The National Association of REALTORS (NAR) reports that pending home sales increased in September. Transactions increased month over month in all four major regions. While sales in the Midwest and South stayed stable, the Northeast and West saw gains year-over-year.

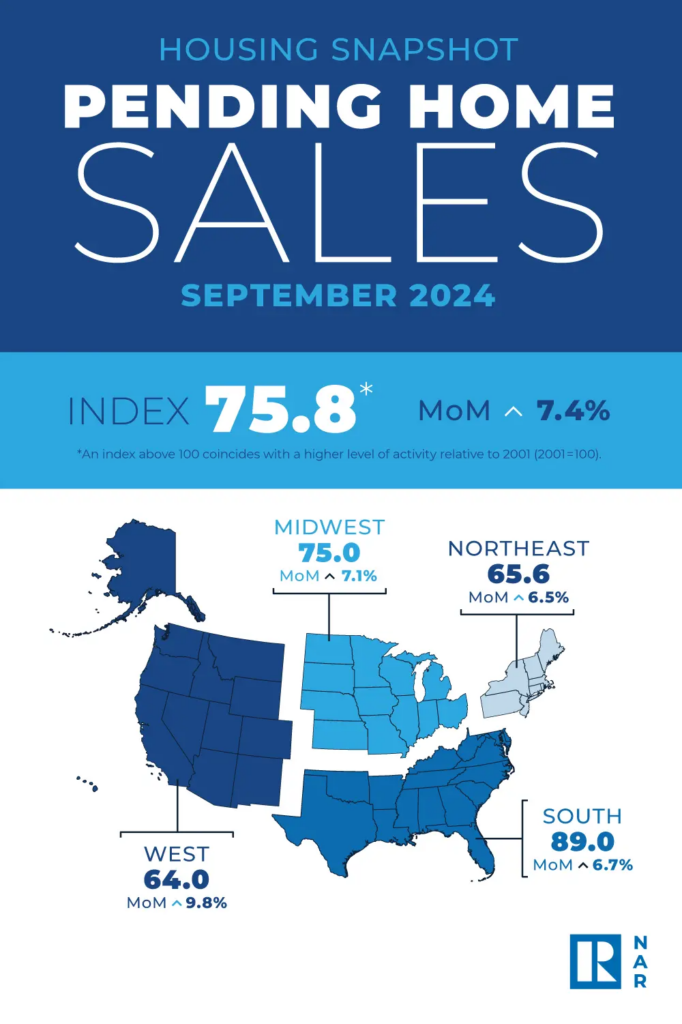

September saw a 7.4% increase in the Pending Home Sales Index (PHSI), a measure of future home sales based on contract signings, to 75.8, the highest level since March (78.3). Pending transactions increased 2.6% year-over-year. The amount of contract activity in 2001 is represented by an index of 100.

Key Findings:

- Pending home sales in September bounced 7.4% to the highest level since March.

- Compared to one month ago, pending sales climbed in all four major U.S. regions, led by the West.

- Year-over-year, contract signings grew in the Northeast and West and were unchanged in the Midwest and South.

“Contract signings picked up in all four regions month-over-month,” said Hannah Jones, Senior Economic Research Analyst at Realtor.com., “increasing the most in the West (+9.8%), followed by the Midwest (+7.1%), the South (+6.7%), and the Northeast (+6.5%). On an annual basis, pending home sales increased in the West (+12.3%) and the Northeast (+3.3%) and held steady in the South and Midwest.”

Jones explained that pending home sales, also known as contract signings, measure the first official stage of a home sale transaction—when a buyer and seller have reached an agreement on terms and price. Pending house sales are a good indicator of market conditions and typically follow existing home sales by one to two months. According to the Realtor.com and WSJ Housing Market Ranking, homebuyers have focused on mid-sized, reasonably priced regions in the Midwest and Northeast, even if housing prices are still high.

Due to limited demand and rising availability, housing competition has diminished nationally. She went on to reveal that consequently, homebuyers are experiencing greater market flexibility and making a marginally lower down payment than they did in the prior quarter and year.

“Contract signings rose across all regions of the country as buyers took advantage of the combination of lower mortgage rates in late summer and more inventory choices,” said Lawrence Yun, Chief Economist for NAR. “Further gains are expected if the economy continues to add jobs, inventory levels grow, and mortgage rates hold steady.”

Pending Home Sales Regional Breakdown

The Northeast PHSI increased 3.3% from September 2023 to 65.6, up 6.5% from the previous month. In September, the Midwest index increased 7.1% to 75.0, the same as the year before.

In September, the South PHSI remained constant from the previous year, improving 6.7% to 89.0. The West index rose 12.3% from September 2023 to 64.0, a 9.8% increase over the previous month.

“Pending home sales surged 7.4% in September as mortgage rates fell as low as 6.08% in the month, spurring buyers to take advantage of the temporary reprieve,” Jones said. “Pending home sales also increased annually, climbing 2.6% compared to September 2023. New home sales, which are also based on contract signings, perked up in September, notching 4.1% higher as buyers responded to slightly improved affordability in the new construction segment as well. Rates have since climbed to 6.54%, possibly sapping some of the energy starting to build in the market.”

She continued: “This Friday’s jobs report will be key in informing mortgage rates in the short term. If the employment gains deviate from expectations in either direction, mortgage rates are likely to swing accordingly. The Fed meeting the following week is another potential source of mortgage rate volatility. Chair Powell’s comments about the future rate path is likely to have a bigger impact on mortgage rates than the rate change itself, assuming the market is correct about a 25 basis point rate reduction.”

NAR Economic and Housing Outlook

Yun predicts slower home price growth and matching improvements in sales over the next two years. According to Yun, in 2025 and 2026, the median price of an existing home will increase to $410,700 and $420,000, respectively. In 2025, the yearly 30-year fixed mortgage rate will drop to 5.9%, but in 2026, it will rise to 6.1%.

“After two years of sluggish home sales in 2023 and 2024, existing-home sales are forecasted to rise to 4.47 million in 2025 and more than 5 million in 2026,” Yun said. “During the next two years, expect a slower rate of growth in home prices that’s roughly in line with the consumer price index because of additional supply reaching the market.”

The next Pending Home Sales report for October 2024 will be released on Wednesday, November 27.

To read the full report, including more data, charts, and methodology, click here.