The nation’s housing deficit has long been thought to be alleviated by a “silver tsunami”—an anticipated influx of properties from elderly owners who will downsize or otherwise move on. However, recent Zillow research indicates that these properties are probably positioned far from the areas where they are most needed.

“Even if we did see a ‘silver tsunami,’ a look at the map tells me it wouldn’t really move the needle in terms of solving our housing affordability crunch,” said Orphe Divounguy, Senior Economist at Zillow. “These empty-nest households are concentrated in more affordable markets, where housing is already more accessible—not in the expensive coastal job centers where young workers are moving and where more homes are most desperately needed.”

There were about 20.9 million empty-nest households in the country in 2022. These households were made up of people 55 and older who had been living in the same property for ten years or more, had no children living there, and had at least two spare bedrooms. In contrast, 8.1 million families in 2022 lived with non-relatives, who probably needed a dwelling of their own. However, the map shows a mismatch between supply and demand.

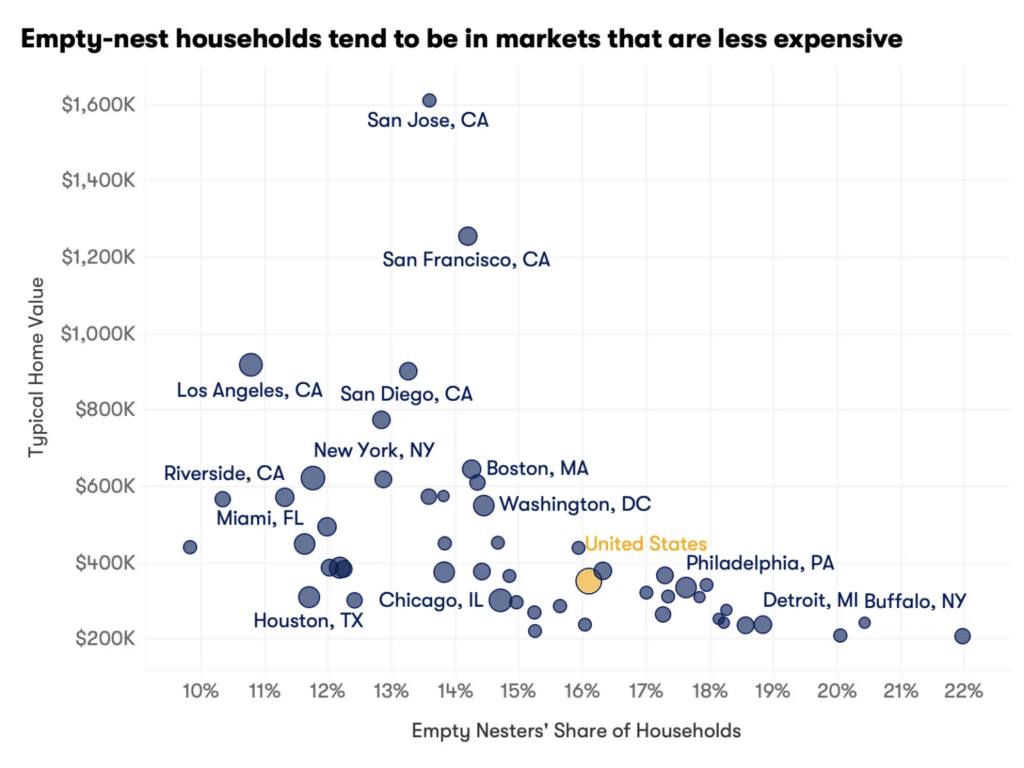

Households with empty nests are typically found in less-priced markets. Pittsburgh had the greatest percentage of empty-nest households (22%), followed by Buffalo, NY (20%), Cleveland (20%), Detroit (19%), St. Louis (19%), and New Orleans (18%) among the 50 largest U.S. metro areas. These markets are already reachable; all but New Orleans are in the top ten for the number of reasonably priced homes available. Additionally, the percentage of household heads under 44 is comparatively low.

People of “Homebuying Age” Live Farther from Empty-Nest Households

However, urban areas with some of the highest concentrations of Gen Zers and millennials are also some of the most costly in the country. San Jose (35%), Austin (32%), and Denver (32%), are the markets with the highest percentages of newly relocated households with members aged 44 and under. Portland and Seattle, both with 30%, are in the top 10. All of these metro areas have a lower percentage of empty-nest households than the national average, and housing affordability is far more difficult to find there than it is nationwide.

Therefore, in pricey, high-demand coastal locations, the effect of a future rise in supply originating from the current stock of older-owned houses will probably have less of an influence on affordability.

Instead, a robust supply expansion from newly constructed homes continues to be the major solution to affordability issues. According to Zillow data, markets with more land-use restrictions experienced the worst housing shortages.

Removing obstacles to homeownership that aren’t connected to monthly income, like credit aid programs, down payment assistance, or closing cost assistance, could potentially increase access to homeownership in addition to encouraging denser construction.

Everyone deserves to have a home!

To read more, click here.