Respondents to a personal finance survey have cited job and income woes, forgetfulness, and inflation as reasons for missing loan payments.

The rising cost of essentials, the number one reason cited for nonpayment last quarter, took a back seat this time to employment-related issues, according to personal finance analysts at the Achieve Center for Consumer Insights, which conducted Achieve’s latest State of Consumer Finances survey, designed to complement the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit.

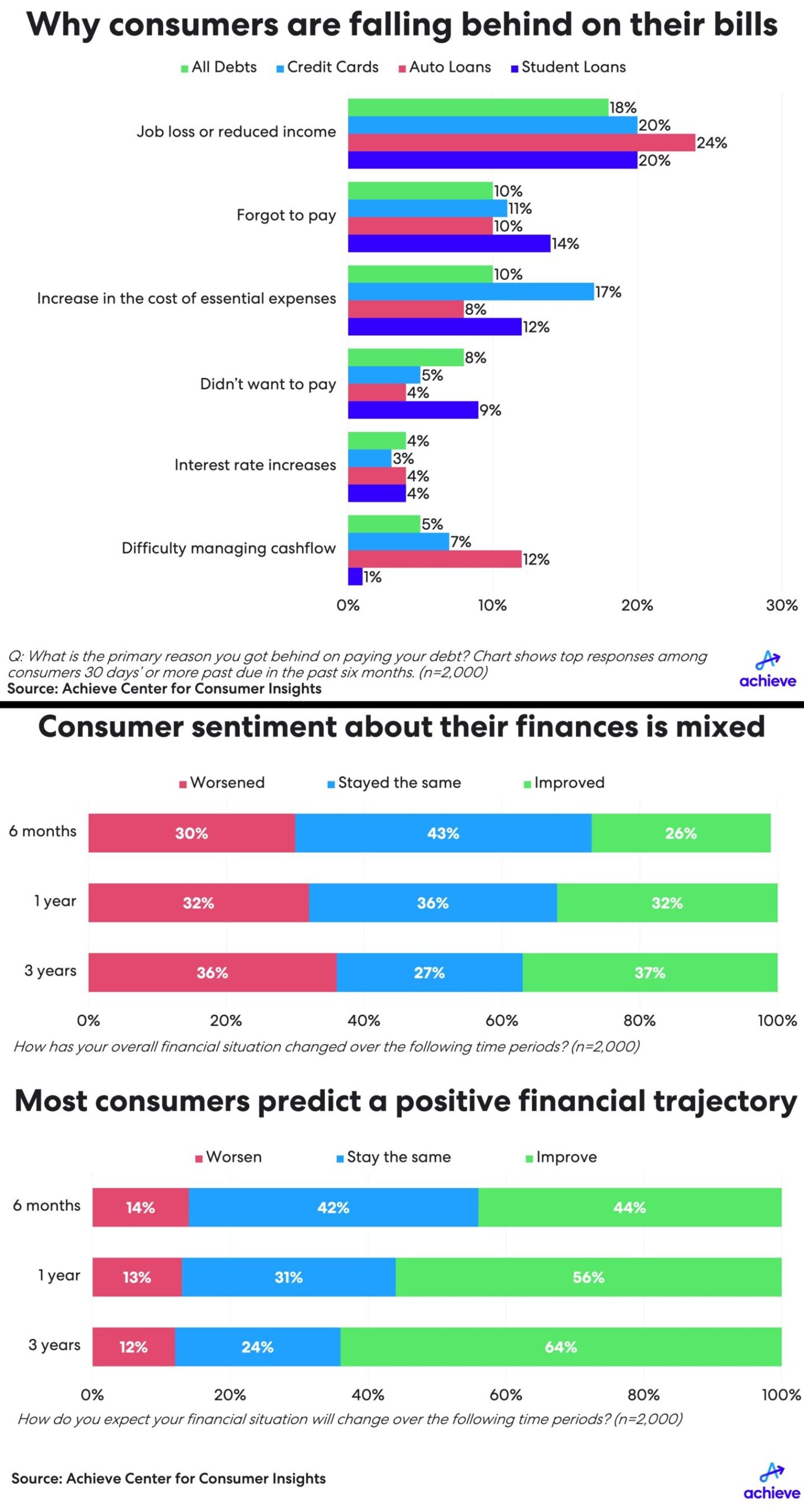

Among 2,000 survey respondents (all borrowers who were 30 days past due on loan payments at least once this year), 18% blamed the delinquency on income loss or cuts. Just 10% of the respondents cited the rising cost of essential goods and services as the primary reason for a missed payment, a significant drop from the last quarter, when 21% of those surveyed blamed inflation.

A small portion of borrowers (8%) said they did not make their loan payments simply because they don’t want to—it’s the fourth most-cited reason, behind job insecurity/income, forgot-to-pay, and inflation for nonpayment, and it was more common this quarter than in past surveys.

According to Achieve Co-Founder and CEO Andrew Housser, the survey’s findings suggest a combination of challenges are contributing to Americans’ rising debt and loan delinquencies.

“Recent positive news about the pace of inflation slowing, and in some cases, even reversing course, appears to be overshadowed by other financial concerns for struggling consumers,” Housser said. “In a sign of the beginnings of a choppy job market, more and more consumers are being impacted by reduced income or job loss. Combine that with interest rates still near decades-long highs, and consumers with significant levels of debt are finding it difficult to make ends meet.”

The percentage of consumers who said it is very difficult or difficult for them to pay their recurring debts on time increased this quarter to 36% compared to 31% in Q2.

More than half of survey participants reported carrying a credit card balance to cover essential expenses. Of that 57%, 27% said living expenses had accrued on their card balances for more than six months.

“Households that find themselves relying heavily on credit cards to pay for basic necessities often get caught up in a cycle of indebtedness that they cannot get out of,” Housser said.

Analysts also warned that consumers who make a habit out of using buy-now-pay-later purchases can quickly find themselves managing numerous transactions, often owing payments to multiple different lenders.

Anxieties considered, consumer sentiment is relatively optimistic, and a majority of respondents said they plan to pay all of their bills on time. Participants were split when assessing their respective personal financial situations—37% cite improvement and 36% say things are worse. Expectations for the future, however, are stronger in both the short and long term.

“Over the next year, 56% of consumers expect their finances will improve,” authors of the report noted. “And that rate grows to 64% when asked about their outlook three years from now.”

Click here to read more on Achieve’s State of Consumer Finances survey findings.