According to a trio of new Redfin surveys, nearly one-third (31.6%) of U.S. renters say housing affordability is a top-three issue when it comes to which candidate they’ll support come November in the upcoming presidential election.

Redfin published three separate reports today about the intersection of housing and the upcoming presidential election, all based on a Redfin-commissioned survey conducted by Ipsos in September 2024, which was fielded to 1,802 people aged 18-65.

Renters Weigh In

The first report focuses on which issues are important to renters and homeowners when it comes to which candidate they’ll support in the election, with 31.6% of renters stating that housing affordability is a top-three issue compared to 17.1% of homeowners.

Kamala Harris voters were slightly more likely than Donald Trump voters to rank housing affordability as a top issue, with 25.1% of all respondents who plan to vote for Harris ranked housing affordability as a top-three issue, compared with 20.4% of respondents who plan to vote for Trump.

More than half (52.1%) of surveyed homeowners reported feeling better off financially than four years ago, compared to less than half (44.2%) of renters. That discrepancy is partly because soaring housing prices have helped homeowners build home equity.

Many Americans broke into homeownership during the pandemic thanks to record-low mortgage rates, but many others were priced out due to surging demand and a lack of supply. Mortgage rates in excess of 6% are exacerbating those high prices, and making it difficult for first-time buyers to afford a home.

Playing the Waiting Game

The second report from Redfin centered on the share of house hunters who are waiting until after the election to buy a home, as 23% of prospective first-time buyers who are likely to purchase their first home in the next year said they are waiting until after the November election.

More than one quarter (26.1%) of prospective first-time buyers are waiting to see if Harris’ housing plan—which includes $25,000 in downpayment assistance for some buyers—goes into effect before they purchase a home. Nearly one in six (15.9%) are waiting to see if Trump’s plans for tackling “issues with affordable housing” are enacted.

“Buying a home can be scary, especially if it’s your first time, you’re worried about the election and you’re not sure if the economy is going to get better or worse,” said Lindsay Garcia, a Redfin Premier Agent in Fort Lauderdale, Florida. “Buyers are uncertain about what will happen in the election—especially first-time homebuyers. We have to remember, the market is cyclical. The economy will keep improving, and when we get past the election, buyers will start to feel more confident again.”

Votes and Values

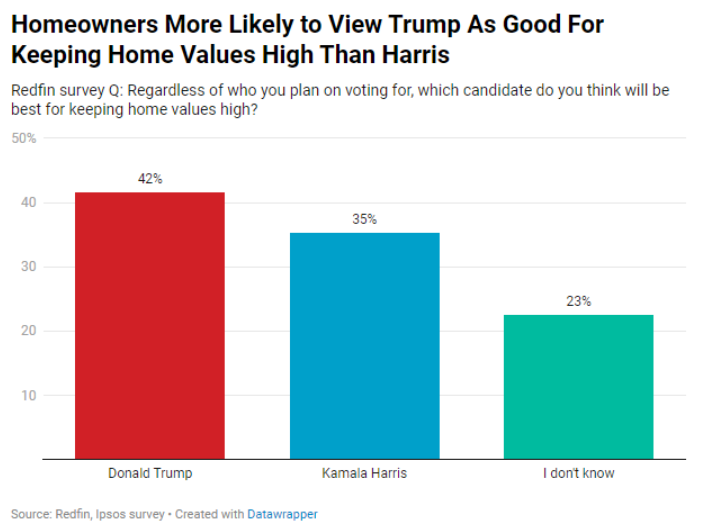

Redfin’s third report focuses on which candidate homeowners believe would be best for keeping home values high with 41.6% of homeowners believing that Trump would be best for keeping home values high, while 35.3% believe Harris would be best.