The Federal Housing Finance Agency (FHFA) has announced the deemed-issuance ratio for the 2025 calendar year in accordance with Internal Revenue Service (IRS) guidelines on the trading of the Uniform Mortgage-Backed Security (UMBS).

The deemed-issuance-ratio is used for diversification reporting on bonds ultimately delivered to the purchaser until the bonds have been disposed of, regardless of the issuing Enterprise on the underlying bonds.

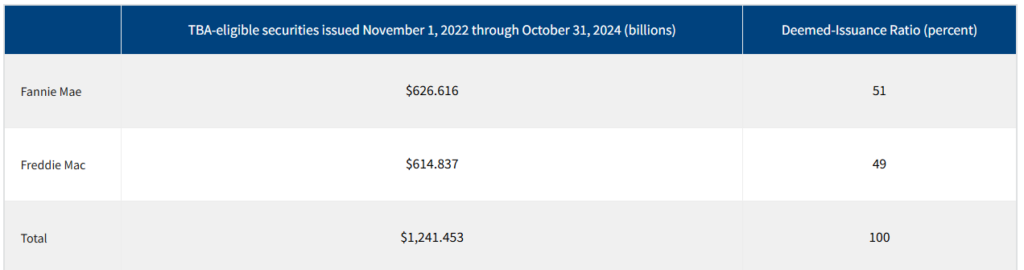

The IRS Revenue Procedure 2018-54 provides that the ratio may be rounded as long as the rounded ratio is further from 50/50 than the actual observed data. Therefore, the deemed-issuance ratio for the 2025 calendar year is 51% Fannie Mae and 49% Freddie Mac.

Revenue Procedure 2018-54 calls for the FHFA to determine a deemed-issuance ratio for each calendar year based on the ratio of TBA-eligible securities issued by Fannie Mae and Freddie Mac during the 24-month period ending October 31 of the preceding year. FHFA announces this ratio annually at least three weeks prior to the affected calendar year.

The IRS procedure provides guidance on Section 817(h) of the Internal Revenue Code (IRC) diversification requirements for variable annuity, endowment, and life insurance contracts. Section 817(h) of the IRC limits the concentration of investments for holders of variable annuity, endowment, and life insurance contracts. It applies to interests in non-publicly available investment companies, partnerships, trusts, and regulated investment companies.

The IRS has provided a deemed-issuance-ratio to allocate issuer exposure for TBA trades between the GSEs (Fannie Mae and Freddie Mac). Compliance with these requirements is affected by the implementation of and trading in Uniform Mortgage-Backed Securities (UMBS).

UMBS are passthrough securities, each representing an undivided interest in a pool of residential mortgages. Freddie Mac offers 30-year fixed-rate UMBS in addition to 20-year, 15-year, and 10-year securities. UMBS are backed by fully amortizing mortgages and pay on a 55-day delay schedule. Freddie Mac guarantees the timely payment of interest and scheduled principal on all UMBS issued by Freddie Mac. Fannie Mae plans to offer an identical guarantee of timely payment of interest and scheduled principal on all Fannie Mae-issued UMBS. UMBS feature a payment delay of only 55 days from the time interest begins to accrue and the time the investor receives a payment.

The FHFA recently announced that the conforming loan limit values (CLLs) for mortgages acquired by Fannie Mae and Freddie Mac for calendar year 2025. In most of the U.S., the 2025 CLL value for one-unit properties will be $806,500, an increase of $39,950 (or 5.2%) from 2024.

The Housing and Economic Recovery Act (HERA) requires that the FHFA adjust the GSEs’ baseline CLL value annually to reflect the change in the average U.S. home price. Earlier today, the FHFA published its Q3 2024 FHFA House Price Index (FHFA HPI) report, which includes statistics for the increase in the average U.S. home value over the last four quarters. According to the report, U.S. house prices increased 5.21%, on average, between the third quarters of 2023 and 2024. Therefore, the baseline CLL in 2025 will increase by the same percentage.