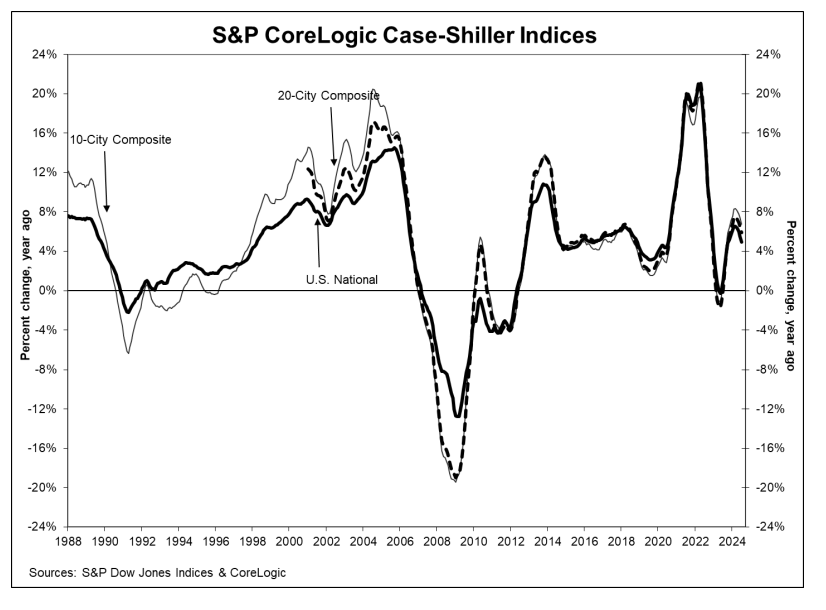

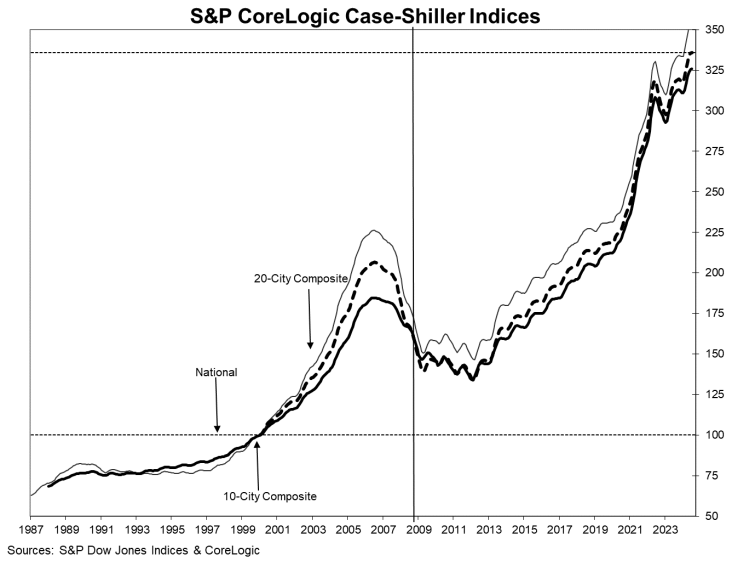

S&P Dow Jones Indices has released the July 2024 results for the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reporting a 5% annual gain for July, down from a 5.5% annual gain the previous month.

The 10-City Composite saw an annual increase of 6.8%, down from a 7.4% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 5.9%, dropping from a 6.5% increase in the previous month. New York again reported the highest annual gain among the 20 cities with an 8.8% increase in July, followed by Las Vegas and Los Angeles with annual increases of 8.2% and 7.2%, respectively. Portland held the lowest rank for the smallest year-over-year growth, notching the same 0.8% annual increase in July as last month.

“The S&P CoreLogic Case-Shiller Index released today showed that home sales prices continued to rise through July, with the national index up 5.0% and the 10- and 20-city composites up 6.8% and 5.9%, respectively,” said Realtor.com Senior Economist Ralph McLaughlin. “July’s growth rate was a deceleration from June, when national growth was 5.5% and the upwardly revised composites ranged from 6.5% (20-city) to 7.4% (10-city), but each index still reached a new high in July. This month’s index includes home sales in May, June, and July, a period in which home sales activity, time on market, and price cuts began to all swing towards a buyer’s market. With mortgage rates peaking in May, next month’s release will begin to fully incorporate this inflection in the housing market that began in June.”

The U.S. National Index, the 20-City Composite, and the 10-City Composite upward trends continued to decelerate from last month, with pre-seasonality adjustment increases of 0.1% for the national index, and both the 20-City and 10-City Composites remained unchanged on the month. After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.2%, while both the 20-City and 10-City Composite reported a monthly rise of 0.3%.

“Accounting for seasonality of home purchases, we have witnessed 14 consecutive record highs in our National Index,” said Brian D. Luke, CFA, Head of Commodities, Real & Digital Assets for CaseShiller. “While the S&P 500 has achieved 39 record highs and the S&P GSCI Gold TR hit 35 record highs, housing is following a similar trajectory. The growth has come at a cost, with all but two markets decelerating last month, eight markets seeing monthly declines, and the slowest annual growth nationally in 2024. Overall, the indices continue to grow at a rate that exceeds long-run averages after accounting for inflation.”

Currently, Zillow reports that the average U.S. home value is at $361,282, up 2.9% over the past year.

“We continue to observe outperformance in most low-price tiers in the market on a three- and five-year horizon,” Luke continued. “The low-price tier of Tampa was the best performing market nationally with five-year performance of 88%. The New York market was the best market annually, posting a gain of 8.9%. New York’s low-tier index, which include home values up to $533,000, helped drive that growth with 10.8% annual gains. Over five years, markets such as New York and Atlanta saw low-price-tiered indices outperforming their market by as much as 20% and 18%, respectively. The relative outperformance of low-price-tiered indices has both benefited first-time homebuyers as well as made it more difficult for those looking for a starter home. The opposite is happening in California, which has the most expensive high-price tiers in the nation, all well over $1 million. The rich are getting richer in San Diego, Los Angeles, and San Francisco where their high-price-tiered indices outperformed on a one- and three-year basis.”

As the final quarter of 2024 gets underway, the 30-year fixed-rate mortgage (FRM) according to Freddie Mac’s Primary Mortgage Market Survey (PMMS) stood at 6.09% as of September 19, 2024. A year ago at this time, the 30-year FRM averaged at full percentage point higher at 7.19%.

Just last week, for the first time in four years, the Federal Reserve cut its benchmark interest rate a full half-point to a new range of 4.75% to 5.0% at the conclusion of the Federal Open Market Committee (FOMC) meeting.

“We expect the rate of home price growth to continue to slow over the next few months before reaccelerating amidst falling interest rates,” added McLaughlin. “In fact, the Realtor.com 2024 forecast update projects growth of just 4.6% for the year, which would imply further cooling in home price growth over the next few months of data releases. However, with mortgage rates falling to 24-month lows and a high probability of further rate reductions, there is a significant chance that the rate of home price growth will bottom out over the next months and then reaccelerate at the end of the year or at the beginning of next as the purchasing power of homebuyers begins to reflect a more favorable rate environment.”