Pending home sales rose in October, marking the third consecutive month of increases, according to new data from the National Association of Realtors (NAR). NAR’s Pending Home Sales Index (PHSI)–a forward-looking indicator of home sales based on contract signings–rose 2% to 77.4 in October. Year-over-year, pending transactions jumped 5.4%. An index of 100 is equal to the level of contract activity in 2001.

“Homebuying momentum is building after nearly two years of suppressed home sales,” said NAR Chief Economist Lawrence Yun. “Even with mortgage rates modestly rising despite the Federal Reserve’s decision to cut the short-term interbank lending rate in September, continuous job additions and more housing inventory are bringing more consumers to the market.”

Another major housing indicator, mortgage application volume, has trended downward. First American Deputy Chief Economist Odeta Kushi noted, “However, mortgage applications–another leading indicator of sales activity–suggest that the housing market’s challenges remain. So far in November, mortgage applications have ticked modestly lower as rates climbed even higher. While increased inventory provides buyers with more options, the reality remains–you can’t buy what you can’t afford.”

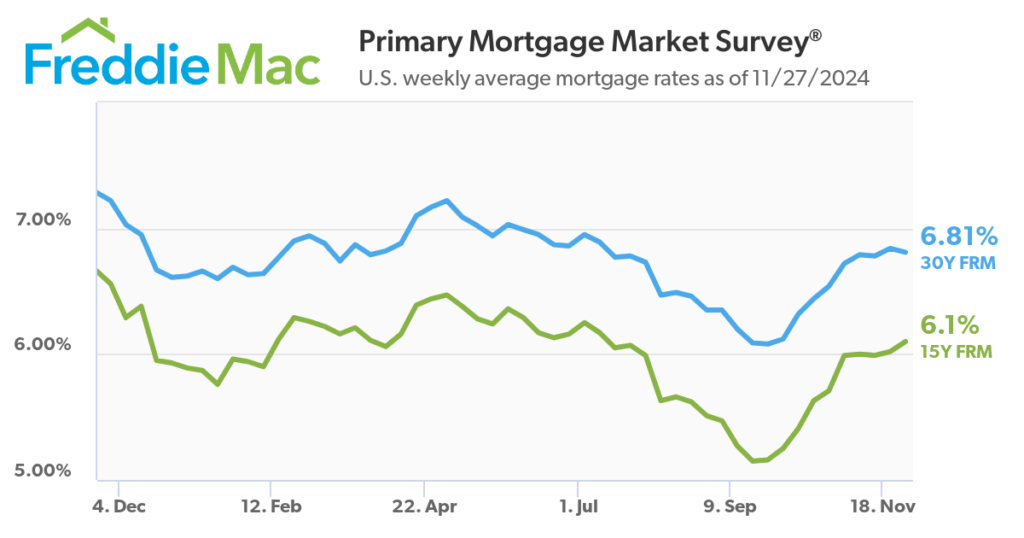

According to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 22, mortgage applications increased 6.3% week-over-week. Freddie Mac reports in its latest Primary Mortgage Market Survey (PMMS), that the 30-year fixed-rate mortgage (FRM) averaged 6.81% as of November 27, down from last week when it averaged 6.84%. A year ago at this time, the 30-year FRM averaged 7.22%.

Sam Khater, Freddie Mac’s Chief Economist. “Rates have been relatively flat over the last few weeks as the market waits for more clarity on specific economic policies. Potential homebuyers are also waiting on the sidelines, causing demand to be lackluster. Despite the low sales activity, inventory has only modestly improved and remains dramatically undersupplied.”

Back in September, the Federal Reserve’s initial cut of the benchmark interest rate by a full half-point to a new range of 4.75% to 5.0%, the first reduction in nearly four years, forced mortgage rates to drop to 6.08%, a two-year low, according to Freddie Mac. This dip was followed by a near two-month surge since then, as the 30-year FRM currently sits at 6.81%.

Regional Roundup

NAR reported the Northeast PHSI jumped 4.7% from last month to 68.7, up 7.2% from October 2023. The Midwest Index grew 4% to 77.8 in October, up 1.8% from the previous year. In the South, the PHSI increased 0.9% to 90.0 in October, up 2.5% from a year ago. The West index edged higher by 0.2% from the prior month to 64.1, up 16.8% from October 2023.

“It’s encouraging to see contract signings increasing in all major regions of the country,” said Yun. “More notable gains from a year ago occurred in the expensive regions of the Northeast and West. The record-high stock market is providing a boost for upper-end home buyers.”

Realtor.com Senior Economic Research Analyst Hannah Jones noted, “Falling inflation remains crucial for mortgage rate progress, but the latest CPI inflation data showed a slight pick-up, which has fueled more market uncertainty. The outcome of the Fed’s December meeting will depend on incoming economic data, including next week’s jobs report. If incoming data continues to cool, the Fed is more likely to choose to cut rates in December’s meeting. However, hotter-than-expected economic data could result in a pause in rate cuts, which could mean higher mortgage rates for longer than initially expected.”