May 2020. The monthly decline was driven by a sharp drop in single-family starts, down 14%, to a seasonally adjusted annual rate of 851,000,” said First American Deputy Chief Economist Odeta Kushi. “Single-family permits, a leading indicator of future starts, also continued its downward trend. Single-family permits are down 9% from their recent 2024 peak. This month’s decline was modest compared to recent months, perhaps pointing to a stabilization in single-family permits.”

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,396,000—4% below the revised June 2024 rate of 1,454,000 and 7% below the July 2023 rate of 1,501,000. Single-family authorizations in July were at a rate of 938,000—0.1% below June 2024’s revised figure of 939,000. Authorizations of units in buildings with five units or more were at a rate of 408,000 in July.

“There was a pronounced downturn in new residential construction activity across the United States in July after a positive swing the month before,” said Realtor.com Senior Economist Joel Berner. “Permits issued for new housing units fell to 1,396,000 on a seasonally adjusted annual basis, down 4.0% from June and 7.0% year-over-year. Housing starts dropped from June’s level by 6.8%, and remain 16.0% below the housing starts figure from last year at this time. Housing completions decreased from their June rate by 16.0%, but remain above 2023 levels by 13.8%. Multi-family projects were the focus of the slide in completions, falling 24.4% month-over-month, while single-family completions actually rose by 0.5%.”

Privately-owned housing completions in July were at a seasonally adjusted annual rate of 1,529,000, which was 9.8% below the revised June 2024 estimate of 1,696,000, but 13.8% above the July 2023 rate of 1,343,000. Single-family housing completions in July were at a rate of 1,054,000—0.5% above the revised June rate of 1,049,000. The July rate for units in buildings with five units or more was 473,000.

What Is Stunting Growth?

“The decline in new home construction mirrors our latest builder surveys, which show that buyers remain concerned about challenging affordability conditions and builders are grappling with elevated rates for builder loans, a shortage of workers and lots, and supply chain concerns for some building materials,” said Carl Harris, Chairman of the National Association of Home Builders (NAHB) and custom home builder from Wichita, Kan.

NAHB reports that builder confidence in the market for newly built single-family homes was 39 in August, down two points from a downwardly revised reading of 41 in July, according to the NAHB/Wells Fargo Housing Market Index (HMI) released today. This is the lowest reading since December 2023.

Forecasting 2024

Despite the drop off in construction, there may be a bright spot on the horizon. Earlier this week, the Mortgage Bankers Association (MBA), in its latest Weekly Applications Survey for the week ending August 9, reported that mortgage loan application volume increased 16.8% week-over-week.

Joel Kan, MBA’s VP and Deputy Chief Economist, said, “Overall applications increased almost 17% to the highest level since January 2023, driven by a 35% increase in refinance applications. The refinance index also saw its strongest week since May 2022 and was 117% higher than a year ago, driven by gains in conventional, FHA, and VA applications. Additionally, purchase applications increased by 3%, with small gains seen across the various loan types, indicating that prospective homebuyers are slowly reentering the market.”

In another move which may help shift the market in a positive direction, Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) shows that the 30-year fixed-rate mortgage (FRM) averaged 6.49%, which is down from the near-8% level recorded at this time last year.

“While rates increased slightly this week, they remain more than half a percent lower than the same time last year,” Sam Khater, Freddie Mac’s Chief Economist, said, “In 2023, the 30-year fixed-rate mortgage nearly hit 8%, slamming the brakes on the housing market. Now, the 30-year fixed-rate hovers around 6.5%, and will likely trend down in the coming months as inflation continues to slow. Lower rates are good news for potential buyers and sellers alike.”

Berner added, “As mortgage rates begin to fall, many potential homebuyers will come off the sidelines and begin to look for new homes. Builders are hoping to thread the needle with their price points on new homes in coming months, attracting buyers whose budgets have recently expanded but competing against existing homes coming onto the market as sellers are more willing to move under newly favorable buying conditions. Price too low and they’ll miss the opportunity to fully cash in on a hotter housing market; price too high and they’ll lose out to new listings of existing homes.”