According to the Fannie Mae Economic and Strategic Research (ESR) Group’s August 2024 commentary, total home sales are predicted to be lower than previously predicted through the end of 2024 and then not significantly increase until later in 2025, even with the recent decline in mortgage rates. In reaction to the more favorable rate environment, purchase mortgage applications have hardly changed, according to the ESR Group, and high-frequency indicators of house purchase demand, such as mortgage applications, showing requests, and listings views, continue to be lower than they were a year ago. the reduction of mortgage rates recently.

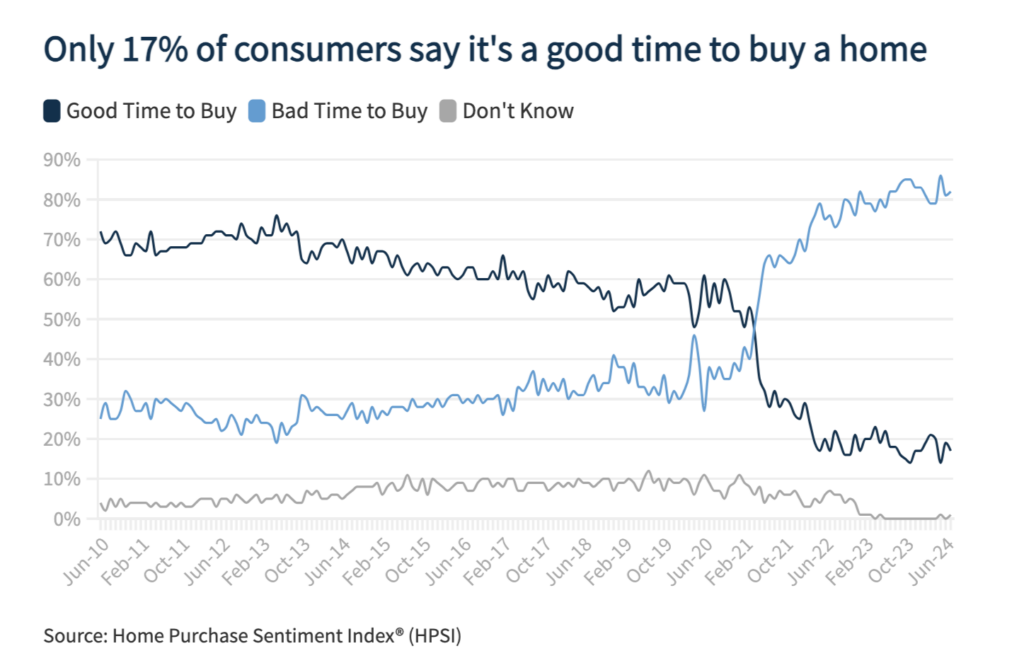

Furthermore, a nearly all-time low percentage of respondents to the Fannie Mae Home Purchase Sentiment Index (HPSI) say that now is a “good time to buy” a house. Because of this, the ESR Group has revised down its prediction for total home sales to 4.78 million in 2024 and 5.19 million in 2025. This is because it anticipates that homebuying will not significantly increase until income growth starts to surpass the growth in home prices and mortgage rates approach 6.0%. As strong builder margins are likely to drive concessions in the upcoming quarters, the ESR Group continues to expect comparative strength in the new home market when compared to existing home sales.

The quantity of newly constructed homes for sale has increased, thus a short-term slowdown in starts is anticipated. current will probably cause future projects to be delayed until current inventory can be sold. By the end of 2024, the ESR Group predicts that mortgage rates will average 6.4%, and by the end of 2025, they will average 5.9%.

Frustration Remains Evident in Consumer Housing Sentiment

Macroeconomically speaking, the stronger-than-expected GDP estimate for Q2 led the ESR Group to raise its real GDP forecast for 2024 from 1.6% to 1.9%. Nonetheless, considering the historically low savings rate and the very bad July employment report—which showed the unemployment rate rising by six tenths from the start of the year to 4.3%—a slowdown in growth is still anticipated. Although the ESR Group’s base case estimate still calls for a gentle landing, it acknowledges that given the historical correlation between steep increases in the unemployment rate and prior business cycles, the likelihood of an economic downturn has probably increased.

“After absorbing recent economic data, bond market participants now appear to expect slower paths for economic growth and inflation, which contributed to a softening in mortgage rates over the last few weeks,” said Mark Palim, Fannie Mae VP and Deputy Chief Economist. “On its face, the lower rate environment should be good for home sales by helping loosen the grip of the so-called ‘lock-in effect,’ in addition to aiding affordability more generally. However, high-frequency data, such as mortgage applications, home showing requests, and listings views, suggest that many potential homebuyers remain reluctant to make the jump.”

The general lack of affordability is still impeding consumer confidence toward the home market, as evidenced by the July decline of 1.1 points in the Fannie Mae Home Purchase confidence Index (HPSI) to 71.5. In June, 19% of consumers said it was a good time to buy a property; this month, only 17% said the same, and 66% of consumers said it was a good time to sell. While they have converged, the shares anticipating rising vs falling home prices over the next 12 months are still quite different, at 41% and 21%, respectively. Over the course of the next year, 29% of consumers anticipate a decrease in mortgage rates, while 31% anticipate an increase. Year-over-year, the entire index is up 4.7 points.

“Even with moderately lower mortgage rates, affordability remains close to historic lows due to the high level of home prices relative to incomes,” Palim said. “We are therefore expecting continued sluggishness in home sales over the rest of the year. One bright spot for the mortgage industry has been the recent uptick in refinance applications, albeit from very low levels.”

To read the full report, including more data, charts, and methodology, click here.