The seventh Credit Insurance Risk Transfer (CIRT) transaction of the year has been completed, according to Fannie Mae. Mortgage credit risk totaling $338.6 million was transferred to private insurers and reinsurers via CIRT 2024-L4.

“We appreciate the support of the 26 insurers and reinsurers that committed to write coverage on this deal, including the strong reception to the new structural enhancements that we introduced in the updated CIRT insurance policy,” said Rob Schaefer, VP of Capital Markets at Fannie Mae.

Under the updated terms to the CIRT insurance policy, coverage will be released more quickly over the life of the transaction if the covered pool of loans continues to perform well. Additionally, the insurance premium obligation will be based on the amount of remaining coverage instead of the outstanding balance of the covered loan pool.

Key Findings:

- In addition to DUS risk sharing, $184.7B of total unpaid principal balance of Multifamily mortgage loans, measured at the time of the transactions, has been covered through MCAS and MCIRT as of Q2 2024.

- An estimated $3.39T of total unpaid principal balance of mortgage loans have been partially covered by Single-Family CRT vehicles at issuance as of Q2 2024.

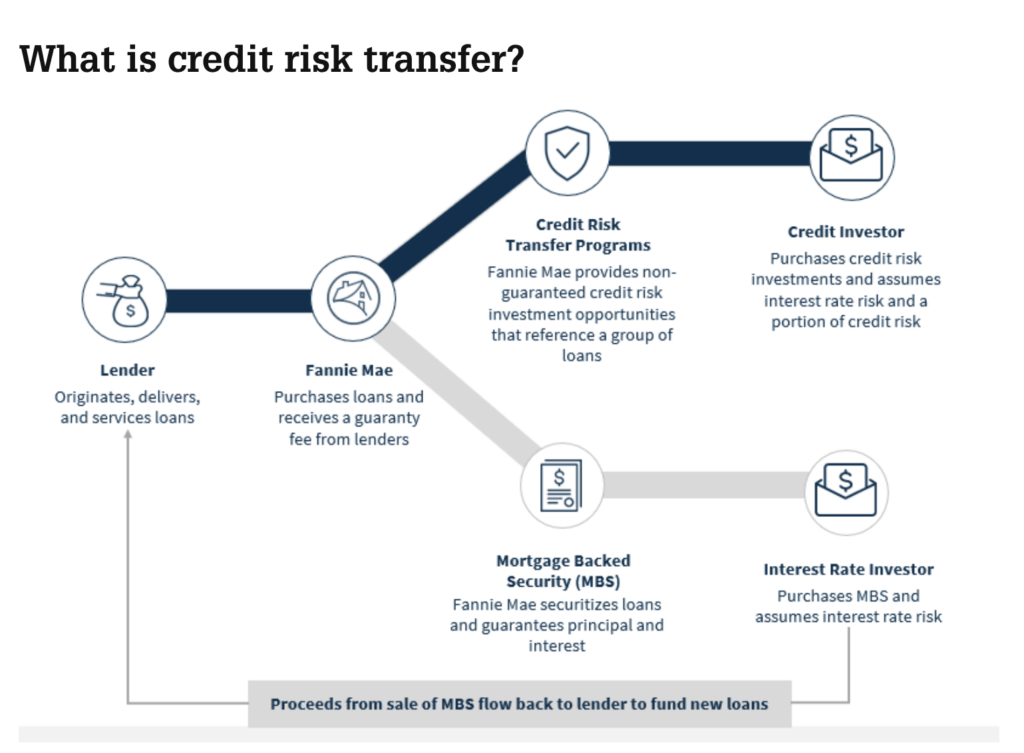

Fannie Mae Sets Standards in Credit Risk Management

About 23,500 single-family mortgage loans with an outstanding unpaid principle balance (UPB) of roughly $7.9 billion make up the covered loan pool for CIRT 2024-L4. Furthermore, the collateral from the covered pool was purchased between September 2023 and December 2023, and its loan-to-value (LTV) ratios range from 60.01% to 80%. The loans included in this deal are fully amortizing, fixed-rate mortgages with a typical 30-year duration that were underwritten with strict credit requirements and improved risk management.

Fannie Mae will bear the risk of the first 170 basis points of loss on the $7.9 billion covered loan pool as a result of CIRT 2024-L4, which went into effect on September 1. The following 430 basis points of loss on the pool will be covered by 26 insurers and reinsurers, up to a maximum coverage of $338.6 million, if the $133.9 million retention layer is depleted.

For a period of eighteen years, coverage for this transaction is based on actual losses. The coverage amount may be lowered at the first month following the policy’s effective date and then every month after that, contingent on the insured pool’s paydown and the principal amounts of covered loans that become significantly past due. Anytime on or after the five-year anniversary of the effective date, Fannie Mae may terminate the coverage under this agreement by paying a cancellation fee.

Through the CIRT program, Fannie Mae has already obtained about $28.1 billion in insurance coverage on $935 billion in single-family loans, calculated at the time of issuance for both front-end and post-acquisition (bulk) transactions.

To read the full release, including more information, click here.