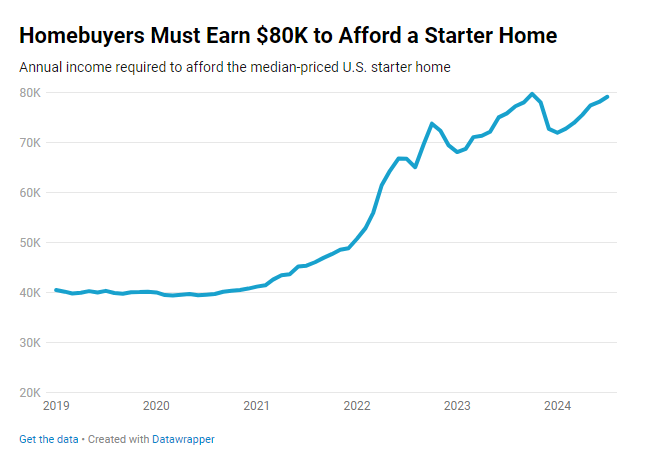

A new report from Redfin has found that the monthly housing payment for the typical U.S. starter home sold in July was $1,981, up 4.4% year-over-year. That means homebuyers must earn $79,252 annually in order to afford a typical U.S. starter home, also up 4.4% year-over-year, and just a few hundred dollars shy of last October 2023’s all-time high.

The average mortgage rate was 6.85% in July, down slightly from its springtime peak, but still more than double pandemic-era lows. The typical starter home sold for a record $250,000 in July, up 4.2% year over year.

Rising prices have pushed many middle-income Americans to buy starter homes, and pushed many lower-income households out of the market altogether. According to U.S. Census Bureau and the U.S. Department of Housing and Urban Development (HUD) data, the median sales price of new homes sold in July 2024 was $429,800, with the average sales price of $514,800.

The typical U.S. household earns an estimated $83,966, just barely more than necessary to afford a starter home. But many people in the market for starter homes make less than the median U.S. income. A family earning 80% or less of the median income—$67,173 or less—cannot afford the typical starter home. Wages are increasing, but not as fast as the income needed to buy a starter home: Average hourly earnings were up 3.6% year over year in July.

Roughly 70% of U.S. starter homes are affordable to the median-earning household, down from about 73% a year ago and near the record low. With housing affordability so strained, starter homes are a hot commodity; lower-income families, middle-income families and investors are all vying for them. Pending sales of starter homes rose 10% year over year in July to their highest level in nearly two years, while they dropped in all other price tiers. Rising demand for starter homes is one reason prices are at a record high.

“There are neighborhoods here that are both desirable and affordable, with homes selling in the $150,000 to $350,000 range. But first-time buyers are struggling because those homes typically get at least five offers,” said Ben Ambroch, a Redfin Premier Agent in Milwaukee. “I recently listed a house for $210,000 and it received several bids, one of which included an offer to buy the seller pizza every Friday night until the deal closed. We ended up going with a higher offer, but that’s an example of the creativity we’re seeing as buyers compete for starter homes.”

Affordability Issues Vary by Region

In half of the 50 most populous U.S. metros, a family earning the local median income can’t afford to buy a starter home.

The affordability gap for starter homes is biggest in California. In both Anaheim and Los Angeles, a family would need to earn twice the local income to afford a starter home. Anaheim’s median income is $122,192; a family needs to earn $251,302 to afford the typical starter home. In Los Angeles, the median income is $93,197 and a household needs to earn $184,477 for a starter home. The gap is only slightly smaller in San Diego, San Francisco, and San Jose. It’s tough to afford even a starter home in much of California because even though residents tend to earn more money than some other parts of the country, it’s not enough to afford the state’s ultra-high home prices. Among the pool of starter homes on the market in many California metros, virtually none are affordable to someone earning the median income.

“Homes in the Bay Area are so expensive that even many high-earning tech employees have been priced out of the area, so they’re looking at neighboring cities,” said Craig Pellegrini, a Redfin Premier Agent in the San Jose area. “I have one client who wanted to buy in Palo Alto, but they can’t afford it anymore so they’re looking in Sunnyvale and Santa Clara. That’s pricing out a lot of lower earners in those neighboring cities completely.”

Starter homes are most affordable to median-earning families in the Rust Belt. In Detroit, where the median household income is $63,937, a family needs to earn $24,590 to buy the typical starter home. That makes Detroit more affordable than any other major U.S. metro for starter homes.

Next comes St. Louis, where the typical household earns $85,750 and a household needs $42,218 for a starter home. Pittsburgh, Cleveland, and Philadelphia round out the top five.

In Austin, a family needs to earn $117,781 to afford the median-priced starter home. That’s down 2.5% from a year ago, making it the only major metro that saw a decline; that’s because home prices have been falling all year in the Texas capital. But still, an Austin household earning the local median income of $103,945 can’t afford a starter home.

The income needed to afford a starter home has increased most in Chicago (+22.5%), Detroit (+19.5%), Cleveland (+15.6%), Cincinnati (+14.7%) and Pittsburgh (+14.6%), as home prices have increased. But the median-earning household can still afford a starter home in those metros.

Bright Spots for Starter-Home Buyers

- There are more starter homes to choose from: Listings of starter homes were up nearly 20% year-over-year nationwide in July, much bigger than the 4.1% increase for mid-priced homes. That gives prospective starter-home buyers in some parts of the U.S. more inventory to choose from.

- Mortgage rates are coming down: Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) shows the 30-year fixed-rate mortgage (FRM) at 6.35%. A year ago at this time, the 30-year FRM averaged 7.18%.

- Growth in income needed to afford a starter home is slowing: The 4.4% year-over-year increase in income necessary to afford a starter home is one of the smallest since the start of 2021. For comparison, the increase was 14% in July 2023.

Click here for more on Redfin’s report on starter home affordability.