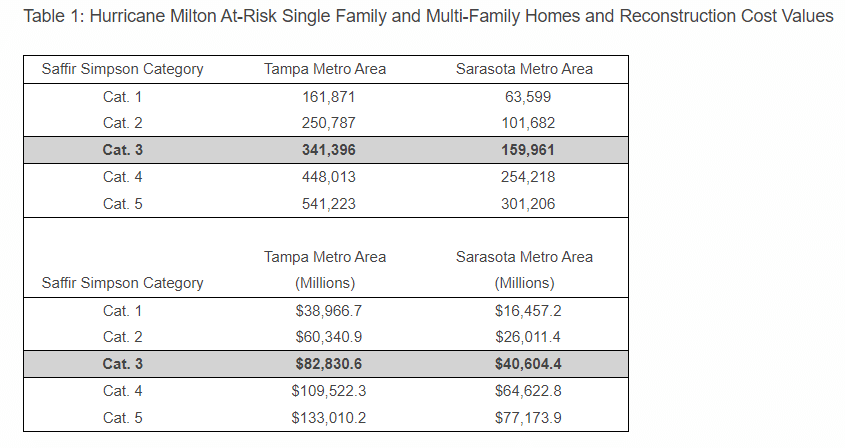

Early estimates from CoreLogic have found that 500,000 single-family and multifamily homes in Tampa Bay and Sarasota, Florida metropolitan areas with a reconstruction cost value (RCV) of approximately $123 billion are at potential risk of storm surge damage from Hurricane Milton.

According to Weather.com, Milton is currently a Category 4 Hurricane, with winds gusting up to 145 miles per hour as of 11 a.m. Wednesday EDT. The storm is centered 190 miles southwest of Tampa, and is tracking to the northeast at 16 miles per hour. Bands of heavy rain with strong wind gusts are spreading across parts of Florida in advance of the storm making landfall. In addition, a tornado watch was in effect for the southern half of the Florida Peninsula on Wednesday, including the Miami, Tampa Bay, and Fort Myers areas. Multiple tornadoes have been confirmed in southern Florida since this morning.

“Hurricane Milton forecasts currently indicate a direct landfall over Tampa Bay as a Category 3 hurricane with maximum sustained winds of 125 miles per hour,” said Jon Schneyer, Director of Catastrophe Response at CoreLogic. “Small changes in the exact landfall location will have monumental consequences on the financial impact of this storm. A direct landfall, or one just north of Tampa Bay, would be a worst-case scenario because the winds and storm surge flooding would be most intense. A more southern landfall would reduce the impact in Tampa Bay but devastate communities along the coast near Sarasota.”

As Milton approaches Florida, its path becomes more certain and the below metropolitan areas at risk will narrow:

The table above indicates the total number of homes with exposure to storm surge damage given the current path of the storm. RCV figures represent the cost to completely rebuild homes in these areas, which CoreLogic estimates using detailed property characteristic data of each unique home combined with current localized costs of materials, equipment and labor. The calculation does not include the value of the land or lot. The RCV figures assume 100% destruction of all at-risk homes and are not a representation of expected damages.

Hurricane-driven storm surge can cause significant property damage when high winds and low-pressure cause water to amass inside the storm, releasing a powerful rush over land when the hurricane moves onshore.

In addition to the damage to housing, CNN reports that Hurricane Milton’s projected devastation in Florida could have a ripple effect on the broader U.S. economy as it will affect jobs, travel, manufacturing, retail sales, and other factors. Approximately 3% of America’s gross domestic product (GDP) is directly in Hurricane Milton’s path, according to Ryan Sweet, Chief U.S. Economist for Oxford Economics.

One hundred years ago, the Tarpon Springs Hurricane inflicted an estimated $10 million in damages at the time, a price tag that would be significantly higher today when adjusted for inflation. More significant than inflation, growth in the area since 1921 in the Tampa Bay, St. Petersburg, and their surrounding regions have grown significantly.

Weather.com reports that Milton will be the fifth hurricane to make landfall in the mainland U.S. in 2024. The first of the year was a Category 1 storm in Beryl, which slammed into the Texas coast in early July. That was followed by a second Category 1 hurricane, Debby, which came ashore in Florida’s Big Bend region about a month later in August. Hurricane Francine, a Category 2 storm, made landfall in southern Louisiana on September 11. The fourth of the year was Hurricane Helene, a Category 4 storm that made landfall in the Florida Big Bend region on September 26 that produced a catastrophic storm surge at the coast, as well as destructive winds and inland flooding that tore through the southeast and southern Appalachians.

According to CoreLogic, the Tampa Bay-St. Petersburg area contains a diverse array of buildings, as well as significant urban development over the past decades. Tampa Bay and St. Petersburg have a mix of residential buildings, ranging from single-family homes to high-rise condominiums. In the city of Tampa alone, there are approximately 157,000 housing units. St. Petersburg adds around 109,000 housing units to the total. When considering the broader Tampa-St. Petersburg-Clearwater, Florida metropolitan area, including other parts of Hillsborough, Pinellas, and Pasco counties, the number of residential buildings increases to 1.5 million. The commercial real estate sector in the Tampa Bay area comprises numerous office buildings, retail spaces, hotels, and industrial properties. In Tampa, notable commercial districts such as downtown, Westshore, and Ybor City contribute to a dense concentration of commercial buildings. St. Petersburg’s downtown and waterfront areas are similarly rich in commercial properties, including several notable office towers and retail centers.

With Hurricane Helene having inflicted damage across the southeast just weeks ago, CoreLogic’s Hazard HQ Command Central has updated its industry insured and uninsured loss estimates using newly available observed wind speed, storm surge depth and precipitation data. The team estimated that Hurricane Helene caused $30.5-$47.5 billion in total wind and flood damage (including both insured and uninsured losses) across 16 states. The insurance industry, including both private companies and the National Flood Insurance Program (NFIP) will provide funds for recovery to home and business owners across the impacted states. Total insured wind and flood losses are expected to be between $10.5-$17.5 billion.

FEMA continues to assist those impacted by Hurricane Helene, making in excess of $286 million (with an additional $180 million in mission assignments to federal partners) in federal assistance for survivors of Helene. FEMA continues to coordinate recovery efforts while awaiting landfall of Hurricane Milton along Florida’s Gulf Coast.