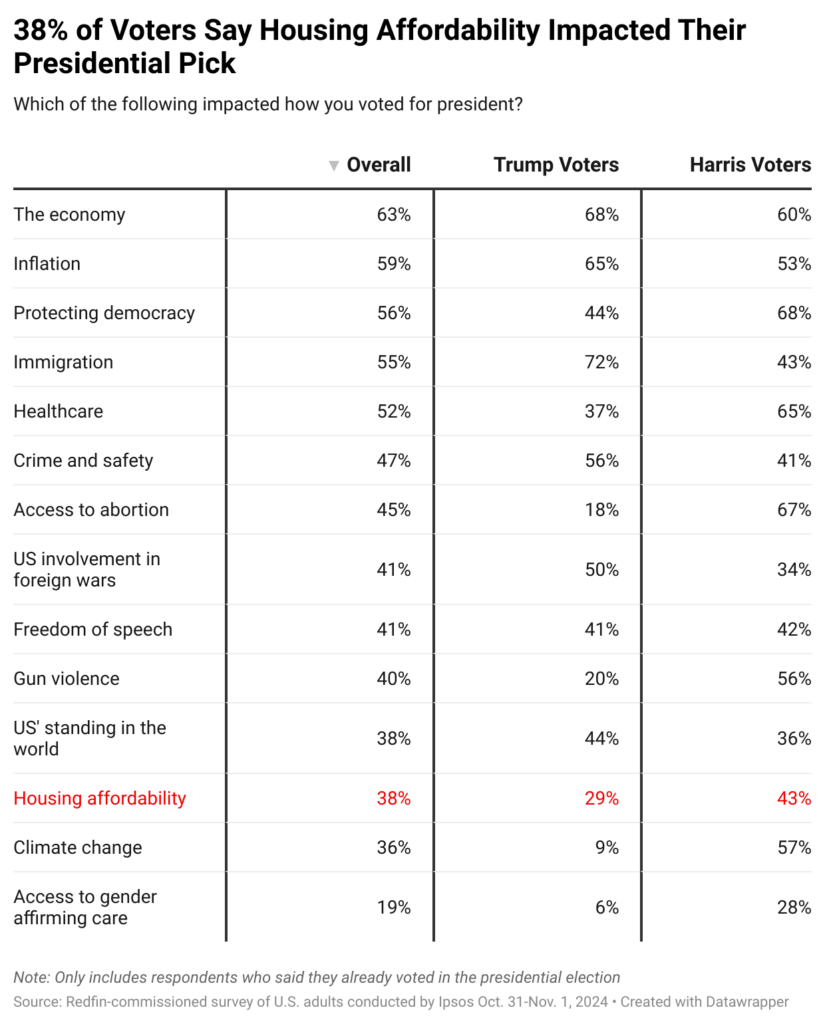

A new Redfin-commissioned survey has found that just under two in five (38%) U.S. residents who had already voted as of November 1 say housing affordability impacted their presidential pick.

Redfin commissioned the survey (conducted by Ipsos) on Oct. 31-Nov. 1, 2024, polling 1,002 U.S. adults.

Kamala Harris voters were much more likely than Donald Trump voters to say housing affordability factored into their decision, as 43% of respondents who already voted for Harris said affordability impacted their pick, compared to just 29% of respondents who already voted for Trump.

For those who already voted, regardless of who they voted for, were less likely to factor housing affordability into their presidential decision than most other issues Redfin asked about. Eleven of the 14 issues listed in the survey were more likely than housing affordability to impact votes. The leading concern for early voters was the economy (63%), followed by inflation (59%), and protecting democracy (56%). Next came immigration (55%), healthcare (52%), crime and safety (47%), access to abortion (45%), U.S. involvement in foreign wars (41%), freedom of speech (41%), gun violence (40%) and the United States’ standing in the world (38%).

The only issues less likely to impact early voters’ presidential pick than housing affordability were climate change (36%) and access to gender affirming care (19%). While voters who have already cast their ballot were more likely to cite issues other than housing affordability, it’s still a crucial factor for many voters. It has become much more difficult to afford to buy or rent a home since the pandemic-driven moving boom, which drove up housing costs. It’s worth noting that homes in traditionally blue parts of the country are typically quite expensive, which is likely one reason Harris voters were more likely to say housing affordability impacted their vote than Trump voters.

Thinking Locally

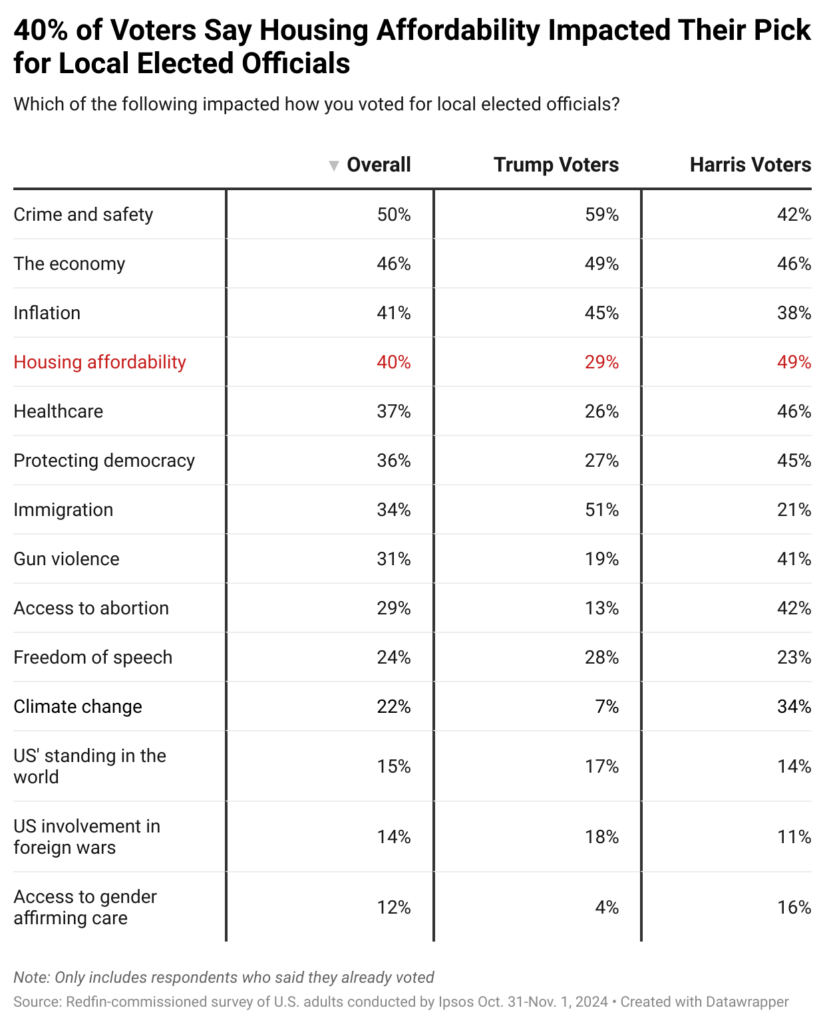

Housing affordability ranked higher when it came to voting for local elected officials than for president, as two in five (40%) U.S. residents who have already voted say housing affordability factored into their pick for local races.

Crime and safety were the most important considerations, with 50% of early voters saying it impacted their decision on who to vote for. It’s followed by the economy (46%) and inflation (41%), then housing affordability. Moving on to local ballot measures, 37% of people who already voted say housing affordability factored into their vote.

The economy was the most prominent issue in regard to local ballot measures/proposals/initiatives, with nearly half (47%) of those who already cast a ballot saying it impacted their decisions. Next were crime and safety (44%) and inflation (42%).

What Direction Will Rates Take?

With the 30-year, fixed-rate mortgage (FRM) currently sitting at 6.72% as of October 31, 2024, up 18 basis points week-over-week according to Freddie Mac, this week marked the fifth straight week of rate increases. A year ago at this time, the 30-year FRM averaged 7.76%.

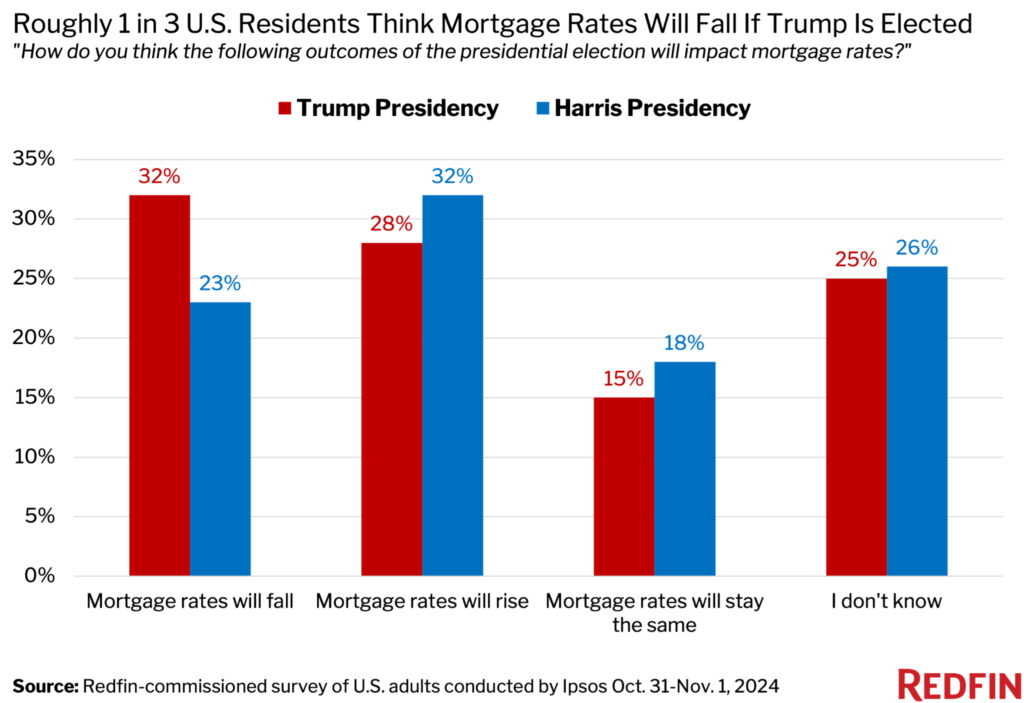

Redfin found that nearly one-third (32%) of U.S. residents believe that mortgage rates will fall if Donald Trump is elected president, while less than one-quarter (23%) think rates will fall if Kamala Harris is elected. Similarly, U.S. residents are more likely to think mortgage rates will increase if Harris becomes president, as 32% think rates will rise if Harris wins, while 28% said rates will rise if Trump wins.

Many were torn however, as 25% of those polled reported they did not know what will happen with mortgage rates if Trump wins, and roughly the same share (26%) did not know what will happen with rates if Harris wins.

Click here to view Redfin’s full report on housing affordability and the presidential election.