A new report from doxo uncovers Americans’ cost of living based on the amount spent on household bills for the 50 largest cities in the nation (based on number of households). doxoINSIGHTS’ 50 Largest U.S. Cities Household Spend Report 2024, which reflects actual bill payment activity across more than 97% of U.S. zip codes, reveals the most and least expensive largest cities for Americans to reside based on average spend per month on bill payments.

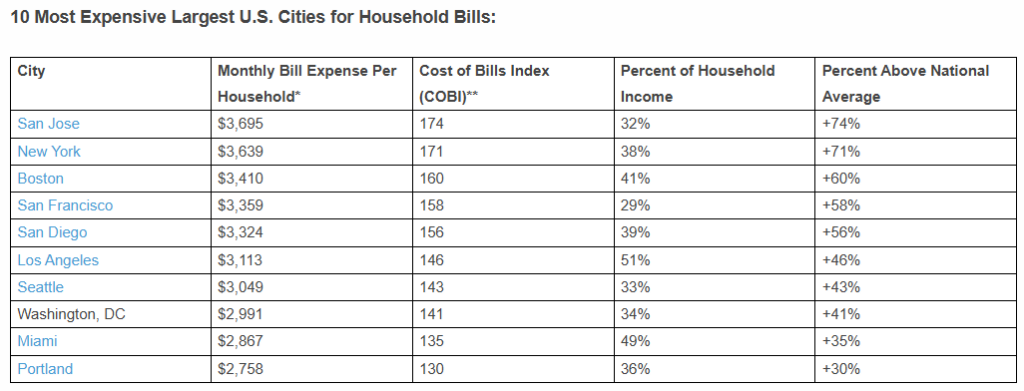

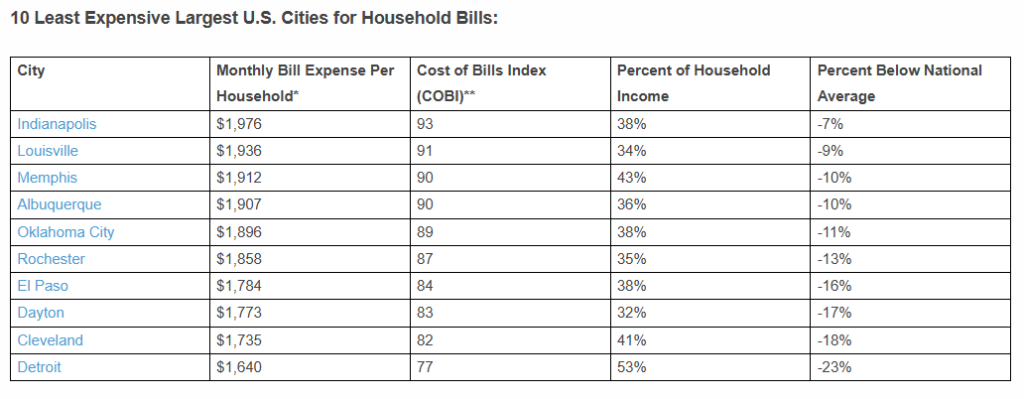

While the average U.S. household spends $25,513 annually on bills, 34% of the U.S. household median income ($74,755) and roughly $2,126 per month, plenty of cities rank well above or below this figure. San Jose, New York, Boston, San Francisco, and San Diego top the list as the most expensive, while Rochester, El Paso, Dayton, Cleveland and Detroit are the most affordable.

The study found that Americans who are frustrated by the persistent inflation experienced over the past few years, are awaiting the economic change they voted for in the 2024 Presidential election.

“With the unparalleled transparency we offer through doxoINSIGHTS, consumers, businesses, and financial institutions have access to the most comprehensive data on real household spending for everyday bills,” said Liz Powell, Senior Director of INSIGHTS at doxo. “With a clear perspective into how much Americans are spending on household bills depending on where they live, and the ability to compare to other cities across the nation, consumers have the insights needed to strengthen their financial well-being. At the same time, this data empowers billers and financial institutions to better understand and meet consumer needs as the economy remains center stage.”

The findings outlined in the Largest 50 U.S. Cities Market Household Spend Report 2024 include the total monthly spend for bills each month, the Cost of Bills Index (COBI), the percentage of income these bills amount to, how these bills compare to the national average and a breakout of each of the ten most common household bills, including:

- Mortgage

- Rent

- Auto Loan

- Utilities (electric, gas, water & sewer, and waste & recycling)

- Auto Insurance

- Cable, Internet & Phone

- Health Insurance (consumer paid portion)

- Mobile Phone

- Alarm & Security

- Life Insurance.

A high-level look at the 10 most expensive and least expensive cities among the 50 largest U.S. cities are outlined below.

From this list of the 50 largest cities in the U.S., doxo’s report reveals the most and least expensive places for Americans to live based on average spend per month on actual household bill payments. Residents of San Jose pay the highest monthly bills out of these 50 cities, at an average of $3,695 in monthly expenses, or 74% higher than the national average of $2,126. California is well represented among the most expensive metro areas ranked, with San Francisco, San Diego, and Los Angeles also on the list. New York, Boston, Washington DC, Seattle, Miami, and Portland also made the list of the top ten most expensive cities.

Findings also show that cities in the Midwest are some of the least expensive in doxo’s largest 50 cities rankings. Detroit residents pay the least in average monthly expenses, at $1,640, which is 23% lower than the national average. Other Midwest-based cities make up the majority of the least expensive cities with Indianapolis, Cleveland, and Dayton all making the list.

Click here for more information or to access the full doxoINSIGHTS’ 50 Largest U.S. Cities Household Spend Report 2024.