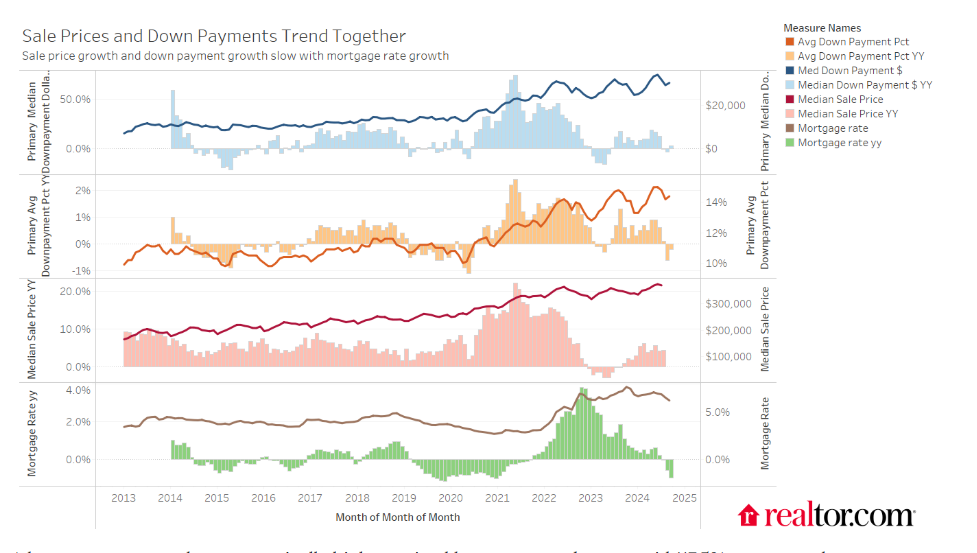

Down payment shares peaked early this year, in Q2 2024 versus the normal Q3 trend, according to Realtor.com’s bi-annual down payment report. Nationwide, down payments in Q3 of 2024 averaged 14.5% with a median down payment of $30,300, down from Q2 2024’s historical peak of 14.9% and $32,700. Overall, 2024 was down year-over-year as easing mortgage rates improved affordability conditions.

“The annual decline in down payments is the result of less buyer competition in the third quarter. Easing demand and increasing inventory gave buyers more flexibility last quarter, which led to slightly lower down payments,” said Hannah Jones, Senior Economic Research Analyst with Realtor.com. “The recent drop in mortgage rates could pave the way for more competition in the coming months, especially if rates fall further, but we haven’t yet seen that reflected in home sales or down payment trends.

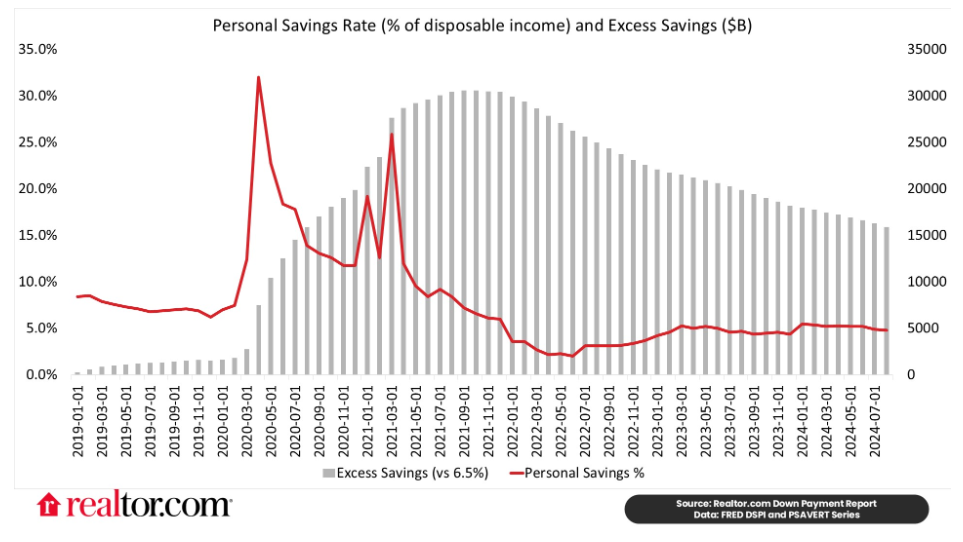

Homebuyers Still Using Pandemic-Era Savings

Two things that likely contributed to homebuyers putting down large down payments are pandemic-era savings and high existing home equity. The typical down payment dollar amount is more than twice the pre-pandemic median, and the typical down payment as a share of purchase price was more than three percentage points higher.

Looking Forward

- Northeast states see climbing down payments: At the state-level, Maine and Rhode Island had the greatest increase in down payment as a percent of price at 1.8 percentage points each. They were followed by Connecticut (+1.2 pp), Vermont (1.1 pp), and New Jersey (+1.0 pp).

- States with largest down payment growth in 2024: Rhode Island saw the largest increase in down dollar payment amount in third quarter 2024, with the typical down payment rising a whopping 33.3%: from $45,300 in Q3 2023 to $60,400 in Q3 2024. Drivers include both the increase in down payment and the median home price increase. This list has mostly higher-than-average down payment markets, plus Ohio, which tends to see a lower percentage down.

- States with largest down payment dollar growth Q3 2023-2024: Down payments as a share of purchase price fell in 24 states in Q3 2024, and down payment dollar amounts fell in 21 states, with significant overlap in the lists of metros with the largest decline in the percentage down and dollars down. Texas, Florida, and Montana might have been hotspots in the pandemic era, but they’ve seeing significant softening over the last year—a combination of waning demand and climbing inventory impacting home prices and reducing competition.

- States with biggest down payment declines: Florida saw down payments fall by almost one quarter (24.0%) year-over-year in Q3, an $8,500 drop. The District of Columbia saw the biggest absolute decline, with down payments dropping more than $17,000 year-over-year, a 17.7% drop. Despite this, down payments are still more than $80,000 on average in the district. For D.C. in particular, falling down payments may reflect the preference for and availability of remote work, allowing workers to live further away from downtown jobs and in more affordable housing areas.

Click here for more on Realtor.com’s latest down payment report.