As the landscape of real estate and finance continues to shift dramatically in 2024—with high interest rates, housing costs, a higher cost of living, and economic uncertainty ahead—an increase in bankruptcy filings may present significant new challenges ahead for mortgage servicers.

We have seen Chapter 7 filings rise by 22% and Chapter 13 filings rise by 15% since 2023, and the Department of Justice forecasts a substantial upturn in filings over the next three years. Unfortunately, many homeowners are not able to avoid losing their home throughout this process—more than 90% of delinquent homeowners entering bankruptcy eventually face foreclosure.

These defaults create extensive financial strain on mortgage servicers, take longer to resolve, and can affect entire communities by decreasing property values and instigating economic downturns.

That’s why Xome, in an exclusive partnership with BKHub, has introduced a new partnership that helps benefit mortgage servicers get ahead of foreclosures, move properties faster, and gain more in debt recovery: bankruptcy trustee auctions.

“Our partnership with BK Hub enables us to offer mortgage servicers a transparent, strategic approach to bankruptcy trustee sales,” said Mike Rawls, CEO of Xome. “Via bankruptcy trustee auctions, we can get more eyes on these properties to sell at prices that more effectively settle debts and help homeowners avoid the financial fallout of foreclosure.”

This strategic alliance leverages BK Hub’s expertise in managing bankruptcy trustee properties. These are assets owned by individuals filing for bankruptcy and sold under recommendation by a bankruptcy trustee to settle debts and avoid defaults. This process typically results in the properties being sold free of liens, making them highly attractive for auctions and quick sales, which in turn helps to preserve asset values and expedite financial recovery for homeowners.

“By offering bankruptcy trustee sales via auction, we can help mortgage servicers manage risk and recover value,” Rawls said. “This approach not only helps stabilize the borrower’s financial situation by avoiding foreclosure but also preserves the value of the asset in the marketplace, creating greater savings and improving loss recovery benefits for the servicer while retaining more of the homeowner’s equity.”

The Benefits of Listing Bankruptcy Trustee Properties With Xome

- Innovative Loss Mitigation: This offering provides mortgage servicers with another strategic option to offer to homeowners in bankruptcy as a viable alternative to foreclosure. This can help servicers mitigate losses more effectively and maintain customer relations by providing more favorable outcomes for struggling homeowners instead of the standard path.

- Enhanced Market Stability: By facilitating the quick sale of bankruptcy trustee properties via auction, Xome and BK Hub ensure these assets are reintegrated into the market swiftly, maintaining property values and aiding in economic stability. This not only helps the community but also improves the financial health of the servicers’ portfolios, bolstering the overall housing market.

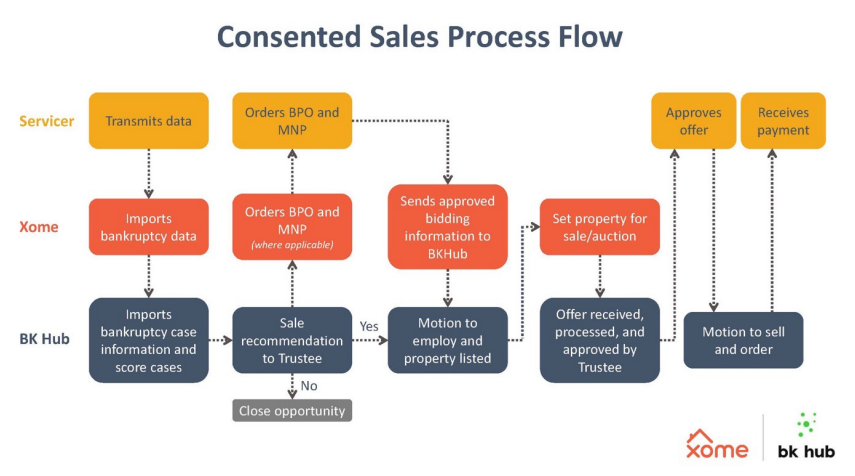

- Streamlined, Efficient Processes: This collaboration simplifies the complexities of bankruptcy sales, with BK Hub interfacing directly with the trustees and Xome facilitating the auction sale through its best-in-class real estate marketplace. This ensures a smooth and efficient transaction process for all involved parties, reducing operational costs and speeding up debt recovery—all of which directly benefit servicers’ profitability.

The strategic partnership between Xome and BK Hub is a game-changer in the real estate market, uniquely positioned to assist mortgage servicers by providing a transparent approach to a pre-foreclosure loss mitigation solution. This collaboration helps mitigate financial risks for servicers and homeowners and introduces a proactive method to handle properties in distress, ensuring better outcomes for the housing market and communities.