Student loans are frequently listed as the primary obstacle for young buyers’ c. But even though loan debt is higher than ever, are loans really the barrier some claim them to be? A new study from First American reviewed the data from the 2022 Survey of Consumer Finances to determine exactly how much impact student loan debt has on the search for home ownership.

Student Loan Debt Payment-to-Income Ratios Have Declined

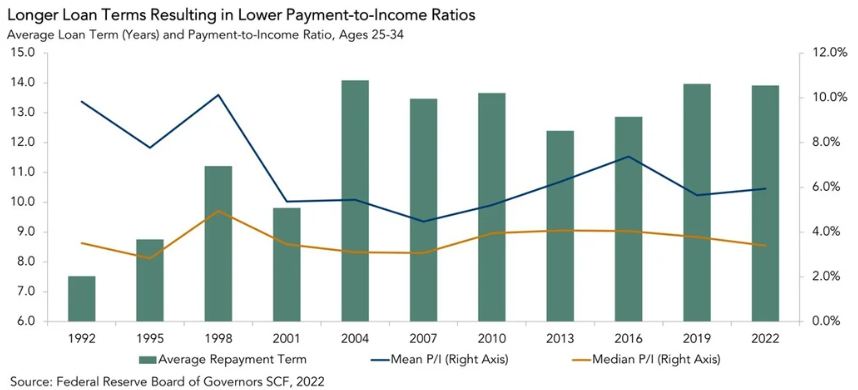

Student loan debt has steadily increased over the past 30 years, bringing the issue into the headlines. Average student loan balances have increased from $12,600 in 1992 to $40,600 in 2022 (adjusted for inflation). Yet the percentage of income that young households put toward student loan repayments each month has actually decreased in recent years. Between 2016 and 2022, the average payment-to-income ratio for families with heads of household aged 25 to 34 dropped from 7.4% to 5.9%.

How does this happen?

One major reason is that the average inflation-adjusted income for young households with student debt increased nearly 70% between 1992 and 2022, from $73,000 to $122,000. Also, the average loan repayment term has almost doubled, from 7.5 years in 1992 to 13.9 years in 2022, lowering monthly payment-to-income ratios, allowing home buyers to borrow more money for a similar monthly payment. This is similar to extending a mortgage term from 15 to 30 years, allowing home buyers to borrow more money for a similar monthly payment. Consequently, student loan repayment terms almost double, accommodating more debt for the same monthly payment.

Then there are the declining interest rates on student loans, with the average annual interest rate down two percentage points in the last three decades—from nearly 8% in 1992 to around 6% in 2022. Education-buying power has been increased by longer repayment terms and lower interest rates, which then lowered payment-to-income ratios.

The Homeownership Return on Education

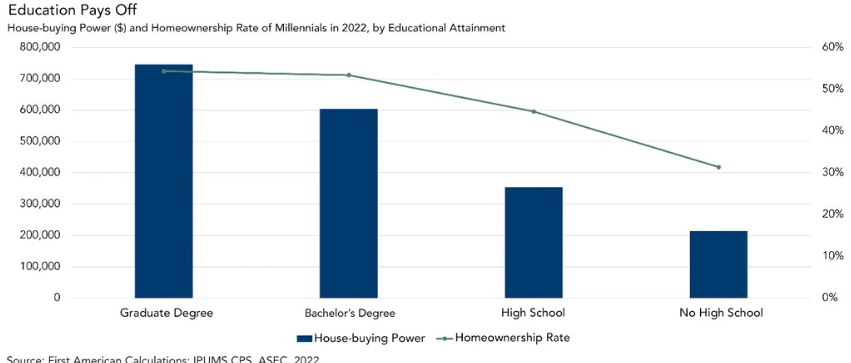

We know that higher educational achievement is positively linked to higher household income, which increases house-buying power. For millennials, the difference in house-buying power between those with a high school diploma (or some college/associate degree) and those with a bachelor’s was around $250,000 in 2022 (adjusted for inflation). That could partially explain why the home ownership rate among millennials in 2022 with a bachelor’s degree was 12.8 percentage points higher than for those with only a high school diploma. That is a powerful reminder of the connection between educational achievement and home ownership.

The focus on increasing levels of student loan debt should always factor in the increase in education-buying power from longer loan repayment terms and lower student loan rates. These free additional funds that young home buyers can put toward their first home. The report suggests that student loan debt probably just delays homeownership, but does not prevent it. Millennials are the most educated generation yet, and their stable payment-to-income ratios and substantial returns on investment from higher education positioned them well to drive homeownership demand, especially as more reach their prime home-buying years.

Click here to read First American’s full report on education and home ownership.