The latest Mortgage Credit Availability Index (MCAI) released by the Mortgage Banker’s Association (MBA) indicated that there was an increase in mortgage credit availability in August.

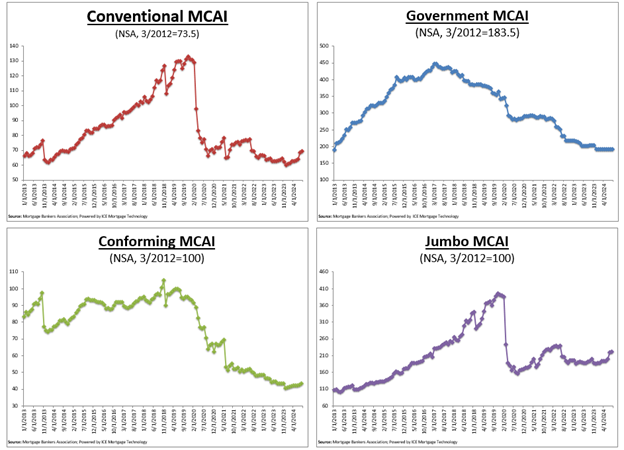

In August, the MCAI increased by 0.9% to 99.0. While increases in the index point to looser credit, a decrease in the MCAI suggests tighter lending requirements. In March 2012, the index was benchmarked at 100. The Government MCAI remained steady, whereas the Conventional MCAI rose by 1.8%. The Conforming MCAI increased by 2.6%, while the Jumbo MCAI increased by 1.5% among the Conventional MCAI’s component indices.

“Credit availability increased in August, with the conventional credit index reaching its highest level since July 2022,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “This was driven by increased cash-out refinance and non-QM programs. Additionally, the jumbo index increased for the eighth consecutive month to its highest level since 2022. Mortgage rates have been on the decline since May 2024, prompting a pickup in refinance activity, which remains limited to a smaller segment of homeowners with higher rates. As a result, the increase in credit availability was the result of lenders broadening their refinance offerings to meet the greater demand.”

Conventional, Government, Conforming, & Jumbo MCAI Component Indices

Using the same process as the Total MCAI, the Conventional, Government, Conforming, and Jumbo MCAIs are created to display the relative credit risk and availability for each index. The population of credit programs that the Component Indices and the Total MCAI both analyze is the main distinction between them. While the Conventional MCAI looks at non-government loan programs, the Government MCAI looks into FHA, VA, and USDA loan programs.

FHA, VA, and USDA loan offerings are not included in the Jumbo and Conforming MCAIs, which are subsets of the normal MCAI. Conventional lending programs that are not subject to conforming loan restrictions are examined by the Jumbo MCAI, whereas those that are are examined by the Conforming MCAI.

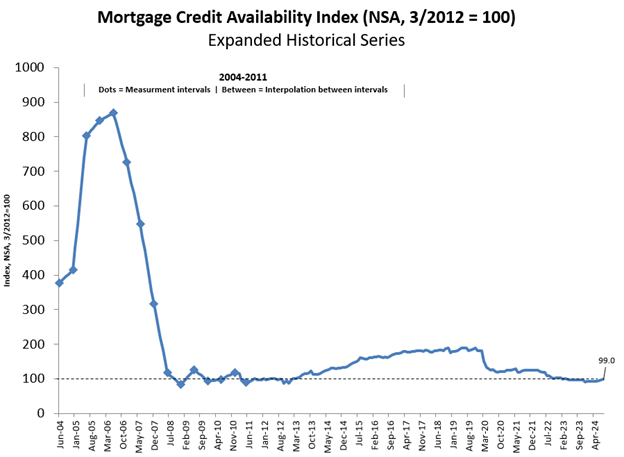

Expanded Historical Series Overview

A longer historical series for the Total MCAI provides perspective on credit availability dating back around ten years; the expanded historical data excludes Conventional, Government, Conforming, and Jumbo MCAI. The expanded historical series, which spans 2004 to 2010, was developed to give the current series historical context by illuminating changes in loan availability during the previous ten years, including the housing crisis and recession that followed.

Note: Less complete and less frequent data were used to construct the data previous to March 31, 2011, which were measured at 6-month intervals and interpolated for charting purposes in the months in between. The expanded historical series from 2004 to 2010 does not include updated methodology.

To read the full report, including more data, charts, and methodology, click here.