According to the Realtor.com September Rental Report, there remains a geographical gap in the rental market despite a national trend of overall rent declines. Despite a nationwide decline in rent, nine of the ten Midwestern markets included in the 50-metro survey experienced year-over-year increases in rent in September. On the other hand, eight out of ten of the markets that saw the largest rent cuts last month were in the South, primarily due to an increase in the number of new multi-family housing developments.

“The balance between housing supply and demand is a key factor shaping regional rent patterns. In markets across the South, increased multi-family inventory is easing competition among renters and driving down prices. On the other hand, in the Midwest, where demand has still outpaced supply, we continue to see rising rents,” said Danielle Hale, Chief Economist at Realtor.com. “Nationally, the relative stability in rent prices should translate into slower shelter inflation in the months ahead, easing one of the biggest recent drivers of price increases.”

With one metro in the Northeast, three in the South, three in the Midwest, and three in the West, the top ten markets with the fastest year-over-year increase in September were dispersed across the nation. Nonetheless, the Midwest’s strong labor market and affordable housing continue to be advantages. September showed year-over-year rent increases in eight of the ten Midwestern locations included in Realtor.com’s research; Cincinnati led the way with an annual growth rate of 3.4%. Minneapolis (1.9%) and St. Louis (2.6%) were two of the top 10 fastest growing markets. The only cities where rent decreased were Detroit (-0.3%) and Chicago (-2.6%).

Top 10 Markets with the Fastest Rent Growth in September 2024

- Cincinnati, OH-KY-IN ($1,393)

- Washington-Arlington-Alexandria, DC-VA-MD-WV ($2,293)

- New York-Newark-Jersey City, NY-NJ-PA ($2,973)

- St. Louis, MO-IL ($1,361)

- San Jose-Sunnyvale-Santa Clara, CA ($3,377)

- Louisville/Jefferson County, KY-IN ($1,287)

- Sacramento-Roseville-Folsom, CA ($1,954)

- Minneapolis-St. Paul-Bloomington, MN-WI ($1,555)

- Oklahoma City ($1,037)

- Portland-Vancouver-Hillsboro, OR-WA ($1,737)

Midwest Shows Strong Employment While Affordability Driving Up Rent

The majority of markets with the biggest annual rent decreases were Southern metro areas. In actuality, the South contained eight of the top ten metro areas with the sharpest losses. The largest drop was recorded in Nashville, TN (-4.8%). Dallas, Austin, Texas; Birmingham, AL; Memphis, TN; Atlanta; Miami; and San Antonio are among the other Southern cities on the list. Renters are getting much-needed relief from the market as a result of the new multi-family housing stock in these locations growing at a quick pace.

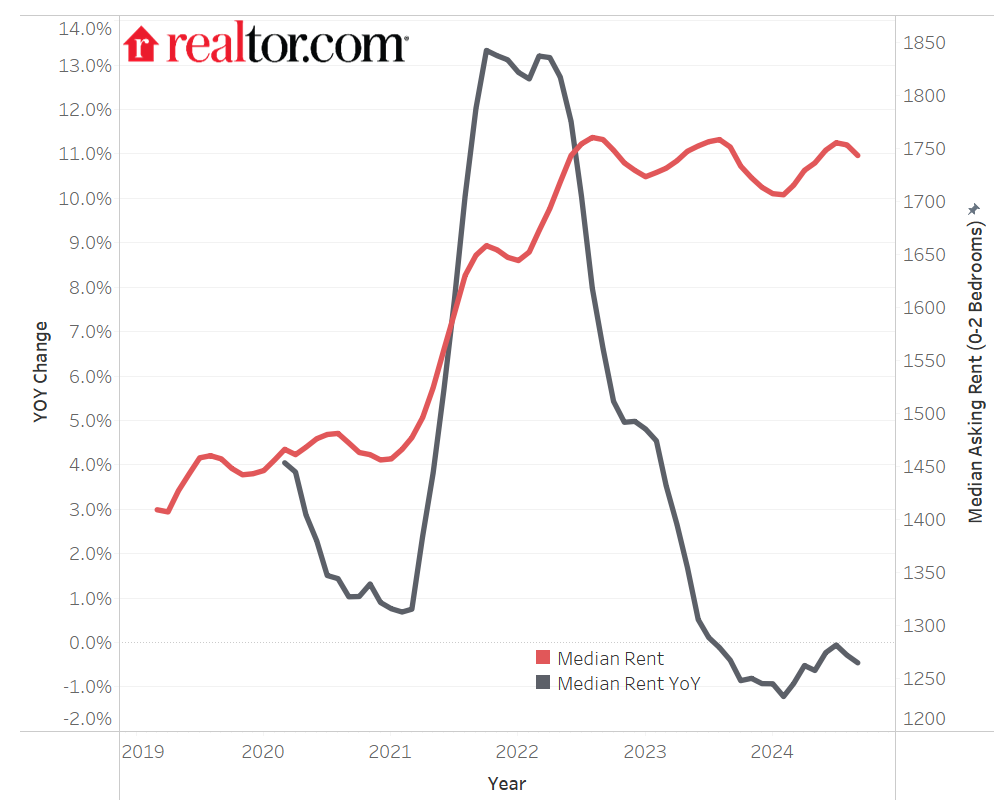

September is the 14th consecutive month in the country where the rent for 0–2 bedroom units has decreased compared to the previous year. At $1,743, the median asking rent decreased by $8, or -0.5%, from the prior year. The U.S. median rent is still only $17 (-1.0%) below its peak from August 2022, despite the overall fall. Notably, median rents are still $286 (19.6%) higher than they were in September 2019 (prior to the pandemic), but this increase is less than the 50.8% increase in the median price-per-square-foot of for-sale home listings over the same five-year period, and is almost in line with the rise in overall consumer prices (up 22.7% over the same period).

Top 10 Markets with the Fastest Rent Decline in September 2024

- Nashville-Davidson–Murfreesboro–Franklin, TN ($1,578)

- Dallas-Fort Worth-Arlington, Texas ($1,475)

- Denver-Aurora-Lakewood, CO ($1,889)

- Austin-Round Rock-Georgetown, Texas ($1,522)

- Birmingham-Hoover, AL ($1,251)

- Memphis, TN-MS-AR ($1,227)

- San Diego-Chula Vista-Carlsbad, CA ($2,828)

- Atlanta-Sandy Springs-Alpharetta, GA ($1,610)

- Miami-Fort Lauderdale-Pompano Beach, FL ($2,372)

- San Antonio-New Braunfels, Texas ($1,268)

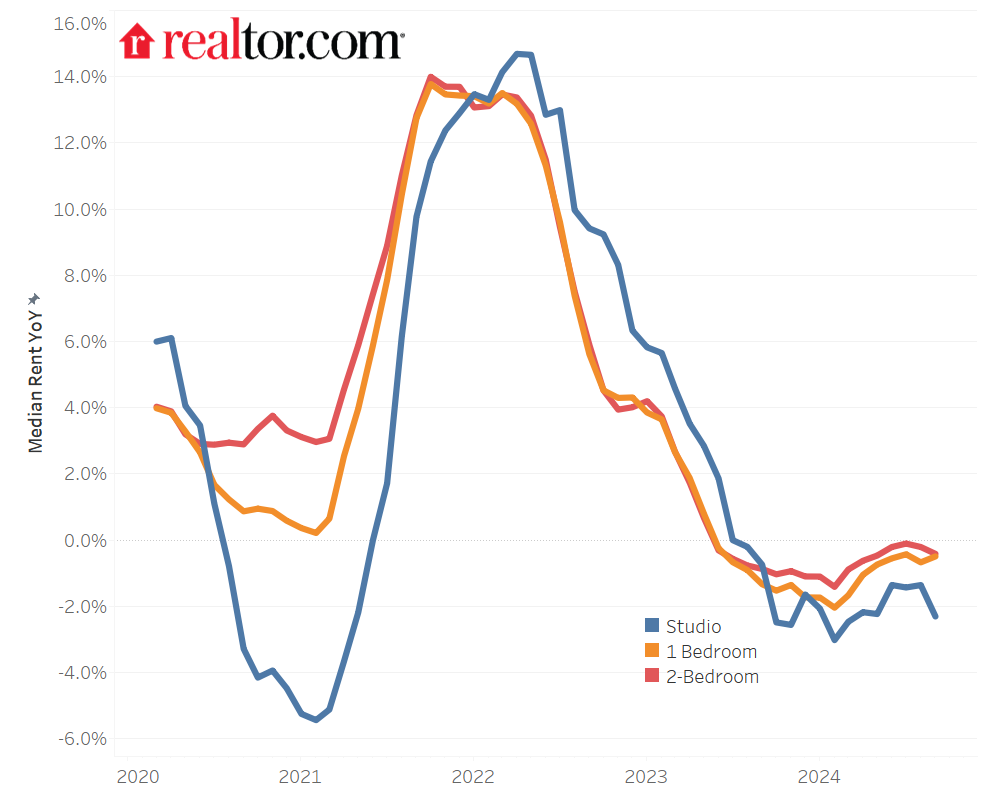

September rent declines were observed in all unit sizes, with the largest reductions occurring in smaller units. The average studio rent decreased by 2.3% year-over-year to $1,442, which is 12.7% more than five years ago but down 3.2% from its peak in October 2022. One-bedroom rental prices dropped to $1,623 on average, marking the 16th consecutive year of declines in rent. Declines in two-bedroom units continued for 16 consecutive months, falling by -0.4% to $1,930. With a growth rate of 21.4% during the previous five years, these larger units had the highest growth rate.

To read the full report, including more data, charts, and methodology, click here.