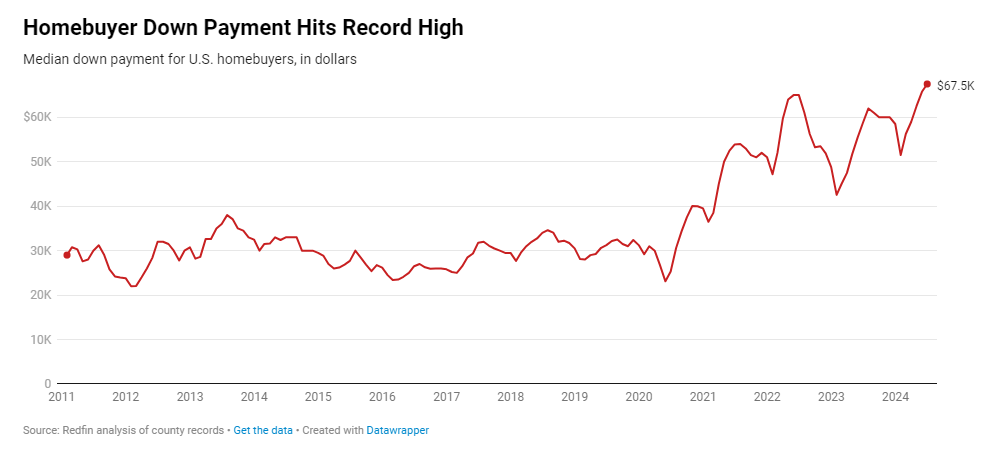

Redfin reports that the typical down payment for U.S. homebuyers hit a record high of $67,500 in June 2024, up 14.8% from $58,788 year-over-year, marking the 12th consecutive month the median down payment has risen year-over-year.

The nearly-15% jump in the median down payment significantly outpaced the increase in home prices, which were up 4% in June year-over-year. The increase is being influenced by the current market, where higher-priced, turnkey homes in desirable neighborhoods are more likely to sell. It’s also partly due to buyers putting down a higher percentage of the purchase price as a down payment.

“Investors are still coming in with all-cash offers on homes that need to be renovated. Traditional buyers are putting down large down payments to try and lower their mortgage payment,” said Annie Foushee, a Redfin Agent in Denver. “These buyers will often utilize the help of family members to put down more than they could on their own.”

Trends in Down Payments

Despite the 30-year, fixed-rate mortgage (FRM) beginning to drop at the end of June, affordability issues linger for the average U.S. home buyer. In June, Redfin reported that the typical homebuyer’s down payment was 18.6% of the purchase price, the highest level in over a decade, and up from 15% over last June.

Redfin also reported that nearly three in five (59.4%) homebuyers put down more than 10% of the purchase price of a home in June, up from 56.6% a year earlier.

In a separate report, Redfin found that the median home sale price rose 4% year-over-year in June 2024 to a record $442,525, up 0.9% over May 2024’s reported average. Also in June, roughly one in five (19.8%) homes for sale had a price cut—the highest level of any June on record. That’s up from 14.4% a year earlier, and is just shy of the 21.7% record high set in October 2022.

Overall, the report found that down payments are increasing for a number of reasons:

- Rising home prices: As previously mentioned, the median-priced U.S. home hit a record of $442,525 in June. Higher home prices naturally lead to a higher down payment, which is a percentage of the home price.

- Elevated mortgage rates: Homebuyers are incentivized to put down more money upfront, and borrow less, when mortgage rates are higher. And despite the current downward trend in the 30-year fixed-rate mortgage which currently stands at 6.46%, in June 2024, the 6.92% average rate reported in June was among the highest in the past 20 years, pushing buyers to increase their down payment to minimize monthly payments.

- Buyers have more equity: With home prices up, people who sell their previous property for more than they purchased it are able to use the extra equity for a larger down payment on their new home. According to a recent USA Today report, since early 2012, when the economy was recovering from the Great Recession, home equity has quadrupled in value, from a low of $8.2 trillion. That same report found that between 2019 and 2022, the median net worth of U.S. households rose 37% to $192,900, after inflation, the largest rise ever recorded by the federal Survey of Consumer Finances.

All-Cash Sales on the Rise

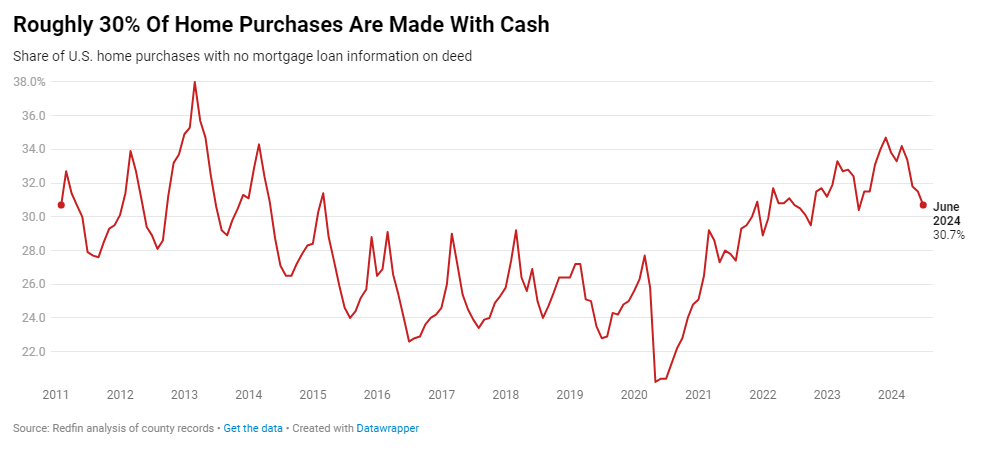

The percentage of U.S. home purchases made with all-cash rose to 30.7% in June, up slightly from 30.4% a year ago.

“The percentage of all-cash sales generally follows the same trend as the rise and fall of mortgage rates. When rates are down, the percentage of all-cash sales is down too, and the opposite is true when rates go up,” said Redfin Senior Economist Sheharyar Bokhari. “That means we may start to see all-cash purchases level off a little now that mortgage rates have started to come down from recent highs.”

Buyer Types Shift

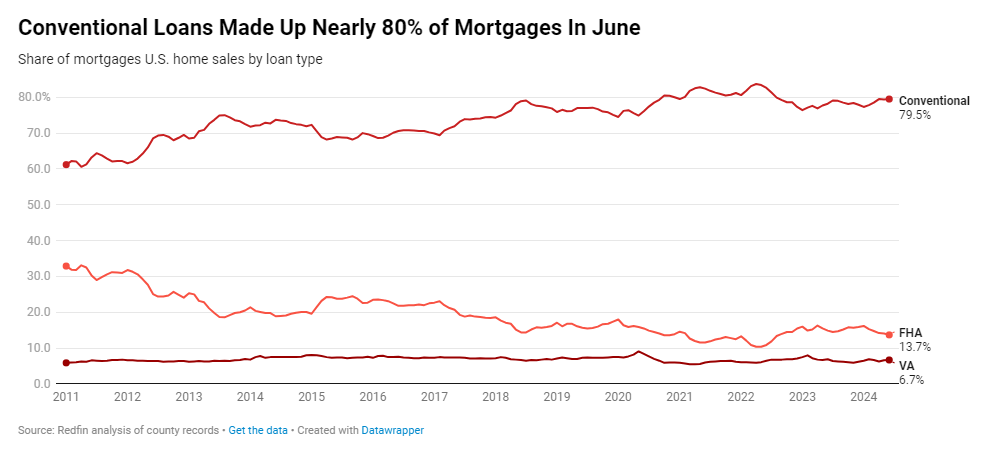

FHA loans comprised 13.7% of mortgaged U.S. home sales in June, the smallest share since August 2022, and down from 14.9% a year earlier. FHA loans have declined because home prices are at near-record highs and mortgage rates are still elevated, meaning fewer relevant buyers are able to afford a home. VA loans made up 6.7% of all mortgaged home sales, down slightly from 6.9% a year earlier.

Conventional loans represented nearly four out of every five loans (79.5%) in June, up slightly from 78.2% a year ago. Jumbo loans—used for higher loan amounts and popular among luxury buyers—represented 6.6% of mortgaged sales, essentially unchanged from 6.5% a year earlier.

Regional Highlights

- In Newark, New Jersey, the median down payment jumped 51.5% to $125,000 from $82,500 a year ago 51.5%—the largest percentage increase among the metros Redfin analyzed. Next came Las Vegas (up 40.7% from $32,328 to $45,500), Washington, D.C. (up 38.7% from $54,800 to $76,000), New Brunswick, New Jersey (up 32.7% from $93,625 to $124,213); and Nashville, Tennessee (up 32% from $46,500 to $61,395).

- Down payments only fell in three metros: Jacksonville, Florida (down 28.4% from $39,950 to $28,338); Oakland, California (down 11% from $219,000 to $195,000); and Tampa, Florida (down 6.4% from $42,500 to $39,773).

- In San Francisco, the median down payment was equal to 25.8% of the purchase price—the highest among the metros Redfin analyzed. It was followed by San Jose, California (25.7%); and Anaheim, California (25%). Down payment percentages are typically higher in San Francisco’s Bay Area due to a higher concentration of wealthy residents who can afford to put a higher percentage of the purchase price down.

- Down payment percentages were lowest in Virginia Beach, Florida (Miami area at 3%)—an area with a higher concentration of veterans using VA loans with little to no down payment—followed by Detroit (6.8%); and Jacksonville, Florida (8.6%).

- In West Palm Beach, Florida, 50.4% of home purchases were made in cash—the highest share among the metros Redfin analyzed—followed by Riverside, California (39.9%) and Detroit (38.9%). All three metros see strong investor activity.

- All-cash purchases were least common in San Jose, California (18.3%); Seattle, Washington (21%); and Oakland, California (21.2%)—three more expensive metros where the median-priced home tops $850,000.

- In Pittsburgh, 28.6% of home purchases were made in cash, up from 19.2% a year earlier—the largest increase among the metros Redfin analyzed. Next came New Brunswick, New Jersey (up from 31.1% to 36.8%) and Newark, New Jersey (up from 25.9% to 31.6%).

- In Providence, RI, 23.1% of home purchases were made in cash, down from 33.5% a year earlier—the lowest increase among the metros Redfin analyzed. Next came Baltimore (down from 36.1% to 26.8%) and Jacksonville, Florida (down from 44.2% to 38.1%).