August showed an improvement in homeowner affordability, with purchase applicants’ national median payment falling from $2,140 in July to $2,057 in August. This is supported by the Mortgage Bankers Association‘s (MBA) Purchase Applications Payment Index (PAPI), which uses information from the MBA’s Weekly Applications Survey (WAS) to assess how new monthly mortgage payments change over time in relation to income.

Key Findings of MBA’s Purchase Applications Payment Index (PAPI) – August 2024

- The national median mortgage payment was $2,057 in August —down $83 from July. It is down by $113 from one year ago, equal to a 5.2% decrease.

- The national median mortgage payment for FHA loan applicants was $1,817 in August, down from $1,838 in July and down from $1,909 in August 2023.

- The national median mortgage payment for conventional loan applicants was $2,056, down from $2,140 in July and down from $2,187 in August 2023.

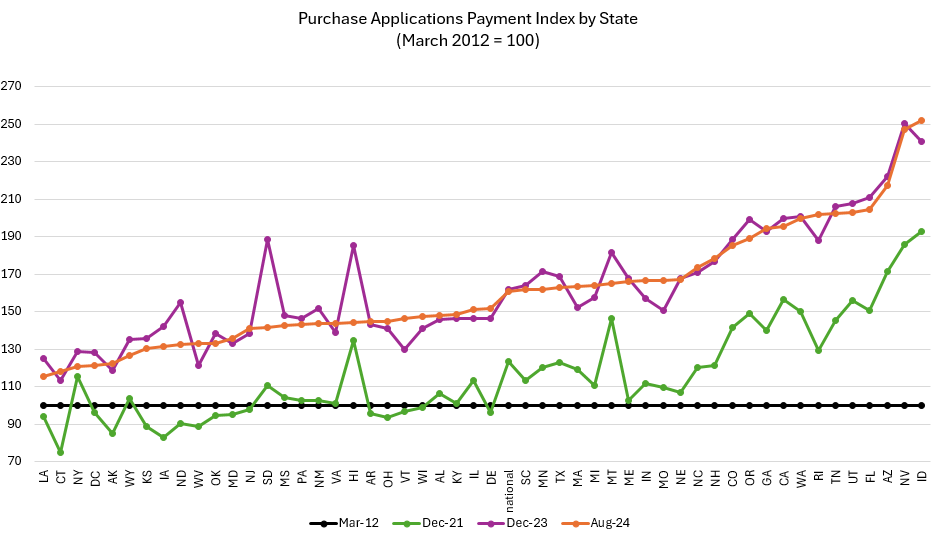

- The top five states with the highest PAPI were: Idaho (252.1), Nevada (247.3), Arizona (217.1), Florida (204.6), and Utah (202.9).

- The top five states with the lowest PAPI were: Louisiana (115.3), Connecticut (118.0), New York (120.8), D.C. (121.1), and Alaska (122.3).

- Homebuyer affordability increased for Black households, with the national PAPI decreasing from 167.7 in July to 161.2 in August.

- Homebuyer affordability increased for Hispanic households, with the national PAPI decreasing from 156.0 in July to 150.0 in August.

- Homebuyer affordability increased for White households, with the national PAPI decreasing from 168.8 in July to 162.3 in August.

“Homebuyer affordability conditions improved for the fourth consecutive month, with lower mortgage rates, rising incomes, and slower home-price growth giving prospective buyers’ budgets a much-needed boost,” said Edward Seiler, MBA’s Associate VP of Housing Economics and Executive Director for the Research Institute for Housing America.

An increase in MBA’s PAPI—indicative of worsening borrower affordability conditions—signifies that the mortgage payment to income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decline in earnings. When loan application amounts, mortgage rates, or incomes rise, the PAPI, a measure of improving borrower affordability conditions, declines.

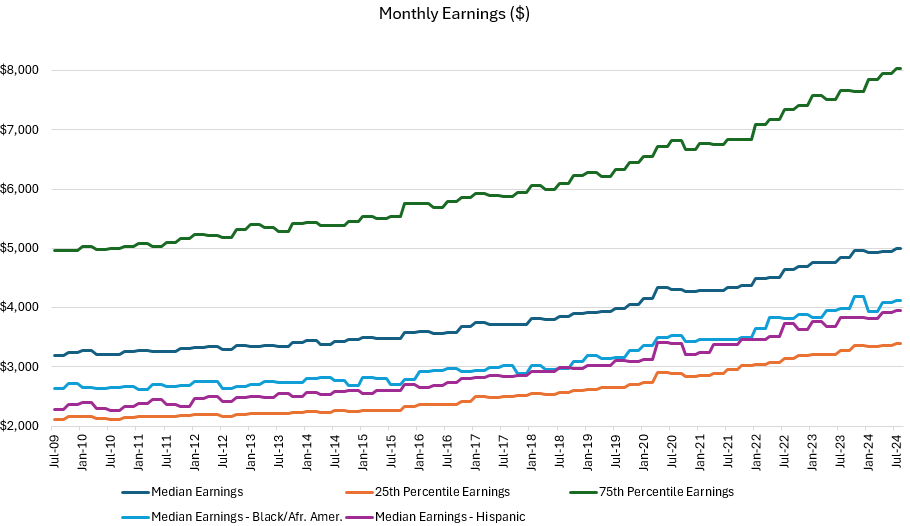

In August, the national PAPI dropped by 3.9%, from 167.2 in July to 160.7 in August. The PAPI is down 8.2 percent annually as a result of the moderate earnings growth, despite a 5.2% decline in payments. The median earnings increased by 3.2% from the previous year. The average mortgage payment for borrowers seeking lower-payment mortgages (the 25th percentile) dropped from $1,444 in July to $1,388 in August.

The median mortgage payment for purchase mortgages from MBA’s Builder Application Survey dropped to $2,362 in August from $2,452 in July, according to the Builders’ Purchase Application Payment Index (BPAPI).

Seiler added, “MBA expects that lower mortgage rates, coupled with increasing housing inventory, will entice additional homebuyers to enter the housing market.”

To read the full report, including more data, charts, and methodology, click here.