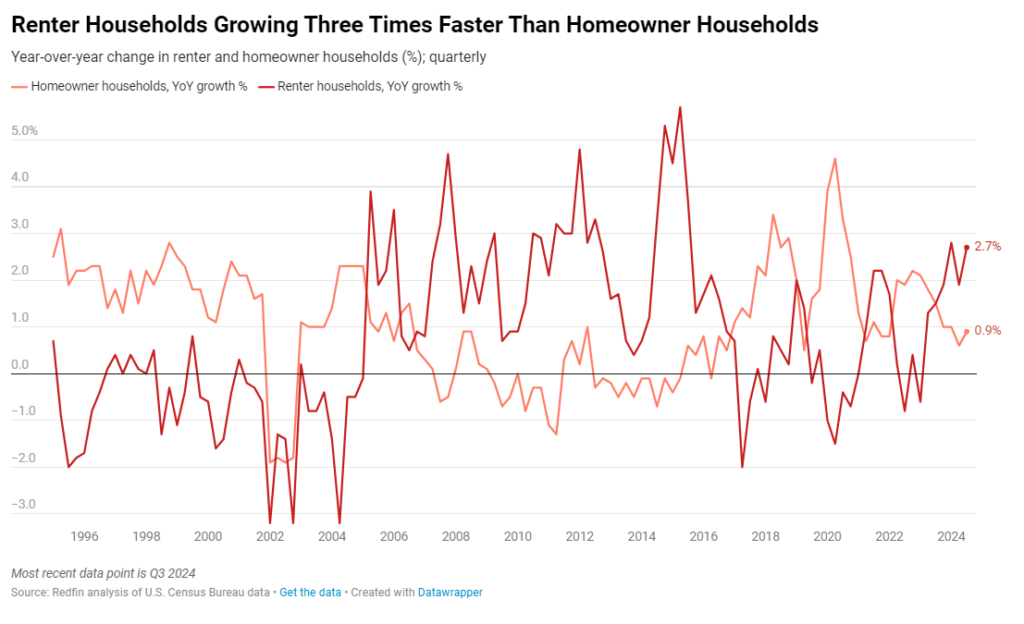

The number of renter households rose 2.7%, in Q3 year-over-year, to a record 45.6 million, according to a new report from Redfin. That rate of growth is three times faster than the 0.9% increase in homeowner households, which now total a record 86.9 million. The 2.7% increase—representing 1.18 million additional renter households—was the second fastest pace since 2015, only trailing the first quarter’s 2.8% rate. Renter households have formed faster than homeowner households for the past four quarters as the cost of buying a home rose faster than the cost of renting.

Redfin reports that the median asking rent was up 0.6% year-over-year in September, but rents have remained largely flat for the past two years—becoming more affordable as wages grew at around 4%. Conversely, home prices climbed 6% year-over-year in September and have grown more than 10% in the past two years. Highlighting the affordability barriers that exist for prospective homeowners, just 2.5% of U.S. homes changed hands in the first eight months of 2024—the lowest rate reported in decades.

“Affordable housing has been at the forefront of this election cycle because so many people are struggling to see how they will ever become homeowners—especially those from younger generations,” said Redfin Senior Economist Sheharyar Bokhari. “With home prices at record highs and mortgage rates remaining elevated, renting is increasingly the only viable choice for many young people and families. Building more homes will help address that, but we also have to recognize that Gen Z and future generations may not view homeownership as a life goal and the rentership rate may continue to rise for years to come.”

Redfin recently conducted a poll on how housing affordability is weighing on voters now that Election Day is here. The survey, conducted across a panel of voters who have already cast their ballots, found that just under two in five (38%) U.S. residents who had already voted as of November 1 said housing affordability impacted their presidential selection at the voting booth. Kamala Harris voters were more likely than Donald Trump voters to say housing affordability factored into their decision, with 43% of respondents who voted for Harris said affordability impacted their pick, compared to just 29% of respondents who already voted for Trump.

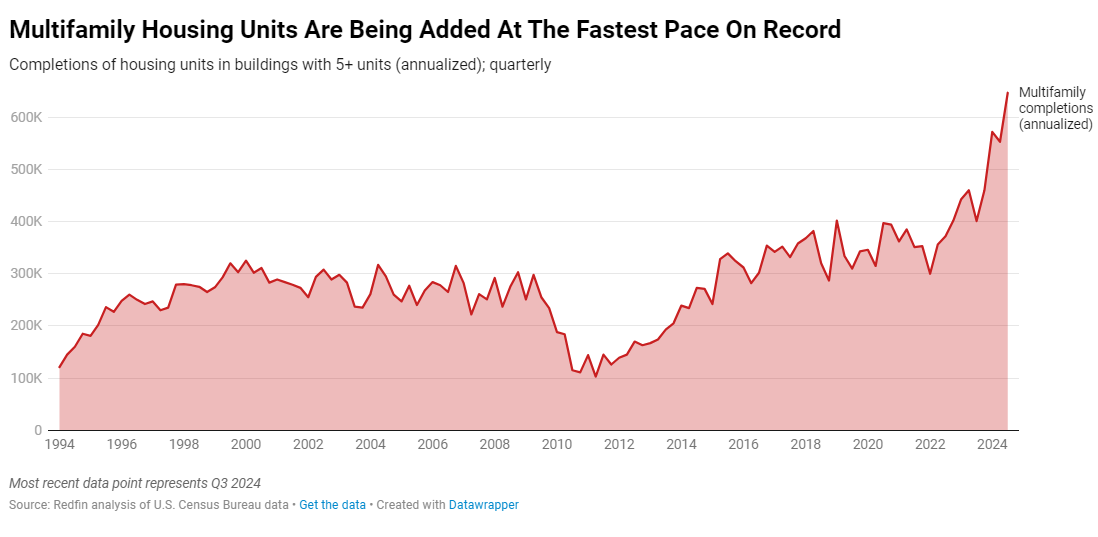

Multifamily Construction on the Rise

One of the reasons that rents have remained stable—and renting has become more attractive to many—is the boom in multifamily construction over the past two years. The country is adding new multifamily housing units at an annual rate of 647,000 (as of Q3)—the fastest pace in records dating back to 1994. The recent boom in multifamily construction helped meet surging demand in some areas—especially in Sun Belt states—but builders are now pumping the brakes. Permits to build multifamily housing units were down 16% year over year in September, and down 47% from the post-pandemic high in February 2023—which was the highest mark in nearly 40 years.

San Jose and L.A. Lead the Pack

Nationwide, 34.4% of households in the U.S. are renter households—a figure that has remained the same for the past three quarters. The rentership share is highest in metros in California and in New York City, where homes are generally more expensive to buy. San Jose, California has a rentership rate of 52%, the highest among the 75 largest U.S. metropolitan areas, followed by Los Angeles (50.8%); New York (49.1%); San Diego (48%); and Fresno, California (47.4%).

Rentership rates are lower in metros where, historically, it’s been more affordable to buy a home. In Cape Coral, Florida, 21.8% of households are renter households—the lowest share among the metros Redfin analyzed—followed by Charleston, South Carolina (23.7%); Columbia, South Carolina (24.5%); Allentown, Pennsylvania (27.2%); and Detroit (28.2%).

Click here to view more on Redfin’s examination of renter households versus homeowners.