In its latest Lending Intelligence Report, J.D. Power examines artificial intelligence and its emergence in the mortgage marketplace.

In the report “With AI-Powered Chatbots Coming to Customer Service, Are Mortgage Customers Ready?” three-fourths of business leaders said they were planning to escalate their AI investments as they continue to see positive strides in customer service functionality.

The report examines c in AI-powered customer service, and how that may change with the continued uptick in servicer adoption.

As noted by J.D. Power, one of the biggest hurdles to AI adoption is customers’ perception of online chat functions. And while early versions of AI chatbots may have left many customers feeling like they were wasting their time, that attitude may be changing as new tech advances emerge and are implemented into day-to-day operations.

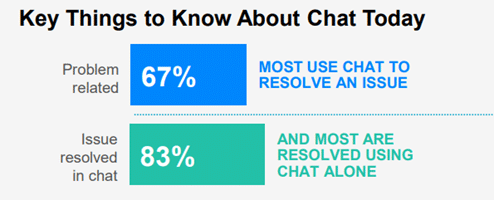

J.D. Power reported that 21% of mortgage servicing customers have experienced a problem in the past 12 months using AI chatbots, with just 9% of those customers having used online chat functions as their initial point of contact—compared to the 48% share of customers who called customer service to seek human interaction. Generation Y and Generation Z were three times more likely to use online chat than older generations found J.D. Power. Two-thirds (67%) of customers using chat said it was to try to solve a problem, and of that group, 83% said that their problem was resolved via chat. Unsurprisingly, those who were able to solve their problem via chat had an overall customer satisfaction rating of 702 (on a 1,000-point scale) vs. 482 for those who could not solve their problem.

Nearly three-fourths (73%) of customers who used chat say they interacted with a live representative, while just 10% thought it was a chat bot, and 17% were not sure. Those who said they interacted with a human had a better experience than those who thought it was a machine on the other side, while 63% of chat users working with a human felt the chat rep used a script, while 37% did not.

J.D. Power reported that customer satisfaction for those who felt no script was used was 699, higher than the average satisfaction score of 636 among those who thought a script was used. Nearly three-fourths (73%) of those customers who felt no script was used said that the process was extremely easy as opposed to 27% of those who felt a script was used.

What Does the Future Hold?

As AI technology advances and new tech is implemented into day-to-day operations, management must weigh cost-effectiveness vs. onboarding. While deciding to retire past technology in lieu of new advances is a common occurrence, training on new tech and maintaining upgrades becomes a cost-consideration that management must weigh.

Cloudvirga, a subsidiary of Stewart Information Services Corporation, recently conducted a consumer survey examining the increasing digitalization of the front-end of the mortgage origination process, and growing homebuyer expectations for an even more automated, digital experience.

Cloudvirga’s research surveyed more than 1,000 recent homeowners nationwide who had bought or refinanced their home within the past two years, with more than three-quarters of those were first-time homebuyers. The survey found that the majority of participants expressed satisfaction with the digital experience provided by lenders, and would expect even more automation in future mortgage transactions. And while comfortable with the online and self-serve aspects of the current origination process, respondents raised serious concerns over the use of AI in mortgages. This presents a challenge for the industry as lenders explore when and how to implement new digital solutions.

And as the J.D. Power study notes, an investment in AI needs to represent a clear understanding of what the customer wants in terms of service and problem resolution, and how they interact with their customer service channels. Without that, customers may simply refuse to engage, leaving lenders out in the cold after making their investment in AI and chatbots.

Click here for more on J.D. Power’s examination of AI and chatbots in the mortgage space.