Young adults today are living with their parents at a rate unseen since 1940, according to a study from Apartment List, whose research team collects and analyzes U.S. rental market data.

Necessity, rather than choice, has placed many families in this position, economists say.

“Fewer than one-in-five [young adults living at home] are earning incomes that would allow them to comfortably afford local rent prices, a far lower share than in the past.”

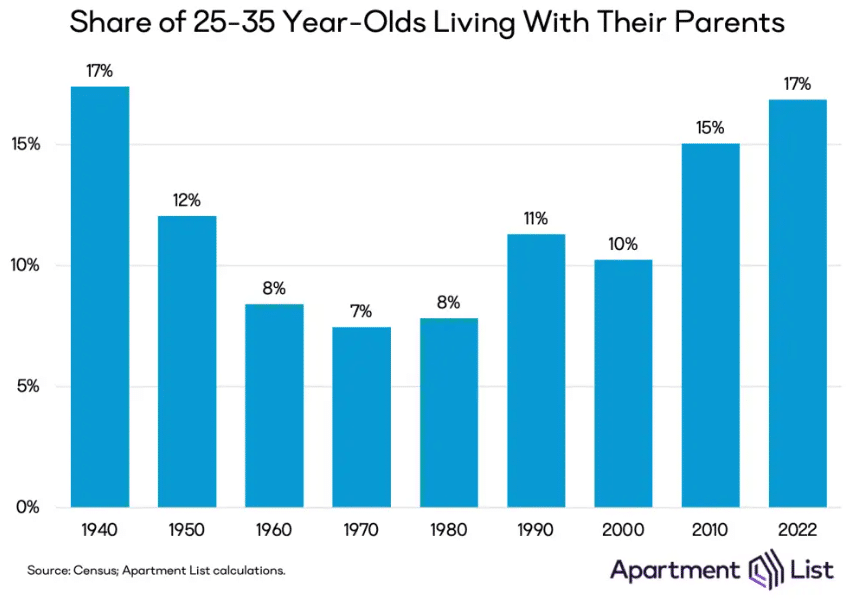

About 7% of 25- to 35-year-olds lived in their parents’ homes in 1970. That share more than doubled as of 2022 to 17%, a share last seen following the Great Depression.

Adults over 25 left the nest in growing numbers after 1940.

“The postwar economic boom and rapid buildup of America’s suburbs enabled more young people to strike out on their own,” Apartment List Senior Housing Economist Chris Salviati said.

By 1960, the share of young adults living with parents declined to 8%, and remained relatively unchanged for 20 years, until the 1980s, when the trend began to reverse.

The study shows that it became slightly more common for young adults to remain in their parents’ households between 1980 and 2000, and numbers rose more rapidly in the new millennium.

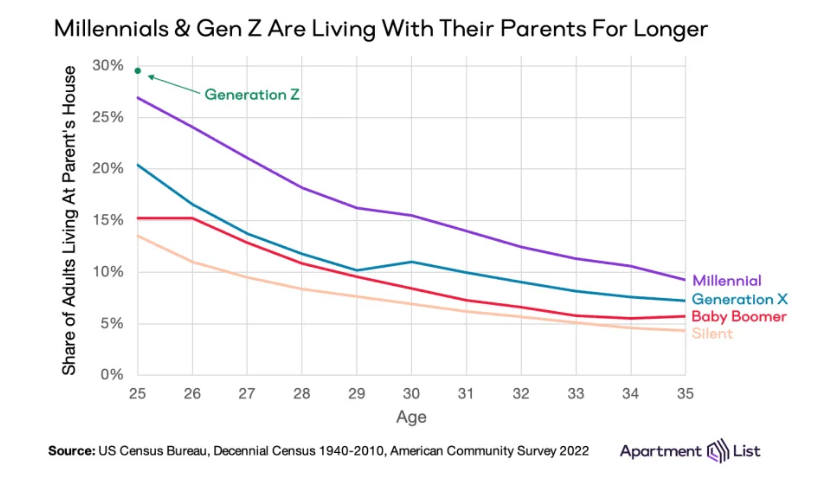

Apartment List data shows a clear, persistent trend of curves gradually shifting up for each generation, but what is its cause? Experts cite waning housing affordability.

“For one, incomes earned by this [demographic] have gradually declined in recent decades,” Salviati said. “More importantly, this drop off in income has been compounded by an even more dramatic increase in housing costs.”

Note: That goes for both renters and potential homebuyers. For a number of reasons, increased rent prices go hand-in-hand with higher home prices, according to the Federal Reserve Board.

Furthermore, utilizing a standard calculation to determine affordability (30% or less of monthly income should be spent on housing) researchers found that the share of young adults now living at home who can afford to live independently has fallen dramatically.

They estimate that in the past more young adults who stayed home (60% in 1960, for instance) had the ability to afford their own place, whereas now independence is an option for just 18%.

Affordability and debt is preventing even college-educated young adults from moving out.

Higher education is increasingly seen as the safest path to economic security, validated by the fact that young adults without college degrees are far more likely to live with their parents, Salviati said. “But as [college] has grown more important, so too has its cost, to the point that student debt has risen to crisis levels.”

Even though the college-educated account for less than one-third of young adults living at home, that’s higher than it’s ever been. In 1980, 6% of young college graduates lived with parents; that doubled by 2022.

The study revealed that young people in more expensive markets and metro areas with stagnant local economies are more likely to live in the parental home.

“That indicates that the story isn’t solely one of housing affordability,” Salviati said, “but also one of economic opportunity.”

Markets such as Nashville, Austin, and Denver, with the fewest young adults still at home, have all experienced waning housing affordability juxtaposed with remarkable economic growth.

Young adults move to these markets for high-paying job opportunities, offsetting rising housing costs, Salviati explained.

Salviati concluded that the study clarified a widespread issue in the U.S.

“That today’s economic realities are forcing many of America’s younger generations to delay major milestones on the path to adulthood.”

To explore more Apartment List findings, visit apartmentlist.com/research.