According to a new study by LendingTree, the current state of the home buying market seems so unattainable for many, as the American dream of home ownership continues to elude many hampered by continued affordability concerns. More specifically, for renters, LendingTree found that 62% of those who rent expressed that they are worried they will never be able to own a home.

Homeownership, long seen as a cornerstone the American dream, has been an uphill struggle for many who, despite a recent dip in mortgage rates under the 7% mark, remain priced out of the market. According to Zillow, the average U.S. home value currently stands at $359,892, a figure that is up 2.7% over the past year.

Key Findings

For the study, LendingTree commissioned QuestionPro to conduct an online survey of 2,048 U.S. consumers ages 18-78 from September 13-17. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control. As uncovered by LendingTree in their analysis:

- Nearly two in three renters (62%) fear they will never be able to own a home. Although 93% of Americans think homeownership is part of the American dream, 36% said their chances were less than ever before.

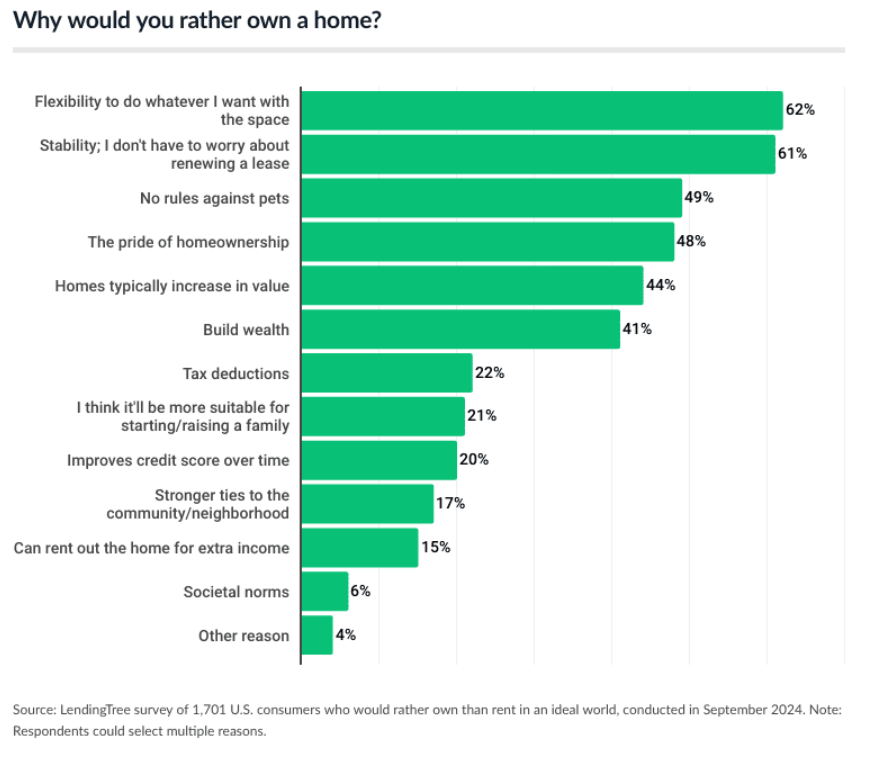

- Most Americans prefer being a homeowner, as 83% would prefer owing over renting. Among those who would rather own, flexibility was the top reason to have their own home (62%), followed by stability (61%), no rules against pets (49%), and pride in owning their own home (48%).

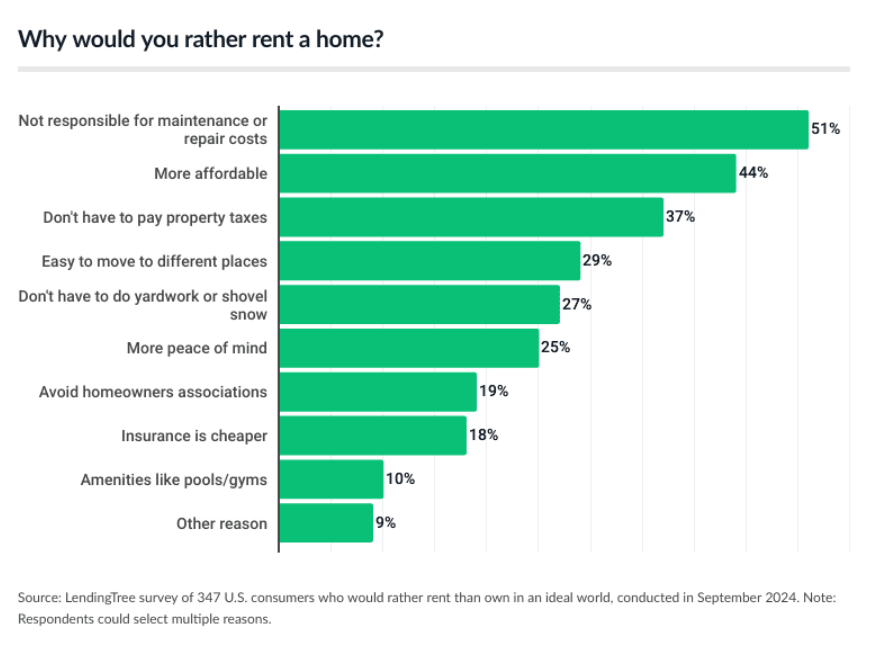

- Renting was a good enough option for the rest as 17% of respondents say they would rather rent than own in an ideal world. Among this group, 51% said it because they did not want to be responsible for maintenance or repair costs, while 44% felt it was more affordable, while 37% said they didn’t want to be responsible for property taxes.

- For those who rent but would prefer to own, cost was the biggest hurdle as 65% of this group said the cost of a down payment is preventing them from purchasing. Additionally, 52% say home prices are too high in their areas, and 39% cited their credit score as a barrier to qualify for a mortgage.

- And while poll respondents rented or owned, many felt that owning a home is the dream for most Americans, as 34% of homeowners most dislike the cost of maintenance or repairs, while 33% cite property taxes. Among renters, the top dislikes listed were unexpected rent increases (30%) and dealing with landlords (21%).

Out of Reach

Despite plenty of homebuying hurdles, 93% of Americans think homeownership is part of the American dream. This belief is widespread across Americans regardless of gender, age, parental status or household income. Women (94%) and men (93%) nearly equally say homeownership is part of the American dream. There’s also consensus among different generations, old and young. Of those polled, 97% of baby boomers (ages 60 to 78), 96% of Gen Xers (ages 44 to 59), 92% of Generation Z’ers (ages 18 to 27) and 90% of millennials (ages 28 to 43) say the American dream involves homeownership.

According to the study, 90% of those in households earning less than $30,000 a year said owning a home is part of the American dream. That’s a bit lower (but still comparable) to the 96% share who earn at least $100,000 a year and say the same.

And of the 62% of renters worried they will never be able to own, 66% of female renters felt they will never own, compared to 57% of male renters. Millennial (67%) and Gen Z (66%) renters were more afraid than Gen X (60%) or baby boomer (49%) renters. Obstacles or struggles in attaining homeownership included the ability to afford a down payment (cited by 65% of renters who would prefer to own), high market prices (52%), and credit score (39%).

Key Reasons to Want to Own

Of those polled by LendingTree, 83% of Americans say they would rather own a home than rent one. Those earning less than $30,000 a year, those without children and Gen Zers, a significant majority (76%, 77% and 79%, respectively) still say they would rather own than rent.

Overall, 62% of those who said they would rather own listed the flexibility to do whatever they wanted with the space as a top reason to own, while 61% cited stability.

Renting Still a Viable Option

Of those surveyed, only 17% say they’d rather be renters than homeowners. Among current renters, that figure jumps to 34%, but it still pales in comparison to the 66% of current renters and 97% of current homeowners who say they’d rather own.

Renting has some perceived benefits over homeownership, as 51% of those who said they would rather rent cite not being responsible for maintenance or repair expenses. Meanwhile, 44% preferred renting due to affordability, and 37% cited not needing to pay property taxes.

Click here for more on LendingTree’s report on the hurdles to homeownership.