Matic announced that it has published its annual year-end trends and predictions report, which examines significant developments in the house insurance market and their effects on mortgage lenders and homeowners. Based on information from 10 million properties, roughly 36 million quotation requests, and external quoting engines, the research provides predictions for 2025 as well as insights into the key trends of 2024.

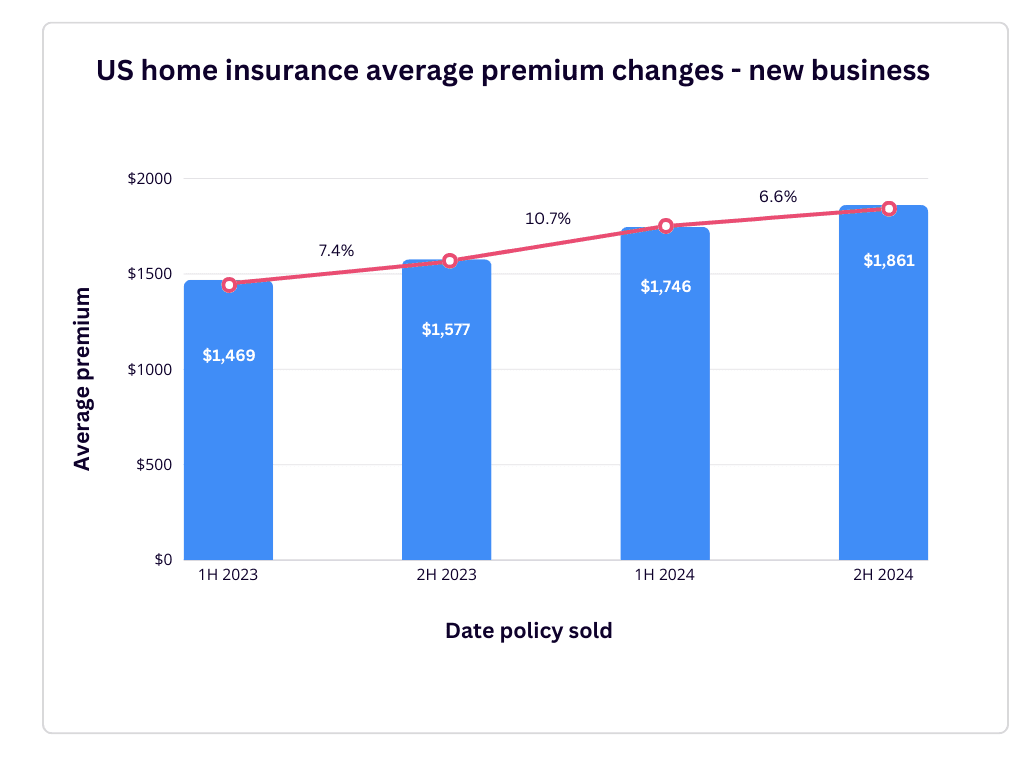

The results demonstrate that although regulatory demands and climatic threats remain obstacles, the market is beginning to stabilize. In the second half of 2024, premium growth slowed considerably, with average rate increases for new plans being 6.6% as opposed to 10.7% in the first half of the year.

“We’re seeing signs of improvement in the home insurance market, driven by a few key factors,” said Ben Madick, CEO and Co-Founder of Matic. “Inflation has started to slow, easing the pressure on repair and claims expenses. On top of that, many carriers received long-awaited approvals for rate increases, which has helped them align premiums with current costs and return to profitability.”

Per the announcement, large national carriers have re-entered states that were previously barred as a result of this change. Consequently, there were 60% more quotes available on average per individual than there were in March, the lowest month of the year.

According to the analysis, if inflation stays under control and there are fewer extreme weather occurrences in 2025, the market may become more balanced. However, climate threats are still quite uncertain. The unpredictability of climate-related losses was brought to light by the $55 billion in damages caused by Hurricanes Helene and Milton in 2024. Insurers are progressively switching from replacement cost to actual cash value (ACV) for roof coverage as a way to control claims costs.

Beyond coastal locations, flood risk is another major worry. Flood risk is no longer solely determined by proximity to water, as demonstrated by events such as Hurricane Helene’s flooding in western North Carolina. As a result, the industry is anticipated to concentrate more on informing households about flood insurance and assessing the efficacy of the private flood insurance market and the National Flood Insurance Program (NFIP).

Major carriers’ reentry is anticipated to improve competition and provide consumers with additional policy options. Regulatory obstacles could still impede development, though. Because state regulators are wary following previous rate hikes, they might be reluctant to authorize any changes, which might limit insurers’ capacity to control inflation or cost increases brought on by the climate.

Although it might not always result in the most affordable rates for homeowners, the research shows that carriers continue to use the practice of combining house and auto insurance as a way to distribute risk. In high-risk areas where regular carriers are few, the Excess and Surplus (E&S) market is also stepping up to meet coverage gaps.

“While the industry is beginning to stabilize, premiums remain at record highs, and interest rates are expected to stay elevated through 2025,” Madick said. “To address these challenges, mortgage lenders are integrating their closing processes with Matic’s insurance marketplace to help their borrowers compare options, find affordable rates, and increase the likelihood of meeting DTI requirements.”

The high cost of insurance continues to be a major concern for mortgage lenders, as it has a direct effect on borrowers’ debt-to-income (DTI) ratios and loan eligibility. According to a recent Matic study, 63% of lenders said that at least one borrower they had recently dealt with had trouble finding an appropriate insurance coverage, which frequently caused closings to be postponed or property purchases to be halted.

With additional networks returning to the market and rate increases being moderated, the market is probably going to strive for stabilization in the upcoming year. The market will, nevertheless, continue to be extremely sensitive to changes in the weather, governmental actions, and general economic trends.

To read the full report, including more data, charts, and methodology, click here.