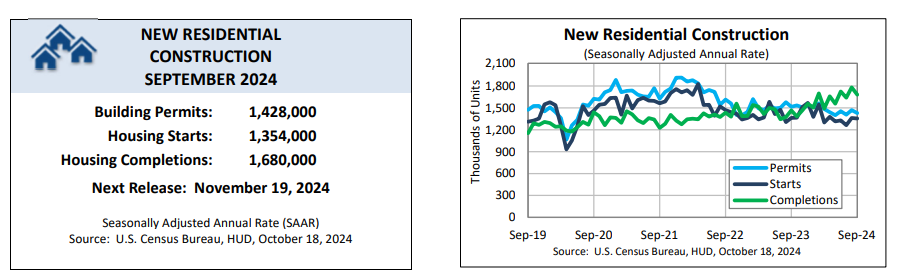

The U.S. Census Bureau and the U.S. Department of Housing & Urban Development (HUD) have announced new residential construction statistics for September 2024. Single-family housing starts in September improved for the second consecutive month, as builder sentiment has improved.

HUD and the Census Bureau found that privately-owned housing starts in September were at a seasonally adjusted annual rate of 1,354,000, which was 0.5% below the revised August estimate of 1,361,000, 0.7% below the September 2023 rate of 1,363,000. Single-family housing starts in September were at a rate of 1,027,000—2.7% above the revised August figure of 1,000,000. The September rate for units in buildings with five units or more was 317,000.

“Single-family starts increased for the second consecutive month, which aligns with the improvement in homebuilder sentiment over the last two months,” said First American Deputy Chief Economist Odeta Kushi. “Builders improved outlook is likely due to the beginning of the Fed’s easing cycle and expectations of lower interest rates in 2025.”

For the first time in four years, the Federal Reserve has slashed its benchmark interest rate in mid-September, a move to force lower borrowing costs for consumers and businesses. The rate cut of a full half-point to a new range of 4.75% to 5.0% was announced by Federal Reserve Chair Jerome H. Powell at the conclusion of the Federal Open Market Committee (FOMC) meeting. The move by Powell is in response to the fight against inflation, after the Fed kept rates at an all-time 23-year high for more than a year.

“Builder sentiment rose to 43 in October, also marking the second consecutive monthly increase,” noted Kushi. “However, sentiment still remains in negative territory, below the break-even mark of 50.”

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,428,000, 2.9% below the revised August 2024 rate of 1,470,000, and 5.7% below the September 2023 rate of 1,515,000. Single-family authorizations in September were at a rate of 970,000, which was 0.3% above the revised August figure of 967,000. Authorizations of units in buildings with five units or more were at a rate of 398,000 in September.

“Permits are a leading indicator of future starts, and they increased for the third consecutive month in September, a positive sign for a supply-starved housing market,” added Kushi. “The housing market remains structurally underbuilt, and homeowners with locked-in low mortgage rates are keeping existing-home inventory limited. More groundbreaking is needed to bridge the gap between supply and demand.”

And that “lock-in” rate may continue as Freddie Mac reports that the 30-year fixed-rate mortgage (FRM) averaged 6.44% as of October 17, 2024, up from last week when it averaged 6.32%. A year ago at this time, the 30-year FRM averaged 7.63 percent. And as Zillow reports, the average U.S. home value is $359,892, up 2.7% over the past year, which may further cause affordability issues for potential home buyers.

In terms of housing completions, privately-owned housing completions were reported at a seasonally adjusted annual rate of 1,680,000 in September, 5.7% below the revised August estimate of 1,781,000, but 14.6% above September 2023’s rate of 1,466,000. Single-family housing completions in September were at a rate of 1,000,000—2.7% below the revised August 2024 rate of 1,028,000. The September rate for units in buildings with five units or more was 671,000.

Robert Frick, Corporate Economist with Navy Federal Credit Union, added: “Builder confidence may be up, but so are mortgage rates, which must be cooling builder enthusiasm for adding even more inventory to the already saturated new home market. With the economy strengthening and the 10-year Treasury yield up, even the Fed’s expected rate cuts aren’t a guarantee that we’ll see sub-6% mortgage rates anytime soon.”

“Despite pent-up demand in the housing market, elevated financing costs continue to challenge both buyers and builders,” Kushi noted. “While builders are growing more confident in their ability to sell newly built homes, they continue to face supply-side hurdles to building them, from higher construction costs to ongoing skilled labor shortages. Lower interest rates may help stimulate progress, but momentum will likely be constrained by these persistent challenges.”

Click here for more on HUD and the Census Bureau’s September 2024 new residential construction statistics.