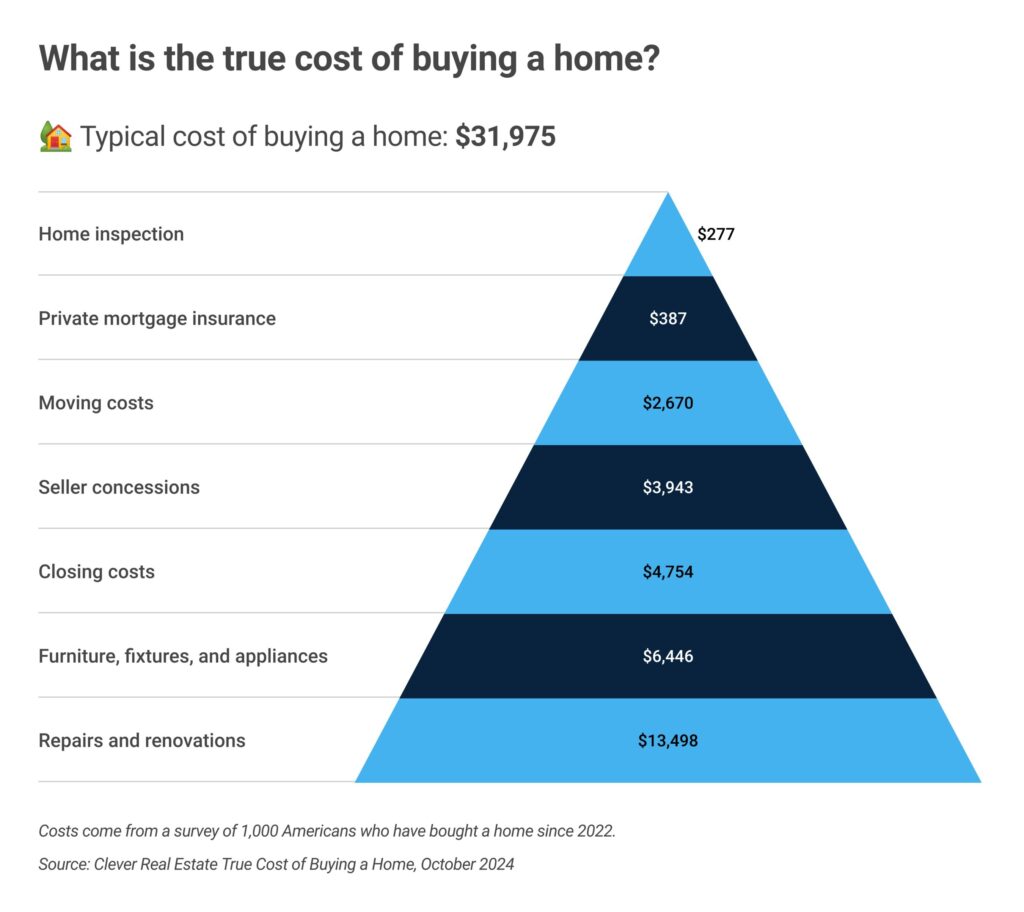

According to new research from Clever Real Estate, a St. Louis-based real estate company, homebuyers spend an average of $31,975 in homebuying expenses, such as closing costs, repairs, and moving, in addition to their down payment.

The costs are broken down into the following:

- Repairs and renovations: $13,498

- Furniture, fixtures, and appliances: $6,446

- Closing costs: $4,754

- Concessions to seller: $3,943

- Moving costs: $2,670

- Private mortgage insurance: $387 annually

- Home inspection: $277

The report, The report, “The True Cost of Buying a Home in 2024,” authored by Jaime Dunaway-Seale, a Content Writer at Clever Real Estate, found that with a 15% down payment on the average-priced U.S. home ($501,500) adding $75,255, the upfront cost totals a staggering $107,230.

The study found that 48% of buyers said costs were higher than expected, with 39% exceeding their budget and 38% reporting impacts on their savings. Notably, 63% of first-time buyers were surprised by the cost. Among Gen Z, 49% exceeded their budget—over 1.5 times more than boomers (31%).

It was noted that 79% of buyers compromised on at least one priority. Buying within budget was the most common priority, but also the most likely to be compromised. Of the 57% who prioritized their budget, more than one in 10 (11%) went over their limit.

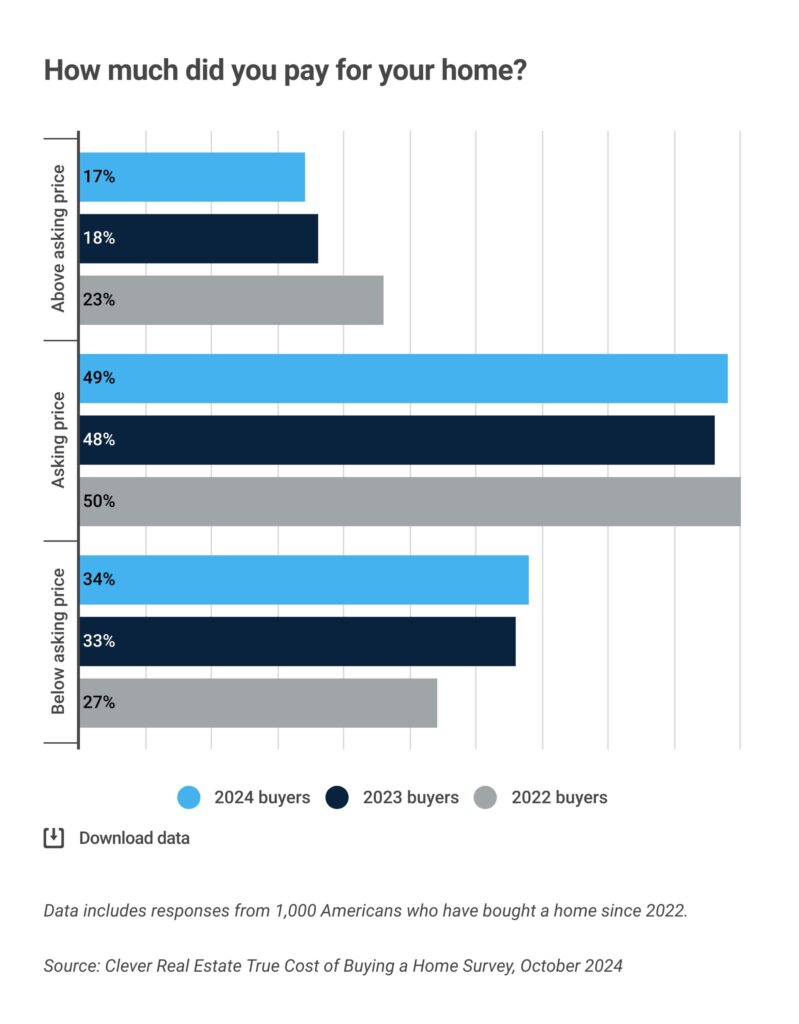

More than half of home buyers (52%) negotiated with the seller, with 94% of those who did achieving success. About 34% of buyers paid below the asking price in 2024—up from 27% in 2022, when the market was more favorable to sellers.

According to the Clever Real Estate report, had buyers known the actual cost of purchasing a home, 68% would have taken a different approach, believing they could have saved an average of $24,000. Moreover, buyers could incur an additional $12,944 in commission costs on the average home if sellers opt not to pay the buyer’s agent commission following the National Association of Realtors (NAR) settlement in August. Although 66% of buyers with agents in 2024 had their commissions covered by sellers, this is no longer required. The study found that 72% of buyers had regrets, with the most common being that buying a home is simply too expensive.

Clever Real Estate produces educational real estate content, reaching more than 10 million readers annually. Since launching in 2017, Clever has reached $11.4 billion in real estate sold, matched more than 138,000 customers with realtors, and saved consumers in excess of $170 million on commission fees. Clever’s network spans 15,000 agents across all 50 states.

Click here to access Clever Real Estate’s report, “The True Cost of Buying a Home in 2024.”