Americans’ evolving work environments and other factors have led to a “difficult commercial real estate landscape in 2024,” according to an analysis of the U.S. office space market by researchers at Flatworld Solutions, national provider of data science and analytics.

Their study revealed the highest commercial real estate delinquency rates since 2015 and vacancy rates topping 20% in job hubs such as San Francisco. On the upside, conditions are uniquely favorable for founders of small businesses, the formation of which has almost doubled since 2020, the researchers noted. Small- and mid-scale enterprises, they added, may be able to revitalize the market by adopting coworking spaces, and private offices.

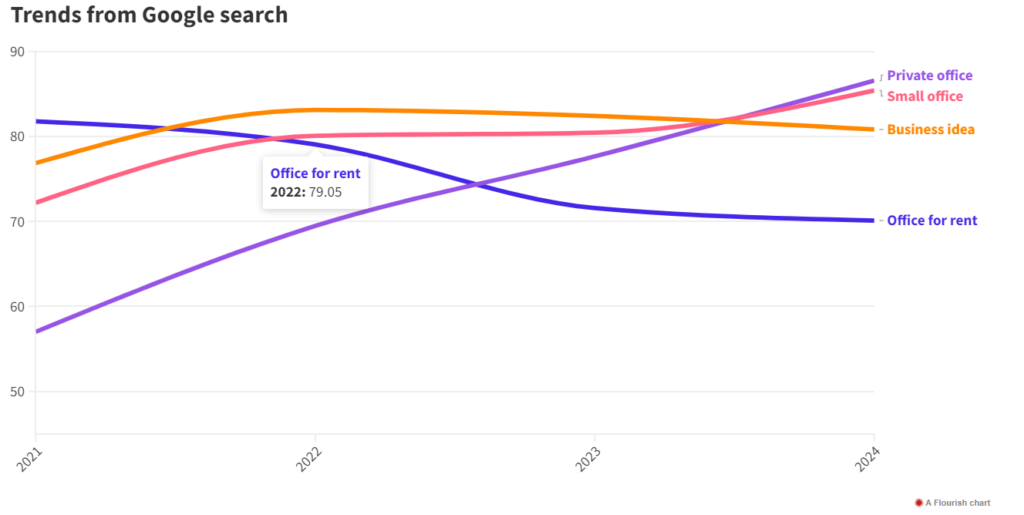

“Increased searches for ‘small offices’ and a surge in new business applications highlight a shift toward small and flexible office spaces,” the report added.

Surging delinquency rates indicate “financial strain among commercial real estate owners and tenants, possibly due to economic challenges or changes in market dynamics,” the report suggested.

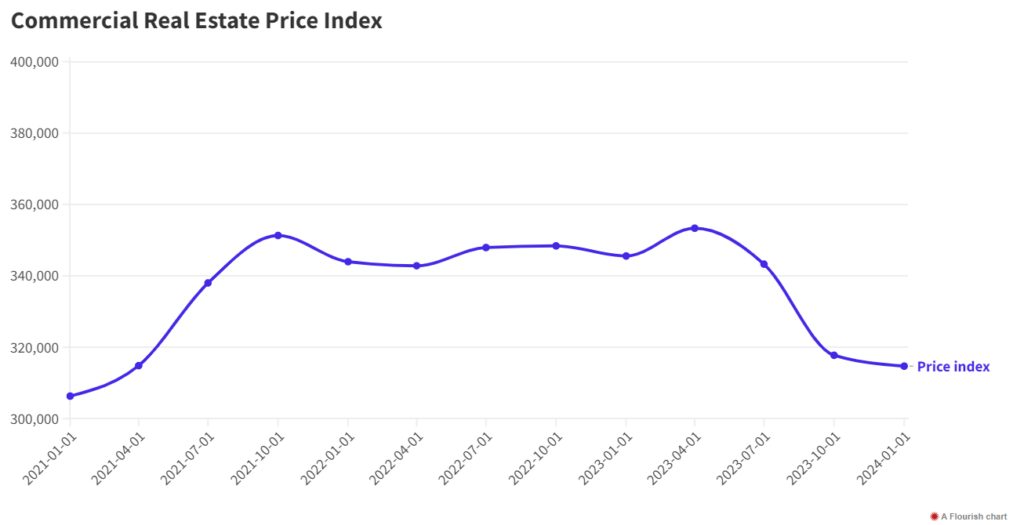

Analysts said they detected a moderate negative correlation between the index price and the delinquency rate.

“This means that when the price index goes down, the delinquency rate rises,” they explained.

The price of commercial real estate sank by 10% in 2024 (following 2023’s post-pandemic rebound), a decline resulting in the lowest prices since 2021 and “indicating a reversal of the previous upward trend.”

San Francisco, Houston, and Dallas top the charts in office vacancies, with respective rates at 21.69%, 18.64%, and 17.97%. Wilmington, NC claims the lowest vacancy rate, at 1.46%.

Meanwhile, Google searches for “small office space” are growing, as are startup applications.

An analysis of Google Trends data revealed “a contrast between searches related to traditional office spaces and alternative workspace solutions,” the researchers noted.

Specifically, there has been a 14% decline in search interest for “office for rent,” since 2021, while search interest for “private office” increased 52%, reportedly.

Searches for “small office” and “business idea” increased moderately, by a respective 18% and 5%.

“This suggests a shifting preference toward flexible and shared workspace solutions, indicating a potential trend where small businesses are replacing large office space,” the analysts noted.

Since 2020, monthly new business applications have averaged 129.8 per 100,000 U.S. inhabitants, with Wyoming, Delaware, and Florida reporting the most activity. In April alone, those top three states received a respective 4,894 (or 837.93 per 100k inhabitants), 4,401 (426.50 per 100k), and 53,393 (236.14 per 100k) applications to start a company.

The synthesized data led specialists to conclude that “the rise of small businesses opens the door to innovative solutions and opportunities in the market.”

For its study, Flatworld Solutions’ data services team utilized Google Trends, National Association of Realtors, and Census Bureau data. For further details, a ranking of vacancies by state and metro areas, and research methodology, visit flatworldsolutions.com.