The recent surge in immigration to the United States has ignited discussions about its potential effects on the housing market, particularly concerning housing costs. This conversation is especially pertinent amid an ongoing affordability crisis, where approximately half of renters are cost-burdened, and many individuals are being priced out of homeownership.

Senior Research Analyst Riordan Frost from the Harvard Joint Center for Housing Studies, recently took a deeper dive into the impact of immigration on the U.S. housing market.

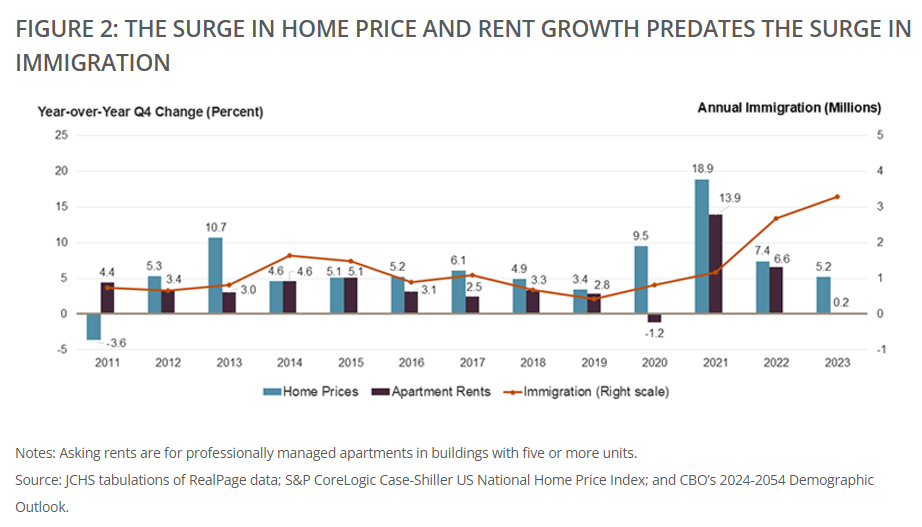

However, data indicates that the timing of the recent immigration surge does not align with the significant increases in rents and home prices observed at the onset of the pandemic. While immigrants contribute to household growth, the surge in housing demand during the pandemic was primarily driven by native-born households amid a constrained housing supply.

Historically, immigrants have played a vital role in household growth and housing demand, though their contribution has fluctuated over time, largely influenced by variations in native-born household formation. For instance, from 2010 to 2015, foreign-born householders accounted for 50% of household growth, a period marked by weak native-born household formation following the Great Recession. As native-born household formation increased leading up to the pandemic, the share of growth from foreign-born households decreased to 23% between 2015 and 2019. During the pandemic, when rents and home prices surged, foreign-born householders contributed to 25% of household growth from 2019 to 2023, indicating that native-born households were the primary drivers of increased housing demand during this period.

It’s noteworthy that the recent surge in immigration occurred in 2022 and 2023, with the Congressional Budget Office estimating that immigration levels rose from an average of 990,000 in 2020 and 2021 to 2.7 million in 2022 and 3.3 million in 2023. However, this surge does not correspond with the significant increases in home prices and rents that began earlier in the pandemic. Home prices experienced substantial growth in 2020 and 2021, and rents, after a slight decline in 2020, saw a sharp increase in 2021. Following the rise in immigration in 2022, the growth rates of house prices and rents slowed considerably, with home price growth declining further and rent growth stalling by 2023.

Several factors contributed to the dramatic rise in housing costs during the pandemic, independent of immigration trends. The millennial generation, born between 1980 and 1994, reached prime homebuying ages (26-40 years old in 2020) with pent-up demand from delayed household formation after the Great Recession. The pandemic also spurred a desire for more spacious housing, especially for those working remotely, leading to an increase in household formations and moves to larger homes or apartments. Additionally, Federal Reserve rate cuts resulted in historically low 30-year mortgage rates, dipping below 3.5% in April 2020 and reaching a low of 2.65% in January 2021, which boosted housing demand as buyers sought to capitalize on increased purchasing power. This heightened demand clashed with a constrained housing supply, leading to significant increases in home prices and rents.

While immigrants add to housing demand, they also play a crucial role in expanding housing supply due to their significant presence in the construction industry. In 2023, immigrants made up 34% of workers in construction trades, a notable figure compared to their 18% share of the overall workforce. This proportion was even higher in the West and South regions, where immigrants constituted 40% of construction trade workers. States with the highest shares of immigrant construction workers included California (52%), New Jersey (52%), Texas (51%), Maryland (50%), and Nevada (48%). Occupations with the highest percentages of immigrant workers were plasterers (61%), drywall installers (61%), roofers (52%), painters (51%), and carpet/floor/tile installers (45%).

In the long term, population and labor force growth are essential drivers of a healthy economy and expanding economic opportunities. However, with the aging baby boom generation and declining birth rates, natural population change (births minus deaths) in the United States is projected to become negative by 2040. At that point, the country will rely entirely on immigration for population growth. While the recent surge in immigration presents short-term challenges, immigrants are and will continue to be a vital source of future economic growth. Without immigration, household growth is expected to slow markedly over the next decade, significantly impacting economic expansion.

While the recent surge in immigration contributes to housing demand, it does not align with the timing of the significant increases in housing costs observed during the pandemic. The surge in housing demand and subsequent rise in costs were primarily driven by native-born household formations, low mortgage rates, and a constrained housing supply. Immigrants also play a crucial role in the construction industry, helping to expand housing supply. As the U.S. faces demographic shifts leading to negative natural population change, immigration will become increasingly vital for sustaining population and economic growth, underscoring the importance of immigrants in the nation’s housing market and broader economy.

Click here for more on the study from Senior Research Analyst Riordan Frost from the Harvard Joint Center for Housing Studies on immigration and the U.S. housing market.