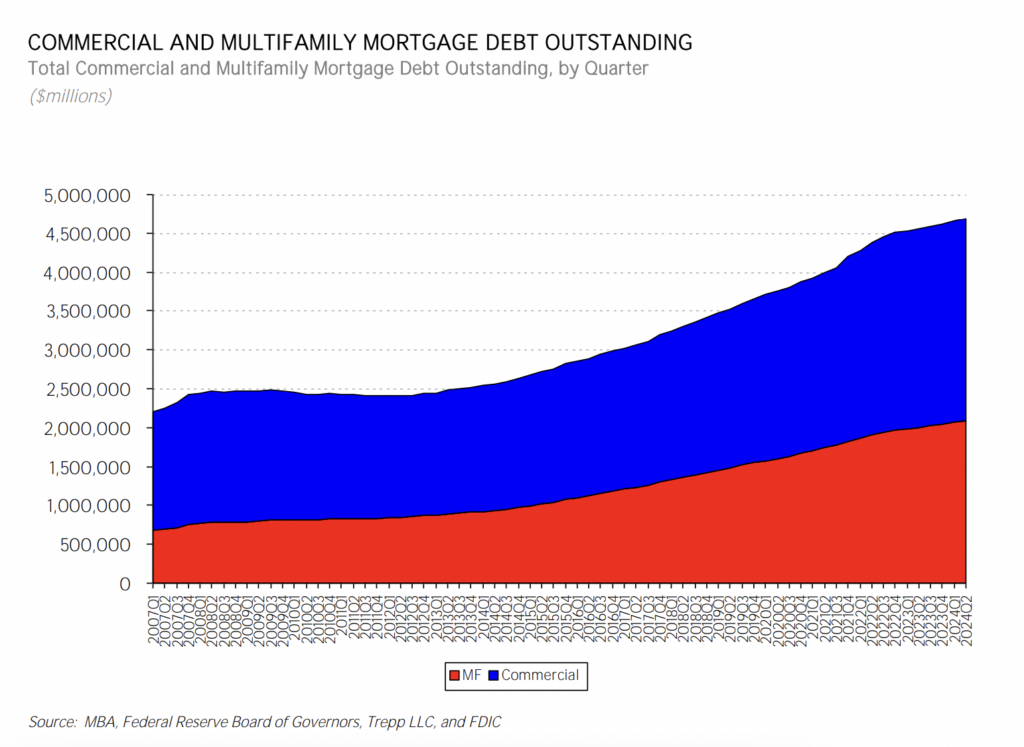

Debt, debt, and more debt! When will consumers catch a break? The most recent Commercial/Multifamily Mortgage Debt Outstanding quarterly report from the Mortgage Bankers Association (MBA) revealed that the amount of outstanding commercial and multifamily mortgage debt rose by $31.4 billion (0.7%) in Q2 of 2024.

At the end of Q2, the total amount of outstanding commercial and multifamily mortgage debt increased to $4.69 trillion. The debt associated with multifamily mortgages alone climbed by $19.4 billion (0.9%) to $2.09 trillion from Q1 of 2024.

“Commercial mortgage debt outstanding grew at a modest pace in the second quarter,” said Jamie Woodwell, MBA’s Head of Commercial Real Estate Research. “Every major capital source increased its holdings of mortgages backed by income-producing properties, but the growth was mixed, with life insurance companies increasing their holdings by 1.8% and banks increasing their holdings by 0.2 percent.”

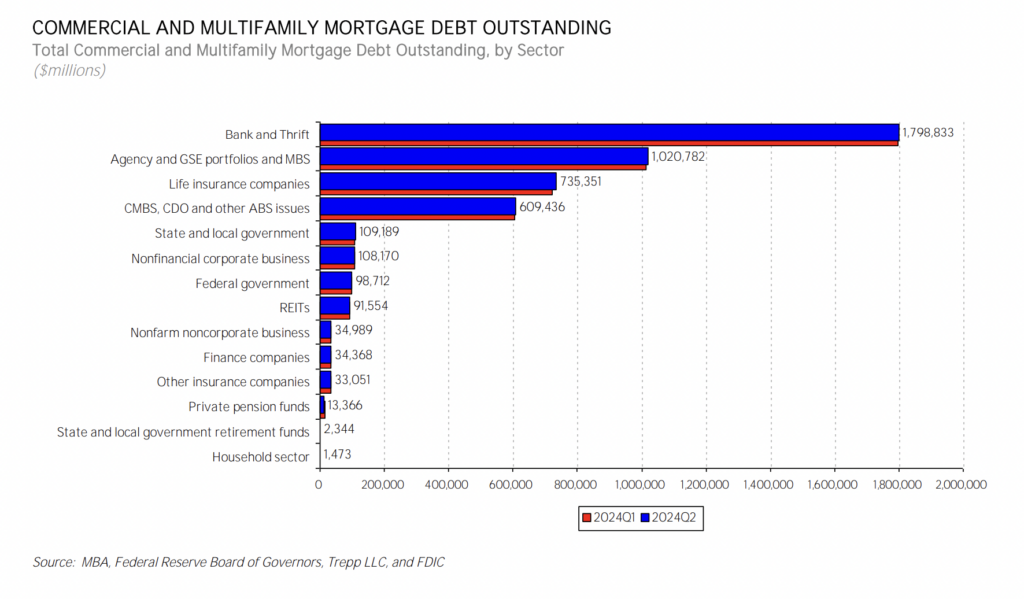

The commercial mortgage-backed securities (CMBS), collateralized debt obligation (CDO), and other asset-backed securities (ABS) issues, life insurance companies, federal agency and government sponsored enterprise (GSE) portfolios, and banks and thrifts are the four largest investor groups.

At $1.8 trillion, commercial banks still control the lion’s share (38%) of commercial and multifamily mortgages. At $1.02 trillion, agency and GSE portfolios and MBS represent the second-largest holdings of commercial and multifamily mortgages (22%). The holdings of life insurance companies total $735 billion (16%), while CMBS, CDO, and other ABS problems account for $609 billion (13%) of the total. CMBS, CDO, and other ABS issues are bought and held by numerous banks, life insurance companies, and GSEs. The report lists these loans under the heading “CMBS, CDO and other ABS.”

Changes In Commercial/Multifamily Mortgage Debt Outstanding

When focusing only on multifamily mortgages, as of Q2 of 2024, agency and GSE portfolios and MBS accounted for 49% of all outstanding multifamily debt, with $1.02 billion. Banks and thrifts came in second with $625 billion, life insurance companies for $234 billion, state and local government for $91 billion, and CMBS, CDO, and other ABS issues for $67 billion.

With a $12.8 billion (1.8%) increase in their holdings of commercial and multifamily mortgage debt in Q2, life insurance firms had the biggest gains in terms of money. Banks and thrifts raised their holdings by $2.9 billion (0.2%), agency and GSE portfolios and MBS climbed by $8.1 billion (0.8%), and CMBS, CDO, and other ABS issues increased by $5.4 billion (0.9%).

The biggest gain in percentage terms was seen by non-financial corporate businesses, whose holdings of commercial and multifamily mortgages increased by 2.0%. On the other hand, assets held by state and local government retirement plans dropped by 12.8%.

“With fewer loans paying off, CRE mortgage balances have continued to grow in recent quarters despite a marked fall-off in the volume of loans being made,” Woodwell said. “We anticipate that long-term interest rates, which are significantly lower than a year ago, will help increase origination activity in coming quarter—boosting both new loans coming onto the books and the payoff of existing ones.”

Changes In Multifamily Mortgage Debt Outstanding

The multifamily mortgage debt outstanding as of Q1 of 2024 increased by $19.4 billion, or a 0.9% quarterly gain. The highest rise in terms of dollars was observed in the holdings of multifamily mortgage debt by agency and GSE portfolios and MBS offerings, which showed a gain of $8.1 billion (0.8%). Life insurance firms saw a gain of $4.4 billion (1.9%) in their assets, while bank and thrifts saw an increase of $4.7 billion (0.8%).

With a 7.8% percentage gain, REITs saw the biggest percentage increase in their multifamily mortgage debt holdings. With a 12.8 percent decrease, state and local government retirement funds had the biggest reduction in their multifamily mortgage debt holdings.

To read the full report, including more data, charts, and methodology, click here.