More than four of every five U.S. residents (82%) believe there should be caps on the amount landlords are allowed to increase rent, according to Redfin. The survey data in Redfin’s report is from a commissioned survey conducted by Ipsos in September 2024. The survey was fielded to 1,802 renters and homebuyers aged 18-65, including 188 who live in California.

Caps on rent increases, also known as rent control, give governments the authority to control how much landlords are allowed to increase rents each year. The White House proposed a federal rent control policy in July—a policy that would cap rent increases on existing units at 5% nationwide. Under President Biden’s proposal, corporate landlords, beginning this year and for the next two years, would only be able to take advantage of faster depreciation write-offs available to owners of rental housing if they keep annual rent increases to no more than 5% each year. This would apply to landlords with over 50 units in their portfolio, covering more than 20 million units across the country. It would include an exception for new construction and substantial renovation or rehabilitation. Only seven states and Washington, D.C. currently have state or local rent control policies in place.

Key Findings

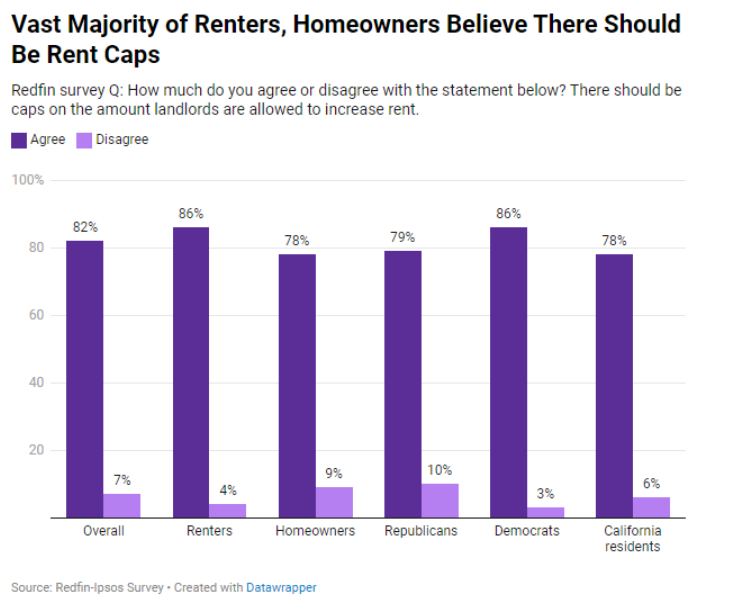

The vast majority of respondents believe there should be caps on the amount landlords are allowed to increase rent, regardless of their political affiliation or whether they own or rent the home they live in:

- 86% of respondents who identified themselves as Democrats believe there should be caps on the amount landlords are allowed to increase rent, compared with 79% of respondents who identified as Republicans.

- 86% of renters believe there should be caps, compared with 78% of homeowners.

Although most of the people surveyed support rent caps, Redfin economists say that in reality, rent caps increase costs in the long run.

“Rent control sounds appealing for renters in theory because it limits price increases and saves money in the short term, but it eventually worsens rental affordability because it exacerbates the supply shortage,” said Chen Zhao, Redfin’s Economic Research Lead. “If rent increases are capped below the amount developers would need to make a profit, they have little incentive to build more apartments and homes. The best way to make rentals more affordable is to build more units.”

Most Californians Back Rent Control

Nearly four of every five respondents who live in California (78%) believe there should be caps on rent increases, similar to the share for the U.S. as a whole.

California has already enacted statewide rent control under the Tenant Protection Act, which says landlords may not raise rent more than 5% plus the increase in cost of living (inflation) each year.

Rent control is particularly a hot button topic in California in the run-up to the Presidential Election because Proposition 33 on the November ballot would allow cities to expand rent control. For instance, city governments could limit annual rent increases to less than 5%, and the state couldn’t intervene.

Many California cities limit the amount a landlord can raise the rent each year. But for nearly 30 years, California has imposed limits on those limits, via a law known as the Costa–Hawkins Rental Housing Act. Cities cannot set rent control on single-family homes or apartments built after 1995. And landlords are free to set their own rental rates when new tenants move in. If Proposition 33 passes, cities would be allowed to control rents on any type of housing–including single-family homes and new apartments, and for new tenants.

The Public Policy Institute of California reports that nearly 30% of California renters spend more than half their income on rent—a share higher than any other state except Florida and Louisiana. Tenant advocates have been fighting Costa-Hawkins for years, as they tried to overturn it with ballot measures in 2018 and 2020. While those efforts failed, in 2019 California Gov. Gavin Newsom signed a law limiting annual rent increases statewide to 5% plus inflation.