According to the Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey, the total number of loans now in forbearance increased from 0.23% to 0.27% as of July 31, 2024. The MBA estimates that 135,000 homeowners are currently in forbearance plans, as the nation’s mortgage servicers have provided forbearance to approximately 8.2 million borrowers since March 2020.

“July saw an increase of approximately 20,000 more U.S. homeowners in forbearance compared to the previous month,” said Marina Walsh, CMB, MBA’s VP of Industry Analysis. “Most of this change can be attributed to recent natural disasters, which accounted for 27% of all loans in forbearance last month compared to 16% in June.”

According to the NOAA’s National Centers for Environmental Information, four new billion-dollar weather and climate disasters were confirmed in July 2024, including one severe weather event that impacted the southern U.S. in mid-May, New Mexico wildfires during June and July, one severe weather event that impacted the central and northeastern U.S. (June 24–26) and Hurricane Beryl (July 8–9).

There have been 19 confirmed weather and climate disaster events to date in 2024, which is second only to 2023 for the highest amount for the first seven months of the year, each with losses exceeding $1 billion. These disasters consisted of 15 severe storm events, one tropical cyclone event, one wildfire event and two winter storms. The total cost of these events exceeds $49.6 billion, and they have resulted in at least 149 fatalities.

Key Highlights of the MBA’s Findings

- The share of Fannie Mae and Freddie Mac (GSE) loans in forbearance increased one basis point from 0.11% to 0.12% in July 2024.

- Ginnie Mae loans in forbearance increased by 12 basis points from 0.44% to 0.56% in July 2024.

- The forbearance share for portfolio loans and private-label securities (PLS) increased two basis points from 0.31% to 0.33%.

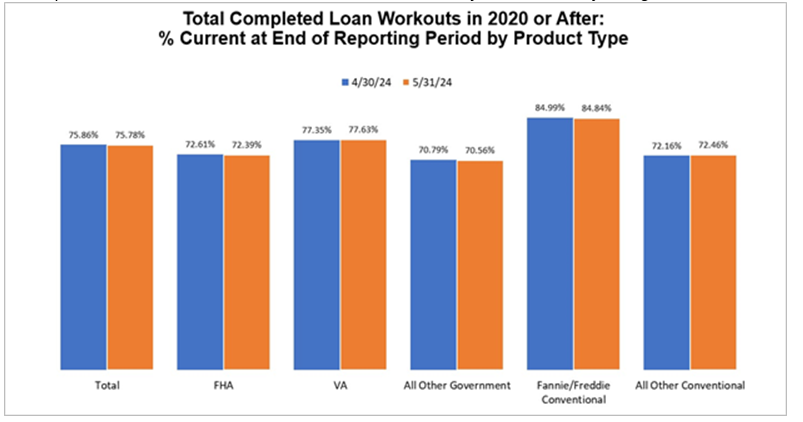

- Total completed loan workouts from 2020 and onward (repayment plans, loan deferrals/partial claims, loan modifications) that were current as a percent of total completed workouts increased to 73.51% in July 2024, up 24 basis points from 73.27% the prior month, but down 227 basis points from May.

- By reason, 66.8% of borrowers are in forbearance for reasons such as a temporary hardship caused by job loss, death, divorce, or disability. Another 26.7% are in forbearance due to a natural disaster, while only 6.6% of borrowers cited they were still in forbearance because of COVID-19 related reasons.

- By stage, 62.7% of total loans in forbearance were in the initial forbearance plan stage, while 20.1% were in a forbearance extension. The remaining 17.2% were classified as forbearance re-entries, including re-entries with extensions.

- The five states reporting the highest share of loans that were current as a percent of servicing portfolio were Washington, Idaho, Colorado, California, and Oregon.

- The five states reporting the lowest share of loans that were current as a percent of servicing portfolio: Louisiana, Mississippi, Indiana, Alabama, and West Virginia.

What Lies Ahead?

With the recent dipping of mortgage rates, Freddie Mac reports in its latest Primary Mortgage Market Survey (PMMS) that the 30-year fixed-rate mortgage (FRM) averaged 6.49% as of August 15, 2024, up from last week when it averaged 6.47%. A year ago at this time, the 30-year FRM averaged 7.09%.

“While rates increased slightly this week, they remain more than half a percent lower than the same time last year,” said Sam Khater, Freddie Mac’s Chief Economist. “In 2023, the 30-year fixed-rate mortgage nearly hit 8%, slamming the brakes on the housing market. Now, the 30-year fixed-rate hovers around 6.5%, and will likely trend down in the coming months as inflation continues to slow. Lower rates are good news for potential buyers and sellers alike.”