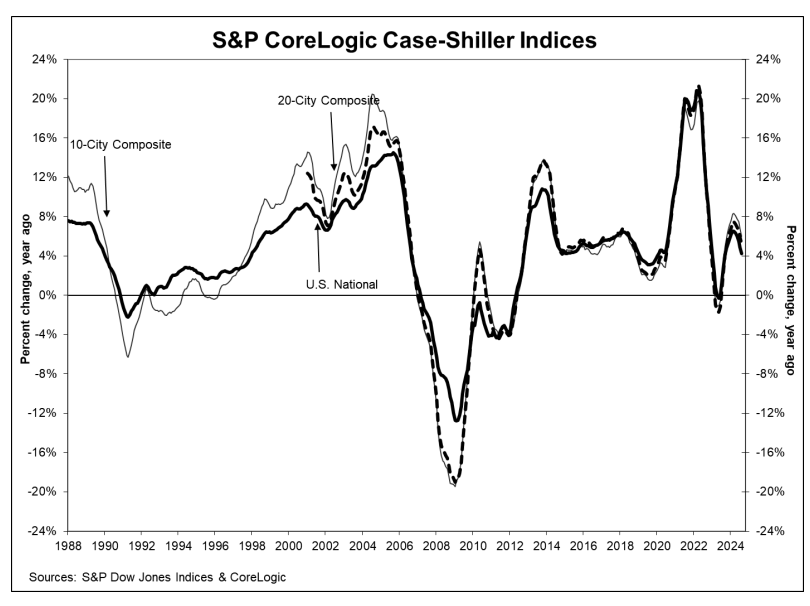

S&P Dow Jones Indices has released its August 2024 results for the S&P CoreLogic Case-Shiller Indices, which shows that U.S. home prices recorded a 4.2% annual gain in August 2024, a slight decrease from previous levels reported in 2024. The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. Census Divisions, reported a 4.2% annual return for August, down from a 4.8% annual gain the previous month. The 10-City Composite saw an annual increase of 6.0%, down from a 6.8% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 5.2%, dropping from a 5.9% increase in the previous month.

“Home price growth is beginning to show signs of strain, recording the slowest annual gain since mortgage rates peaked in 2023,” said Brian D. Luke, CFA, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “As students went back to school, home price shoppers appeared less willing to push the Index higher than in the summer months. Prices continue to decelerate for the past six months, pushing appreciation rates below their long-run average of 4.8%. After smoothing for seasonality in the data, home prices continued to reach all-time highs, for the 15th month in a row.”

New York again reported the highest annual gain among the 20 cities with an 8.1% increase in August, followed by Las Vegas and Chicago with annual increases of 7.3% and 7.2%, respectively. Denver posted the smallest year-over-year growth of 0.7%.

The pre-seasonally adjusted U.S. National Index, 20-City Composite, and 10-City Composite upward trends reversed in August, with a -0.1% drop for the national index, and the 20-City and 10-City Composites saw -0.3% and -0.4% returns for this month, respectively. After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.3%, while the 20-City and 10-City Composite reported a monthly rise of 0.4% and 0.3%, respectively.

“Regionally, all markets continue to remain positive, barely,” Luke added. “Denver posted the slowest annual gain of all markets this year, dropping below Portland for the first time since the spring. The Northeast remains the best performing region, with the strongest gains for over a year. Currently, only New York, Las Vegas, and Chicago markets are at an all-time high. Comparing average gains of traditional red and blue states highlight a slight advantage for home price markets of blue states. With stronger gains in the Northeast and West than the South, blue states have outperformed red states dating back to July 2023.”

Realtor.com Senior Economic Research Analyst Hannah Jones added, “The housing market varies significantly regionally. “Affordable markets in the Midwest and well-located Northeast locales continue to see substantial demand, as highlighted in the Fall 2024 RDC/WSJ Housing Market Ranking. Southern markets, on the other hand, continued to cool. New York City (+8.1%), Las Vegas (+7.3%) and Chicago (+7.2%) saw the highest price growth while Denver (+0.7%) saw the slowest growth.”

How Will the Remainder of 2024 Play Out?

What lies ahead for the housing landscape will be heavily influenced by what transpires the first week of November. The results of Election Day on November 5, and what political party takes control of the White House for the next four years will surely impact the housing landscape. As LendingTree recently examined, the housing policies of presidential candidates Kamala Harris and Donald Trump will shape the remainder of 2024 moving forward.

In addition, the market awaits the next move by the Federal Reserve as their decision to hold, cut or raise rates will be determined at the conclusion of the next Federal Open Market Committee (FOMC) meeting on Thursday, November 7.

In mid-September, for the first time in four years, the Federal Reserve slashed its benchmark interest rate, a move designed to force lower borrowing costs for consumers and businesses. The rate cut of a full half-point to a new range of 4.75% to 5.0% was announced by Federal Reserve Chair Jerome H. Powell at the conclusion of the FOMC meeting in response to the fight against inflation, after the Fed kept rates at an all-time 23-year high for more than a year.

“A persistent decline in mortgage rates could re-invigorate buyer demand and lead to accelerating price growth,” said Bright MLS Chief Economist Lisa Sturtevant. “However, existing home sales fell in September as recent mortgage rate progress did little to sway buyers into action. Mortgage rates climbed through October, pushing the possible pick-up in buyer demand further out. Zooming out, mortgage rates are expected to continue to trend lower in the coming months, but the path may be rather bumpy week-to-week, depending on incoming economic data. Buyers generally expect mortgage rates to improve over the next year, which could mean they choose to stay on the sidelines until further progress is realized.”