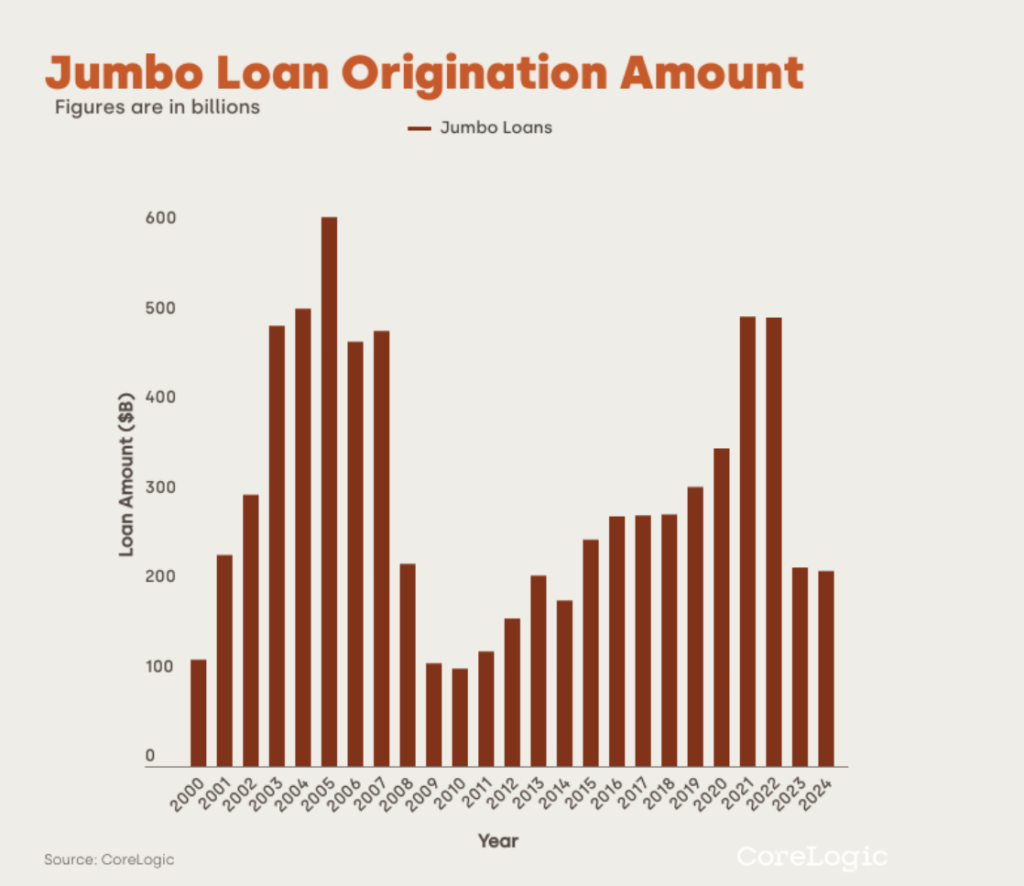

An examination of CoreLogic data indicates that, in comparison to prior years, jumbo mortgage originations saw a discernible drop in both dollar quantities and market share in 2023 and 2024. The decline in mortgage origination activity was probably caused by a combination of high interest rates and continuously rising home prices over the previous two years.

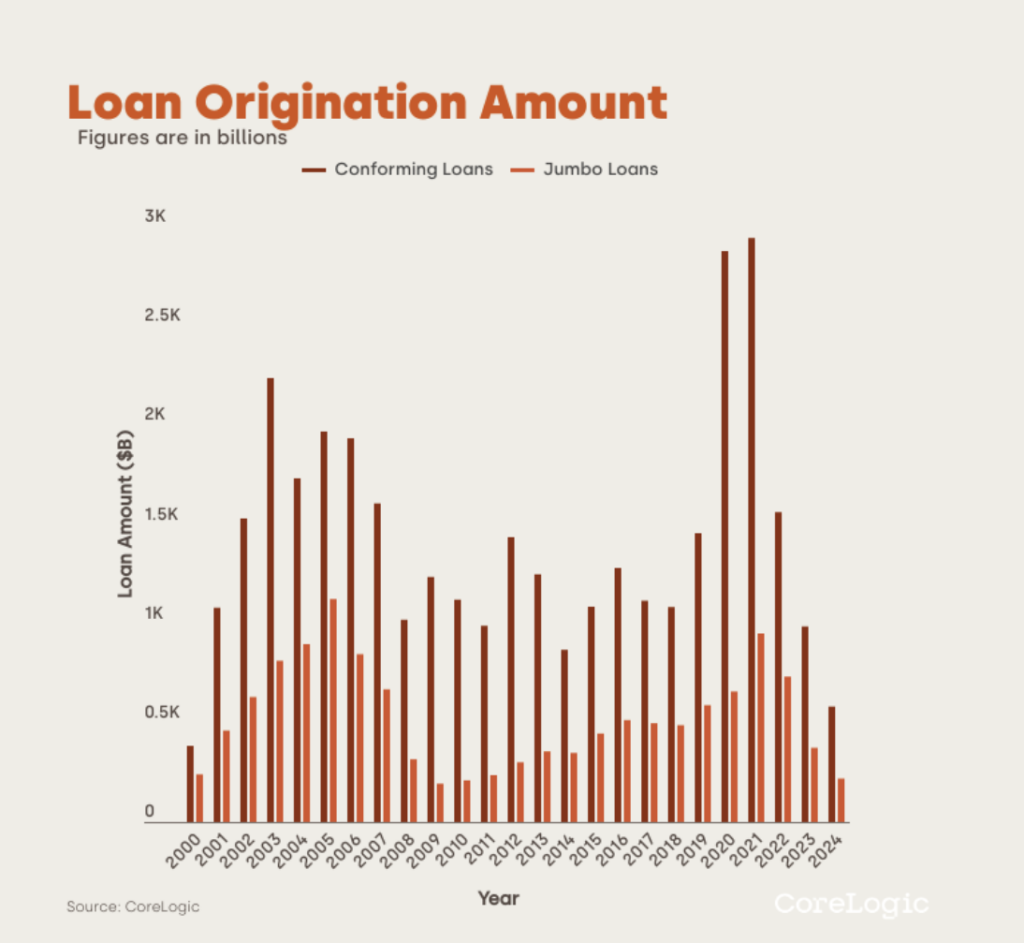

Both conforming and jumbo loan origination volumes have changed over time. These volumes, which include both buy and refinance loans, peaked in 2021. Origination volumes decreased in 2022 as interest rates rose. Jumbo loan volumes plummeted 61% and conforming loan volumes fell 67% from their peak in 2021 to 2023.

The volume of jumbo loans originated in 2024 decreased by 56% from 2022 and 2% from 2023 from January to July of each year. Since 2014, this is the lowest level.

Mortgage origination volumes surged in 2020 and 2021 as a result of the historically low mortgage rates and the quick growth in housing prices. 30-year, fixed-rate conforming mortgages had an all-time low annual average interest rate of 2.96% in 2021. But interest rates started to rise, reaching a 19-year high in October 2023 at an average of 7.6%. The average 30-year fixed-rate mortgage interest rate dropped to 6.08% by September 2024.

Jumbo Loan Markets See Decline in Growth

The jumbo mortgage market shrank in the early months of the epidemic for both buy and refinance loans, according to a detailed examination of CoreLogic data. Jumbo loans fell 7 percentage points over a 12-month period to 18 percent in May 2020, the lowest market share since 2012.

But after that decline, jumbo purchase loans started to rise again. On the other hand, jumbo refinance loans kept falling, reaching their lowest percentage of all mortgages since 2011 in October 2020 (14%).

Jumbo Market Share of Conventional Purchase and Refinance Mortgages (by Dollars Originated)

As the economy improved in 2021, jumbo mortgages for purchases and refinances started to increase. But as interest rates began to gradually increase and home prices increased by double digits, the proportion of jumbo purchase loans began to fall in December 2021, and by July 2024, it accounted for 21% of all buy mortgages. Jumbo refinance loans, on the other hand, increased until December 2022 before falling. Their portion is now back to what it was before the outbreak.

Following the most recent Federal Reserve meeting, mortgage refinance activity is anticipated to rise as interest rates decline. Three-quarters of jumbo loans have interest rates below 4% as of July 2024, with the majority being secured at ultralow or low rates. Currently, only around 10% of jumbo loans have interest rates of 6% or more. Refinancing these loans, which were primarily started in 2023 and 2024, would be advantageous if interest rates drop below 6%.

To read the full report, including more data, charts, and methodology, click here.