A recent LendingTree study highlights a considerable rise in 30-year fixed-rate mortgage refinance offers, showing an impressive 41.59% increase from September 2023 to September 2024. This growth correlates with a notable decrease in the average annual percentage rate (APR) on refinance loans, which fell by 156 basis points—from 8.19% down to 6.63%. With the drop in interest rates, homeowners across the country are seizing the opportunity to lower their monthly mortgage payments or cash out equity. On average, this reduction in APR has translated to a monthly savings of $136, even as average loan amounts have climbed by $16,245.

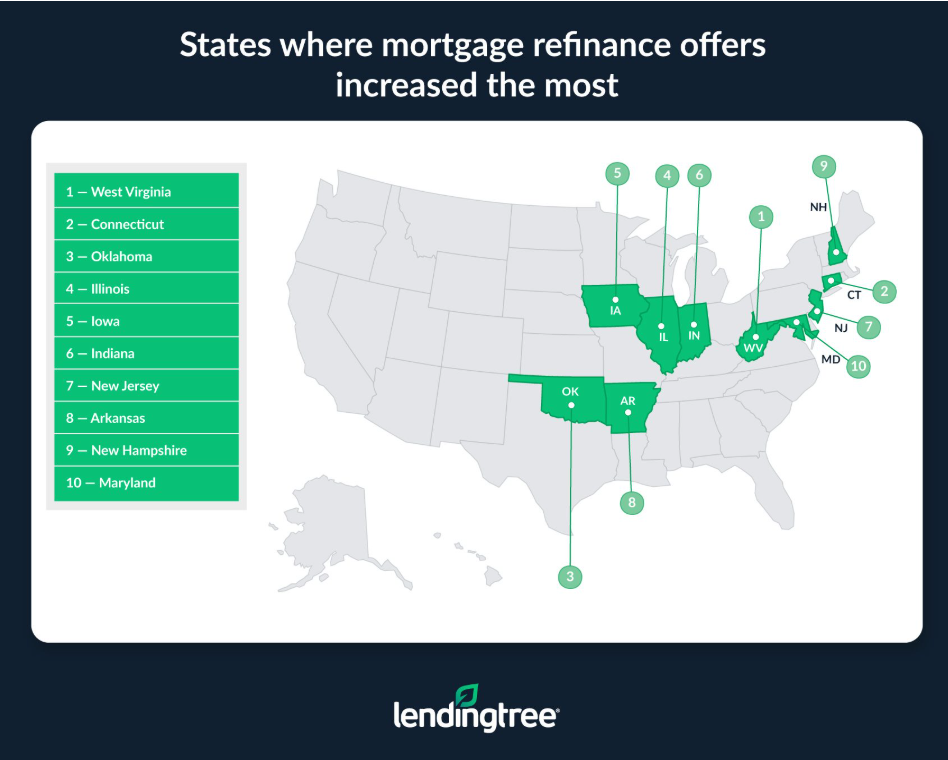

LendingTree’s analysis, based on approximately 180,000 refinance offers on its platform, provides a comprehensive look at the refinancing landscape across the U.S. The report focuses on the 25 states where refinance offers increased most significantly year-over-year, illustrating a widespread trend in homeowners looking to lock in lower rates. Notably, 10 states saw refinance offers more than double within the past year, led by West Virginia, which recorded a remarkable 235.69% growth rate. Other states with substantial increases include Connecticut at 144.34% and Oklahoma at 141.77%. This trend reflects a strong response from homeowners seeking to capitalize on declining rates to improve their financial standing.

Despite the allure of refinancing at a lower rate, the study also emphasizes that not all homeowners are necessarily positioned to benefit from current refinance options. Many existing mortgages have rates below 5%, with a substantial portion of loans locked in below 4% or even 3%. For these homeowners, refinancing could mean a marginal reduction in monthly payments, which may not offset the associated closing costs.

Refinancing typically incurs expenses ranging from 2% to 6% of the loan value. Although these costs can often be rolled into the loan itself, this approach results in a higher loan balance and, in some cases, higher monthly payments.

For homeowners considering refinancing, determining a break-even point—the time it will take for monthly savings to cover upfront costs—remains critical. Factors like loan size, monthly savings, and long-term plans for staying in the home will all influence whether refinancing is the right financial move. As lenders cautiously adjust their offers amid market fluctuations, homeowners must assess their individual situations to decide if refinancing aligns with their goals.

LendingTree’s findings underscore the strategic role of refinancing amid favorable interest rate shifts. By examining the notable uptick in refinance offers, particularly in states with the highest year-over-year increases, this study provides insight into the broader economic impact of declining APRs on household finances nationwide.

Click here for more on LendingTree’s analysis of refi trends nationwide.